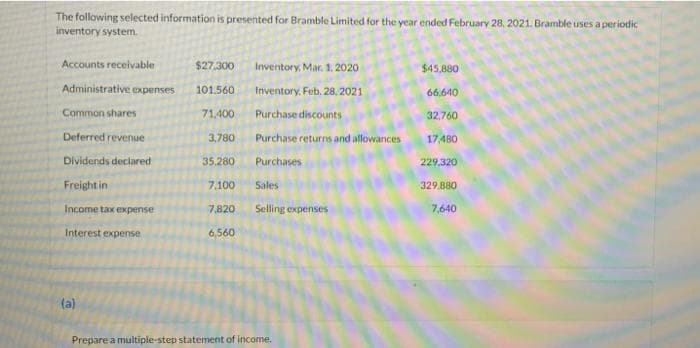

The following selected information is presented for Bramble Limited for the year ended February 28, 2021. Bramble uses a per iodic inventory system. Accounts receivable $27,300 Inventory, Mar. 1. 2020 $45,880 Administrative expenses 101.560 Inventory, Feb, 28, 2021 66,640 Common shares 71,400 Purchase discounts 32,760 Deferred revenue 3,780 Purchase returns and allowances 17,480 Dividends declared 35,280 Purchases 229,320 Freight in 7.100 Sales 329.880 Income tax expense 7,820 Selling expenses 7,640 Interest expense 6,560 (a)

The following selected information is presented for Bramble Limited for the year ended February 28, 2021. Bramble uses a per iodic inventory system. Accounts receivable $27,300 Inventory, Mar. 1. 2020 $45,880 Administrative expenses 101.560 Inventory, Feb, 28, 2021 66,640 Common shares 71,400 Purchase discounts 32,760 Deferred revenue 3,780 Purchase returns and allowances 17,480 Dividends declared 35,280 Purchases 229,320 Freight in 7.100 Sales 329.880 Income tax expense 7,820 Selling expenses 7,640 Interest expense 6,560 (a)

Financial Accounting

15th Edition

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter6: Accounting For Merchandising Businesses

Section: Chapter Questions

Problem 5PA: The following selected accounts and their current balances appear in the ledger of Clairemont Co....

Related questions

Question

Transcribed Image Text:Prepare a multiple-step statement of income.

BRAMBLE LIMITED

Statement of Income

Year Ended february 2 2021

Transcribed Image Text:The following selected information is presented for Bramble Limited for the year ended February 28, 2021. Bramble uses a periodic

inventory system.

Accounts recelvable

$27,300

Inventory, Mar. 1. 2020

$45,880

Administrative expenses

101.560

Inventory, Feb, 28, 2021

66,640

Common shares

71.400

Purchase discounts

32,760

Deferred revenue

3,780

Purchase returns and allowances

17,480

Dividends declared

35.280

Purchases

229,320

Freight in

7.100

Sales

329.880

Income tax expense

7,820

Selling expenses

7,640

Interest expense

6,560

(a)

Prepare a multiple-step statement

income.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning