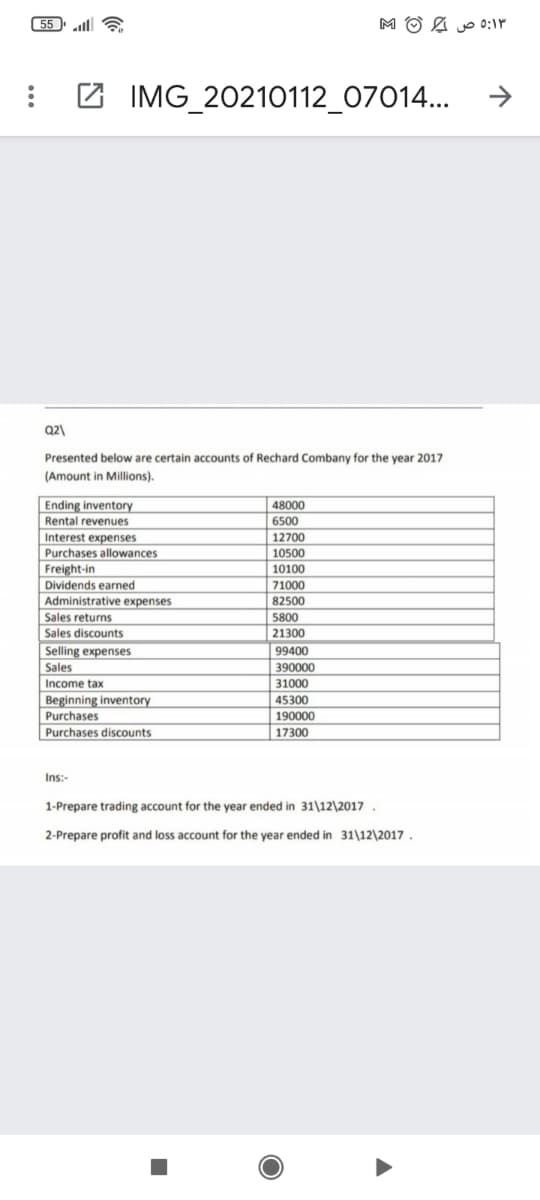

Presented below are certain accounts of Rechard Combany for the year 2017 (Amount in Millions). Ending inventory Rental revenues 48000 6500 Interest expenses Purchases allowances Freight-in Dividends earned Administrative expenses 12700 10500 10100 71000 82500 Sales returns 5800 Sales discounts 21300 Selling expenses Sales 99400 390000 Income tax 31000 Beginning inventory Purchases 45300 190000 Purchases discounts 17300 Ins:- 1-Prepare trading account for the year ended in 31\12\2017. 2-Prepare profit and loss account for the year ended in 31\12\2017.

Presented below are certain accounts of Rechard Combany for the year 2017 (Amount in Millions). Ending inventory Rental revenues 48000 6500 Interest expenses Purchases allowances Freight-in Dividends earned Administrative expenses 12700 10500 10100 71000 82500 Sales returns 5800 Sales discounts 21300 Selling expenses Sales 99400 390000 Income tax 31000 Beginning inventory Purchases 45300 190000 Purchases discounts 17300 Ins:- 1-Prepare trading account for the year ended in 31\12\2017. 2-Prepare profit and loss account for the year ended in 31\12\2017.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter7: Operating Assets

Section: Chapter Questions

Problem 5MCQ: Refer to the information for Cox Inc. above. What amount would Cox record as depreciation expense at...

Related questions

Topic Video

Question

100%

Transcribed Image Text:55 ll 6

M O & o 0:1P

->

2 IMG_20210112_07014...

Q2)

Presented below are certain accounts of Rechard Combany for the year 2017

(Amount in Millions).

Ending inventory

Rental revenues

48000

6500

Interest expenses

Purchases allowances

12700

10500

Freight-in

10100

Dividends earned

71000

82500

Administrative expenses

Sales returns

Sales discounts

Selling expenses

5800

21300

99400

Sales

Income tax

390000

31000

Beginning inventory

45300

Purchases

190000

17300

Purchases discounts

Ins:-

1-Prepare trading account for the year ended in 31\12\2017 .

2-Prepare profit and loss account for the year ended in 31\12\2017.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning