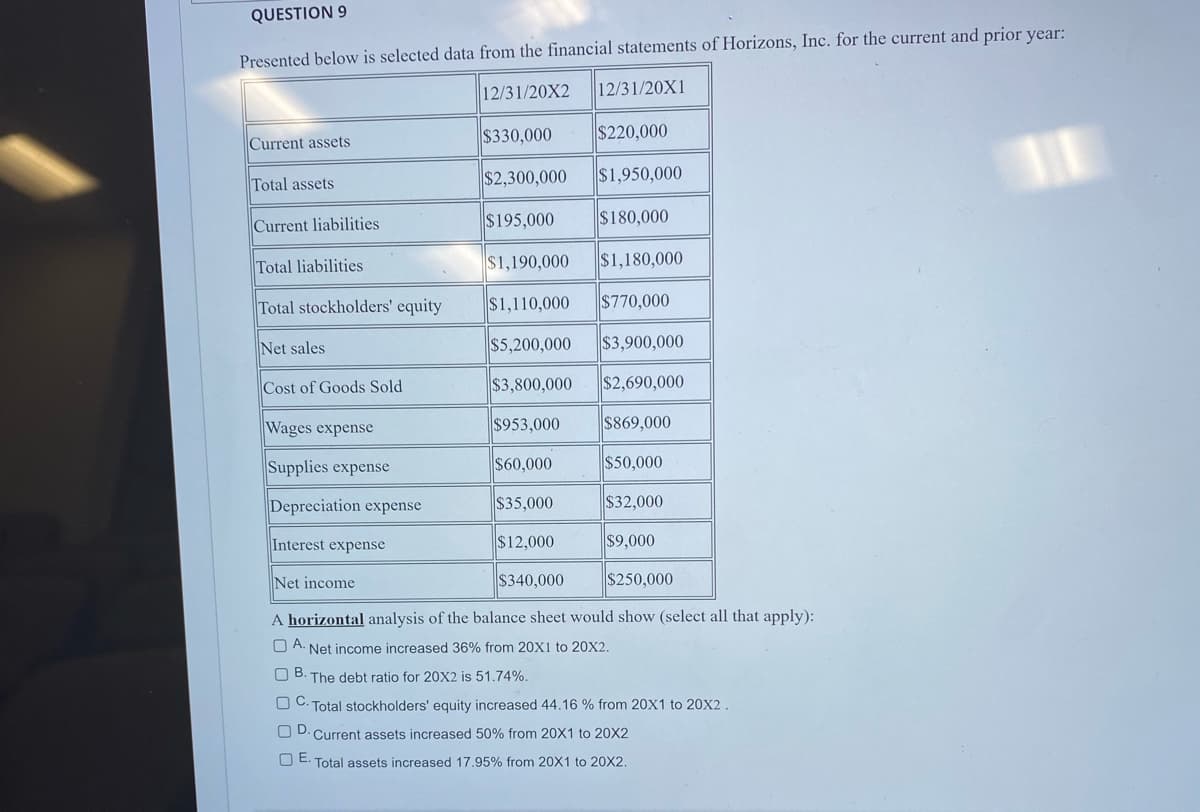

Presented below is selected data from the financial statements of Horizons, 12/31/20X2 12/31/20X1 $330,000 $220,000 Current assets Total assets $2,300,000 $1,950,000 Current liabilities $195,000 $180,000 Total liabilities $1,190,000 $1,180,000 Total stockholders' equity $1,110,000 $770,000 Net sales $5,200,000 $3,900,000 Cost of Goods Sold $3,800,000 $2,690,000 Wages expense $953,000 $869,000 Supplies expense $60,000 $50,000 Depreciation expense $35,000 $32,000 Interest expense $12,000 $9,000 Net income $340,000 $250,000 A horizontal analysis of the balance sheet would show (select all that apply): O A. Net income increased 36% from 20X1 to 20X2. В. The debt ratio for 20X2 is 51.74%. C. Total stockholders' equity increased 44.16 % from 20X1 to 20X2. Current assets increased 50% from 20X1 to 20X2 E. Total assets increased 17.95% from 20X1 to 20X2.

Presented below is selected data from the financial statements of Horizons, 12/31/20X2 12/31/20X1 $330,000 $220,000 Current assets Total assets $2,300,000 $1,950,000 Current liabilities $195,000 $180,000 Total liabilities $1,190,000 $1,180,000 Total stockholders' equity $1,110,000 $770,000 Net sales $5,200,000 $3,900,000 Cost of Goods Sold $3,800,000 $2,690,000 Wages expense $953,000 $869,000 Supplies expense $60,000 $50,000 Depreciation expense $35,000 $32,000 Interest expense $12,000 $9,000 Net income $340,000 $250,000 A horizontal analysis of the balance sheet would show (select all that apply): O A. Net income increased 36% from 20X1 to 20X2. В. The debt ratio for 20X2 is 51.74%. C. Total stockholders' equity increased 44.16 % from 20X1 to 20X2. Current assets increased 50% from 20X1 to 20X2 E. Total assets increased 17.95% from 20X1 to 20X2.

Chapter2: Analysis Of Financial Statements

Section: Chapter Questions

Problem 20PROB

Related questions

Question

100%

Help

Transcribed Image Text:QUESTION 9

Presented below is selected data from the financial statements of Horizons, Inc. for the current and prior year:

12/31/20X2

12/31/20X1

$330,000

$220,000

Current assets

$2,300,000

$1,950,000

Total assets

Current liabilities

$195,000

$180,000

Total liabilities

$1,190,000

$1,180,000

Total stockholders' equity

$1,110,000

$770,000

Net sales

$5,200,000

$3,900,000

Cost of Goods Sold

$3,800,000

$2,690,000

Wages expense

$953,000

$869,000

Supplies expense

$60,000

$50,000

Depreciation expense

$35,000

$32,000

Interest expense

$12,000

$9,000

Net income

$340,000

$250,000

A horizontal analysis of the balance sheet would show (select all that apply):

O A. Net income increased 36% from 20X1 to 20X2.

The debt ratio for 20X2 is 51.74%.

O C. Total stockholders' equity increased 44.16 % from 20X1 to 20X2 .

O D. Current assets increased 50% from 20X1 to 20X2

O E. Total assets increased 17.95% from 20X1 to 20X2.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning