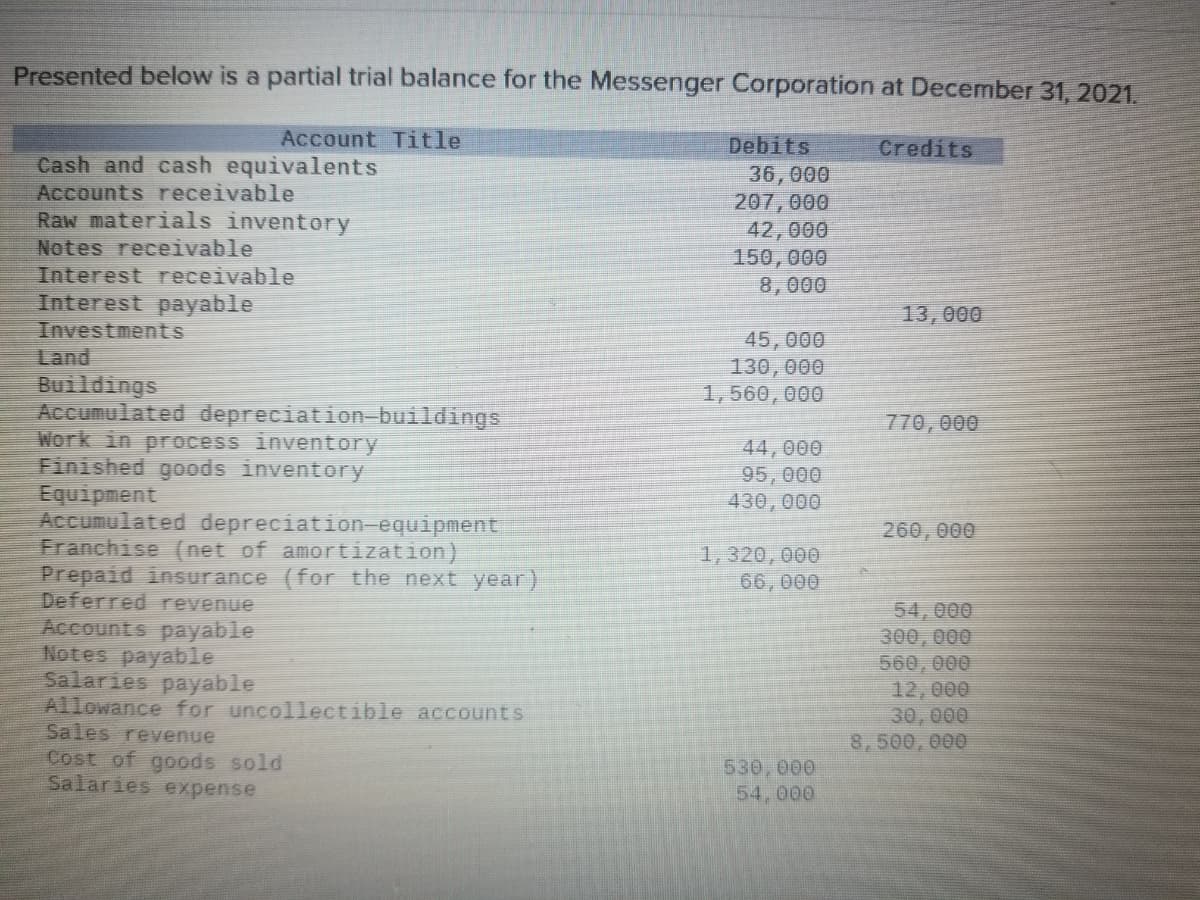

Presented below is a partial trial balance for the Messenger Corporation at December 31, 2021. Account Title Debits 36,000 207,000 42,000 150, 000 8,000 Credits Cash and cash equivalents Accounts receivable Raw materials inventory Notes receivable Interest receivable Interest payable Investments 13,000 45,000 130, 000 1,560, 000 Land Buildings Accumulated depreciation-buildings 770, 000

Presented below is a partial trial balance for the Messenger Corporation at December 31, 2021. Account Title Debits 36,000 207,000 42,000 150, 000 8,000 Credits Cash and cash equivalents Accounts receivable Raw materials inventory Notes receivable Interest receivable Interest payable Investments 13,000 45,000 130, 000 1,560, 000 Land Buildings Accumulated depreciation-buildings 770, 000

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter7: Inventories: Cost Measurement And Flow Assumptions

Section: Chapter Questions

Problem 12GI: Consider each of the following independent situations. Should a company report the goods in its...

Related questions

Question

Transcribed Image Text:Presented below is a partial trial balance for the Messenger Corporation at December 31, 2021.

Account Title

Debits

36,000

207,000

42,000

150, 000

8,000

Credits

Cash and cash equivalents

Accounts receivable

Raw materials inventory

Notes receivable

Interest receivable

Interest payable

Investments

Land

Buildings

Accumulated depreciation-buildings

Work in process inventory

Finished goods inventory

Equipment

Accumulated depreciation- equipment

Franchise (net of amortization)

Prepaid insurance (for the next year)

Deferred revenue

Accounts payable

Notes payable

Salaries payable

Allowance for uncollectible accounts

Sales reyenue

13,000

45,000

130,000

1,560,000

770, 000

44,000

95,000

430,000

260,000

1,320, 000

66,000

54, 000

300,000

560,000

12,000

30,000

8,500, 000

Cost of goods sold

Salaries expense

530,000

54,000

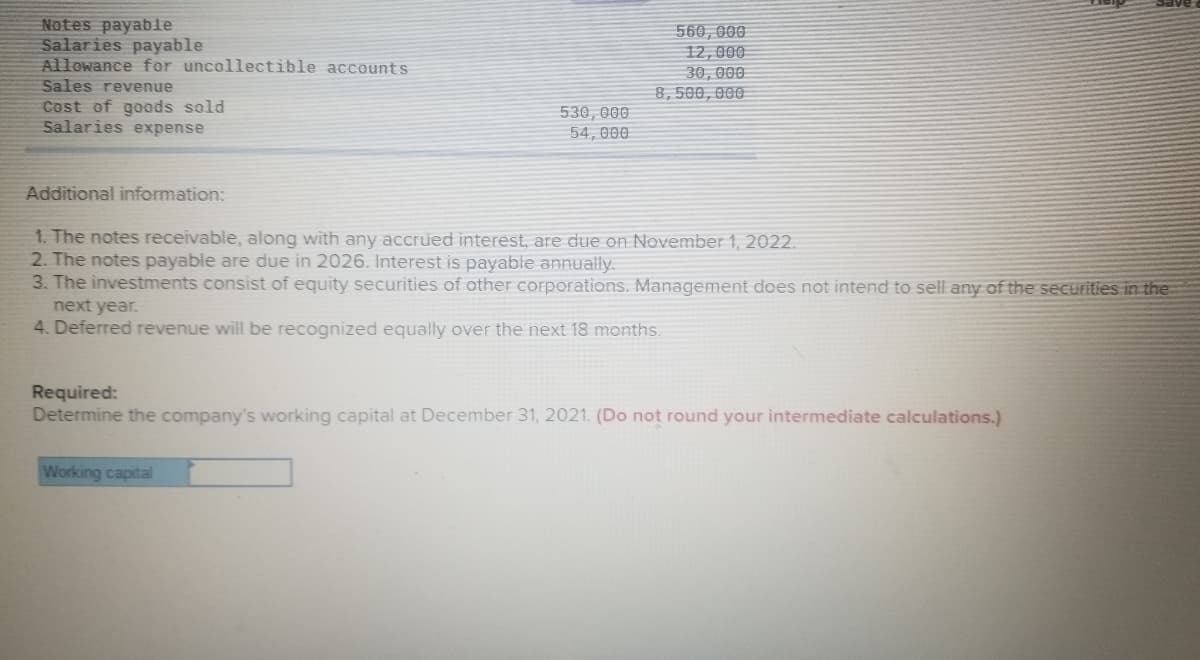

Transcribed Image Text:Notes payable

Salaries payable

Allowance for uncollectible accounts

Sales revenue

Cost of goods sold

Salaries expense

560, 000

12,000

30, 000

8,500, 000

530,000

54, 000

Additional information:

1. The notes receivable, along with any accrued interest, are due on November 1, 2022.

2. The notes payable are due in 2026. Interest is payable annually.

3. The investments consist of equity securities of other corporations. Management does not intend to sell any of the secutities in the

next year.

4. Deferred revenue will be recognized equally over the next 18 months.

Required:

Determine the company's working capital at December 31, 2021. (Do not round your intermediate calculations.)

Working capital

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning