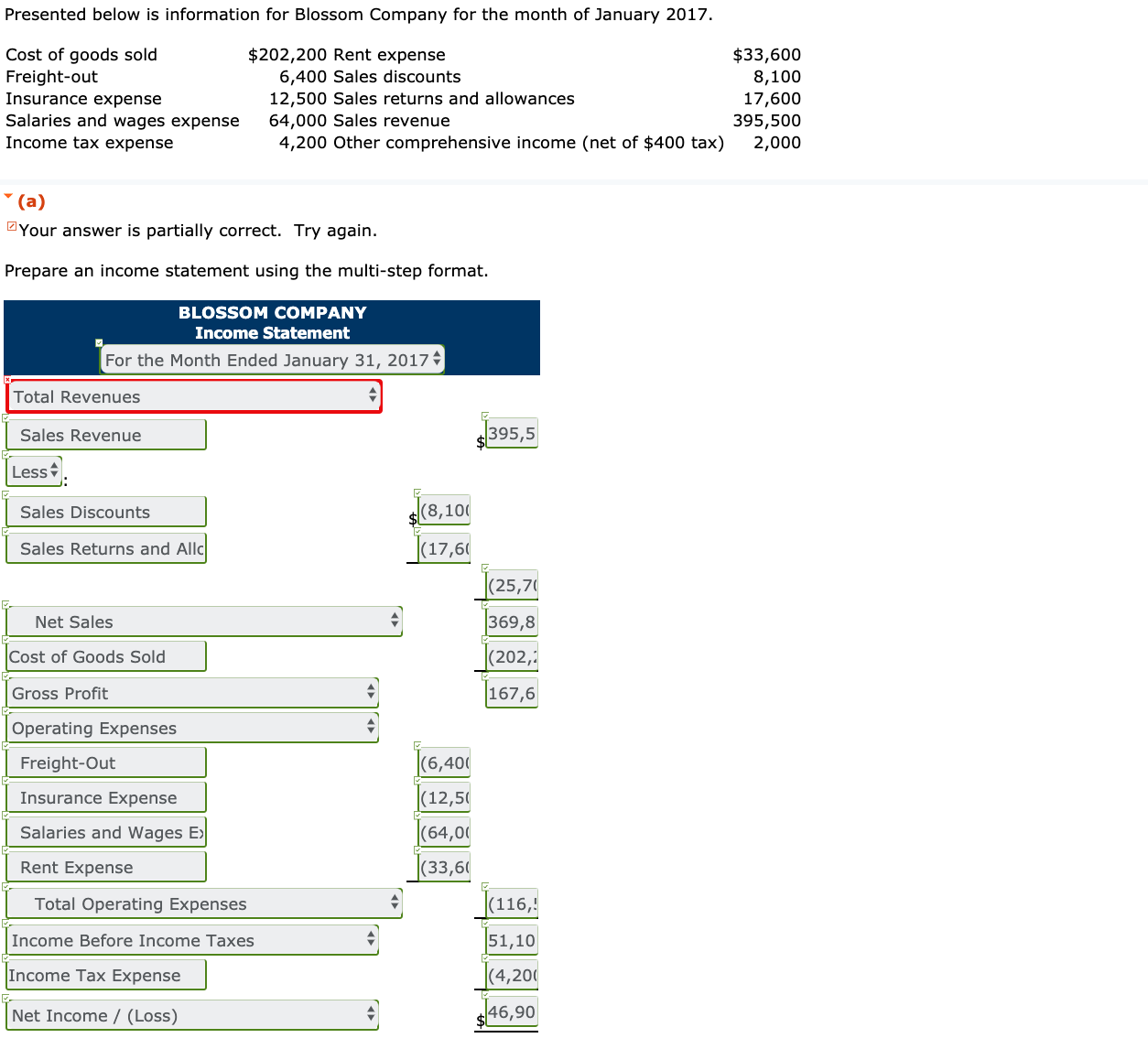

Presented below is information for Blossom Company for the month of January 2017. Cost of goods sold Freight-out Insurance expense $202,200 Rent expense 6,400 Sales discounts 12,500 Sales returns and allowances 64,000 Sales revenue 4,200 Other comprehensive income (net of $400 tax) $33,600 8,100 17,600 395,500 2,000 Salaries and wages expense Income tax expense (a) ZYour answer is partially correct. Try again. Prepare an income statement using the multi-step format. BLOSSOM COMPANY Income Statement For the Month Ended January 31, 2017 Total Revenues Sales Revenue 395,5 Less (G,10 |(17,6 Sales Discounts (8,10( Sales Returns and Allc (25,7 Net Sales 369,8 Cost of Goods Sold (202,: Gross Profit 167,6 Operating Expenses |(6,400 Freight-Out Insurance Expense |(12,50 Salaries and Wages E> (64,00 Rent Expense |(33,60 Total Operating Expenses (116,! Income Before Income Taxes 51,10 Income Tax Expense |(4,200 Net Income / (Loss) 46,90 Prepare a comprehensive income statement. BLOSSOM COMPANY Comprehensive Income Statement $

Presented below is information for Blossom Company for the month of January 2017. Cost of goods sold Freight-out Insurance expense $202,200 Rent expense 6,400 Sales discounts 12,500 Sales returns and allowances 64,000 Sales revenue 4,200 Other comprehensive income (net of $400 tax) $33,600 8,100 17,600 395,500 2,000 Salaries and wages expense Income tax expense (a) ZYour answer is partially correct. Try again. Prepare an income statement using the multi-step format. BLOSSOM COMPANY Income Statement For the Month Ended January 31, 2017 Total Revenues Sales Revenue 395,5 Less (G,10 |(17,6 Sales Discounts (8,10( Sales Returns and Allc (25,7 Net Sales 369,8 Cost of Goods Sold (202,: Gross Profit 167,6 Operating Expenses |(6,400 Freight-Out Insurance Expense |(12,50 Salaries and Wages E> (64,00 Rent Expense |(33,60 Total Operating Expenses (116,! Income Before Income Taxes 51,10 Income Tax Expense |(4,200 Net Income / (Loss) 46,90 Prepare a comprehensive income statement. BLOSSOM COMPANY Comprehensive Income Statement $

Chapter6: Merchandising Transactions

Section: Chapter Questions

Problem 22Q: The following is select account information for August Sundries. Sales: $850,360; Sales Returns and...

Related questions

Question

100%

Transcribed Image Text:Presented below is information for Blossom Company for the month of January 2017.

Cost of goods sold

Freight-out

Insurance expense

$202,200 Rent expense

6,400 Sales discounts

12,500 Sales returns and allowances

64,000 Sales revenue

4,200 Other comprehensive income (net of $400 tax)

$33,600

8,100

17,600

395,500

2,000

Salaries and wages expense

Income tax expense

(a)

ZYour answer is partially correct. Try again.

Prepare an income statement using the multi-step format.

BLOSSOM COMPANY

Income Statement

For the Month Ended January 31, 2017

Total Revenues

Sales Revenue

395,5

Less

(G,10

|(17,6

Sales Discounts

(8,10(

Sales Returns and Allc

(25,7

Net Sales

369,8

Cost of Goods Sold

(202,:

Gross Profit

167,6

Operating Expenses

|(6,400

Freight-Out

Insurance Expense

|(12,50

Salaries and Wages E>

(64,00

Rent Expense

|(33,60

Total Operating Expenses

(116,!

Income Before Income Taxes

51,10

Income Tax Expense

|(4,200

Net Income / (Loss)

46,90

Transcribed Image Text:Prepare a comprehensive income statement.

BLOSSOM COMPANY

Comprehensive Income Statement

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning