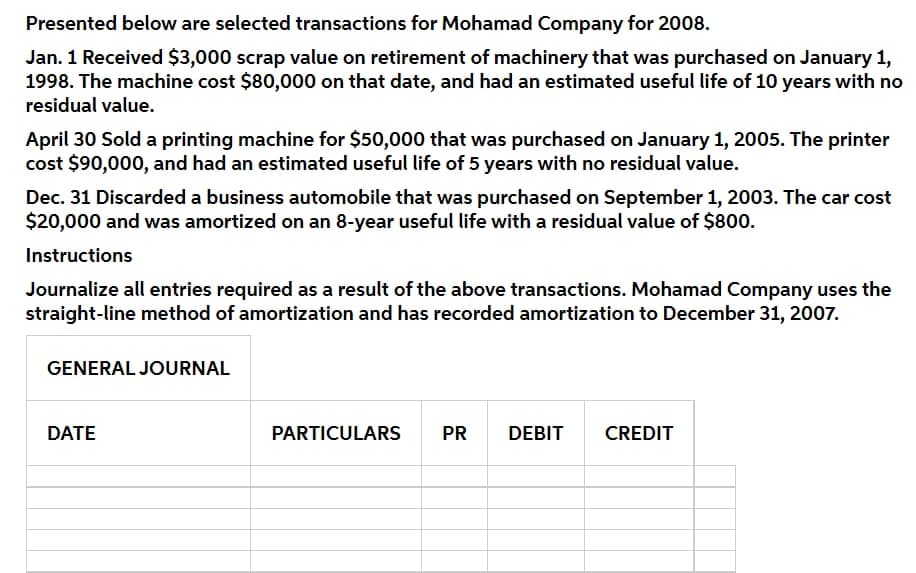

Presented below are selected transactions for Mohamad Company for 2008. Jan. 1 Received $3,000 scrap value on retirement of machinery that was purchased on January 1, 1998. The machine cost $80,000 on that date, and had an estimated useful life of 10 years with no residual value. April 30 Sold a printing machine for $50,000 that was purchased on January 1, 2005. The printer cost $90,000, and had an estimated useful life of 5 years with no residual value. Dec. 31 Discarded a business automobile that was purchased on September 1, 2003. The car cost $20,000 and was amortized on an 8-year useful life with a residual value of $800. Instructions Journalize all entries required as a result of the above transactions. Mohamad Company uses the straight-line method of amortization and has recorded amortization to December 31, 2007. GENERAL JOURNAL DATE PARTICULARS PR DEBIT CREDIT

Presented below are selected transactions for Mohamad Company for 2008. Jan. 1 Received $3,000 scrap value on retirement of machinery that was purchased on January 1, 1998. The machine cost $80,000 on that date, and had an estimated useful life of 10 years with no residual value. April 30 Sold a printing machine for $50,000 that was purchased on January 1, 2005. The printer cost $90,000, and had an estimated useful life of 5 years with no residual value. Dec. 31 Discarded a business automobile that was purchased on September 1, 2003. The car cost $20,000 and was amortized on an 8-year useful life with a residual value of $800. Instructions Journalize all entries required as a result of the above transactions. Mohamad Company uses the straight-line method of amortization and has recorded amortization to December 31, 2007. GENERAL JOURNAL DATE PARTICULARS PR DEBIT CREDIT

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter10: Long-lived Tangible And Intangible Assets

Section: Chapter Questions

Problem 29P

Related questions

Question

please answer correct

Transcribed Image Text:Presented below are selected transactions for Mohamad Company for 2008.

Jan. 1 Received $3,000 scrap value on retirement of machinery that was purchased on January 1,

1998. The machine cost $80,000 on that date, and had an estimated useful life of 10 years with no

residual value.

April 30 Sold a printing machine for $50,000 that was purchased on January 1, 2005. The printer

cost $90,000, and had an estimated useful life of 5 years with no residual value.

Dec. 31 Discarded a business automobile that was purchased on September 1, 2003. The car cost

$20,000 and was amortized on an 8-year useful life with a residual value of $800.

Instructions

Journalize all entries required as a result of the above transactions. Mohamad Company uses the

straight-line method of amortization and has recorded amortization to December 31, 2007.

GENERAL JOURNAL

DATE

PARTICULARS

PR

DEBIT

CREDIT

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning