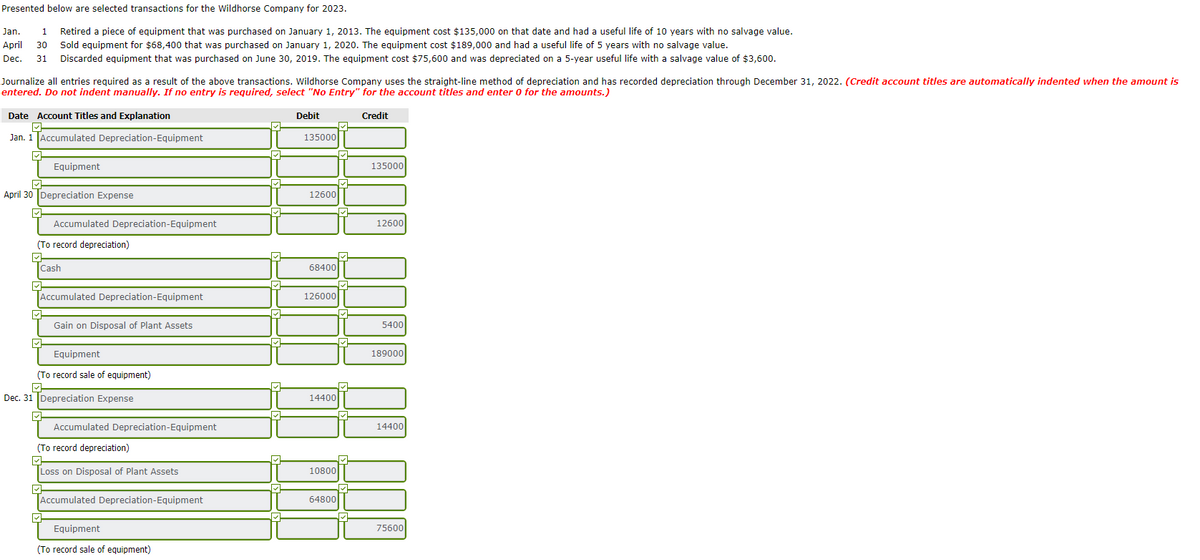

Presented below are selected transactions for the Wildhorse Company for 2023. Jan. 1 Retired a piece of equipment that was purchased on January 1, 2013. The equipment cost $135,000 on that date and had a useful life of 10 years with no salvage value. April 30 Sold equipment for $68,400 that was purchased on January 1, 2020. The equipment cost $189,000 and had a useful life of 5 years with no salvage value. Dec. 31 Discarded equipment that was purchased on June 30, 2019. The equipment cost $75,600 and was depreciated on a 5-year useful life with a salvage value of $3,600. Journalize all entries required as a result of the above transactions. Wildhorse Company uses the straight-line method of depreciation and has recorded depreciation through December 31, 2022. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.)

Presented below are selected transactions for the Wildhorse Company for 2023. Jan. 1 Retired a piece of equipment that was purchased on January 1, 2013. The equipment cost $135,000 on that date and had a useful life of 10 years with no salvage value. April 30 Sold equipment for $68,400 that was purchased on January 1, 2020. The equipment cost $189,000 and had a useful life of 5 years with no salvage value. Dec. 31 Discarded equipment that was purchased on June 30, 2019. The equipment cost $75,600 and was depreciated on a 5-year useful life with a salvage value of $3,600. Journalize all entries required as a result of the above transactions. Wildhorse Company uses the straight-line method of depreciation and has recorded depreciation through December 31, 2022. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.)

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter22: Accounting For Changes And Errors.

Section: Chapter Questions

Problem 8P: At the beginning of 2020, Holden Companys controller asked you to prepare correcting entries for the...

Related questions

Question

Transcribed Image Text:Presented below are selected transactions for the Wildhorse Company for 2023.

Jan.

1

Retired a piece of equipment that was purchased on January 1, 2013. The equipment cost $135,000 on that date and had a useful life of 10 years with no salvage value.

April

30

Sold equipment for $68,400 that was purchased on January 1, 2020. The equipment cost $189,000 and had a useful life of 5 years with no salvage value.

Dec.

31

Discarded equipment that was purchased on June 30, 2019. The equipment cost $75,600 and was depreciated on a 5-year useful life with a salvage value of $3,600.

Journalize all entries required as a result of the above transactions. Wildhorse Company uses the straight-line method of depreciation and has recorded depreciation through December 31, 2022. (Credit account titles are automatically indented when the amount is

entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.)

Date Account Titles and Explanation

Debit

Credit

Jan. 1 Accumulated Depreciation-Equipment

135000

Equipment

135000

April 30 Depreciation Expense

12600

Accumulated Depreciation-Equipment

12600

(To record depreciation)

Cash

68400

Accumulated Depreciation-Equipment

126000

Gain on Disposal of Plant Assets

5400

Equipment

189000

(To record sale of equipment)

Dec. 31 Depreciation Expense

14400

Accumulated Depreciation-Equipment

14400

(To record depreciation)

Loss on Disposal of Plant Assets

10800

Accumulated Depreciation-Equipment

64800

Equipment

75600

(To record sale of equipment)

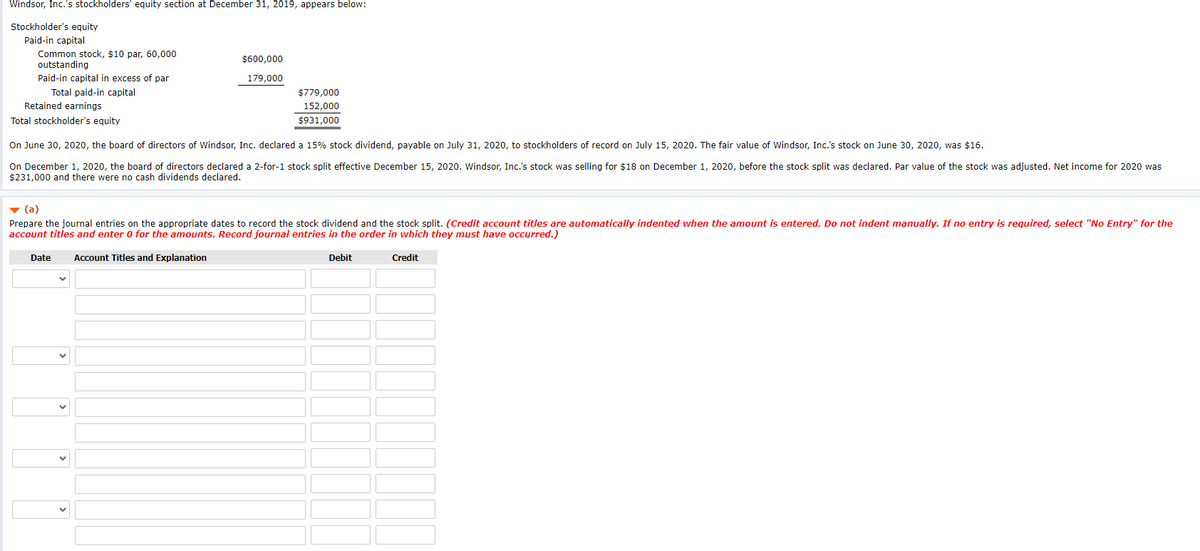

Transcribed Image Text:Windsor, Inc.'s stockholders' equity section at December 31, 2019, appears below:

Stockholder's equity

Paid-in capital

Common stock, $10 par, 60,000

outstanding

$600,000

Paid-in capital in excess of par

179,000

Total paid-in capital

Retained earnings

$779,000

152,000

Total stockholder's equity

$931,000

On June 30, 2020, the board of directors of Windsor, Inc. declared a 15% stock dividend, payable on July 31, 2020, to stockholders of record on July 15, 2020. The fair value of Windsor, Inc.'s stock on June 30, 2020, was $16.

On December 1, 2020, the board of directors declared a 2-for-1 stock split effective December 15, 2020. Windsor, Inc.'s stock was selling for $18 on December 1, 2020, before the stock split was declared. Par value of the stock was adjusted. Net income for 2020 was

$231,000 and there were no cash dividends declared.

v (a)

Prepare the journal entries on the appropriate dates to record the stock dividend and the stock split. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the

account titles and enter 0 for the amounts. Record journal entries in the order in which they must have occurred.)

Date

Account Titles and Explanation

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning