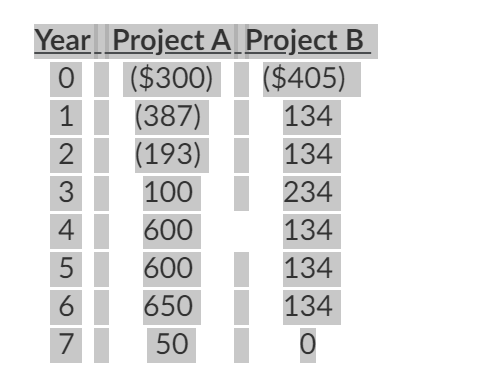

Prestwood Products Company's cost of capital is 11.2% and the company is considering two mutually exclusive projects. In the past, it usually takes about 5 years for the company to recoup its investments from a good project. The projects' expected cash flows are as follows: Project A's IRR is?

Q: Colsen Communications is trying to estimate the first-year cash flow (at Year 1) for a proposed…

A: The operating cash flow is calculated as revenues less expense net of taxes.

Q: Prestwood Products Company's cost of capital is 11.2% and the company is considering two mutually…

A: Internal rate of return: It refers to the annual rate of return where the NPV ( net present value )…

Q: Based upon the following cash flows, should Chipper Nipper Cookie Company introduce a new product,…

A: The NPV and IRR can be computed using excel as follows:

Q: Hub and Less Inc. needs to maintain 5 percent of next-year's sales in net working capital. The firm…

A: Working capital may be described as a company's money on hand to conduct its regular business…

Q: The firm has a cost of capital of 9%. g. Evaluate the acceptability of the proposed investment…

A: IRR can be calculated by following function in excel =IRR(values,[guess]) Values = Cash flows Guess…

Q: The Seattle Corporation has been presented with an investment opportunity which will yield cash…

A: Step 1: Payback period: represents the time period required for the recovery of the initial…

Q: Today, Northwest Agricultural is investing $29,800 in a “pears” project with a cost of capital of…

A: Profitability index is a measure of capital budgeting decision which aims to analyze whether the…

Q: Angat Corporation is evaluating the purchase of a P 500,000 die attach machine. The cash inflows…

A:

Q: An analyst at Stoneville Corporation estimates that a project has the following after-tax net cash…

A: Capital budgeting is the process by which a corporation examines potential large projects or…

Q: Gigantic Group has prepared the following estimates for a long-term expansion The initial investment…

A: Internal rate of return is one of the capital budgeting techniques. It is the rate at which the…

Q: Project X Cash flows 150,000 60,000 40,000 30,000 80,000 40,000 Project Y Cash flows 150,000 60,000…

A: Capital budgeting is an important technique for the analysis of long-term capital projects. The…

Q: Before evaluating the economic merits of a proposed investment, the XYZ Corporation insists that its…

A: Net present value is the sum of present value of cash flows. NPV is calculated by NPV function in…

Q: Kern Co, is planning to invest in a two-year project that is expected to yield cash flows from…

A: The maximum investment required today is calculated as present value of cash inflows

Q: A company is considering two mutually exclusive projects. Both require an initial investment of…

A: The question is related to Capital Budgeting. Capital budgeting is the process by which a…

Q: Perez Company is considering an investment of $30,485 that provides net cash flows of $9,000…

A: Internal Rate of Return: In the field of financial analysis, a statistic known as the internal rate…

Q: American Manufacturer has the opportunity to invest in a 4 year project that required an initial…

A: WACC = 10% Year Cash flow 0 -900000 1 100000 2 100000 3 400000 4 400000

Q: Shilling Company is evaluating two different capital investments, Project X and Y. Either X or Y…

A: Present value index is the ratio of present value of cash inflows to present value of cash outflows.

Q: Jen Law Firm is evaluating a project that must create a revenue of $4,600 in the 1st year, $5,200 in…

A: Future worth refers to the value of the amount in future which is deposited or received today at…

Q: ABC Inc. is considering a project that will have annual sales of $36,750 and costs, including…

A: Operating Cash Flow is te cash flow generated from the operations of a company

Q: SLAC Corp is planning to expand and new projects is expecting to earn an average of P750,000.00…

A: The price of means the total amount return necessary by a corporation to justify beginning on a…

Q: ABC Industries is considering a 3-year project that will cost $200 today followed by free cash flows…

A: Adjusted Present Value (APV) is the capital budgeting technique that provide Net Present Value of a…

Q: A 4-year project has an annual operating cash flow of $55,000. At the beginning of the project,…

A: The cash flow in the year 4 will be the aggregate of the followings Year 4 cash flow = Annual…

Q: NUBD Co. is considering a five-year investment that costs P100,000. The investment will produce…

A: Initial Cost = P 100,000 Cash inflow in year 1 and 2 = P 25,000 Cash inflow in year 3,4 and 5 = P…

Q: erez Company is considering an investment of $26,945 that provides net cash flows of $8,500 annually…

A: Internal rate of return is the rate at which the present value of cash inflows will be equal to the…

Q: Kurt Hozak, VP of Operations at McClainManufacturing, has to make a decision between two…

A: Net present value is defined as the difference between the present value of cash inflows and the…

Q: Company is evaluating two projects, Project A and Project B. The initial investment on both the…

A: The time value of money is a basic financial concept that holds that money in the present is worth…

Q: Kolyma Ltd. is investing £15,000 in a new project. The net cash inflows from the project are…

A: Net present value of the project means difference of present value of cash inflows and present value…

Q: Torpedo Co. is considering a new project generating an annual cash revenue of $500,000 in…

A: Time value of money (TVM) refers to the method used to measure the amount of money at different…

Q: Cummings Products Company's cost of capital is 11.2% and the company is considering two mutually…

A: Payback period is period required to recover initial investment of projects.

Q: Cummings Products Company's cost of capital is 11.2% and the company is considering two mutually…

A: A method of capital budgeting that helps to evaluate the present worth of cash flow and a series of…

Q: Stan Co. is considering a five-year investment that costs P100,000. The investment will produce…

A: Calculations are as follows

Q: The Carlo Company has been allocated RM600,000 on investment projects for the coming year. Four…

A: NET PRESENT VALUE NPV means the present value of cash inflows are compared with…

Q: Prestwood Products Company's cost of capital is 11.2% and the company is considering two mutually…

A: The net present value is the difference between the present value of cash inflows and the present…

Q: XYZ is considering investing in a new and cooking machine at an initial cost of $100,000. After…

A: To Find: IRR

Q: NUBD Co. is considering a five-year investment that costs P100,000. The investment will produce cash…

A: Cost of investment = P 100,000 Cash inflow in year 1 and 2 = P 25000 Cash inflow in year 3 to 5 = P…

Q: A firm has the opportunity to invest in a project having an initial outlay of $20,000. Net cash…

A: Given information: Initial outlay amount is $20,000 Net cash flows amounted to $5,000 for 5 years…

Q: GoodFish Corporation is considering a new project with a four-year useful life. The initial…

A: NPV represents net present value which is the the net value added by undertaking a capital budgeting…

Q: Hathaway, Inc., a resort company, is refurbishing one of its hotels at a cost of $6,820,850.…

A: IRR is the internal rate of return.

Q: Hathaway, Inc., a resort company, is refurbishing one of its hotels at a cost of $7,188,472.…

A: Internal rate of return is defined as the metric, which is generally used in the financial analysis…

Q: Baskets and More is expanding and expects operating cash flows of $20,800 a year for 5 years as a…

A: YEAR CASH FLOW 0 Initial Investment -57000 0 Net working capital -5000 1 cash flow…

Q: acob Inc. is considering a capital expansion project. The initial investment of undertaking this…

A: Profitability Index (PI) is calculated by dividing Present value of Cash flows by the initial…

Q: What is project A's payback period

A: Payback Period: It is the period in which the project recovers the initial cost of the project.

Q: Company is evaluating two projects, Project A and Project B. The initial investment on both the…

A: Annual present worth is calculated using PMT function in excel

Q: Prestwood Products Company's cost of capital is 11.2% and the company is considering two mutually…

A: Internal Rate of Return (IRR): It is a tool used in capital budgeting decisions for evaluating an…

Q: olsen Communications is trying to estimate the first-year cash flow (at Year 1) for a proposed…

A: Cash flow shows the cash inflow and cash outflow of the company.

Q: anthers plc is considering a project which will generate cash flows of £5,000 each year from years 3…

A: Solution: Total presnet value of cash flows is computed by adding presnet value of of cash flows of…

Q: Perez Company is considering an investment of $30,485 that provides net cash flows of $9,000…

A: Internal rate of return is the rate at which the present value of cash inflows is equal to the…

Prestwood Products Company's cost of capital is 11.2% and the company is considering two mutually exclusive projects. In the past, it usually takes about 5 years for the company to recoup its investments from a good project. The projects' expected cash flows are as follows:

Project A's IRR is?

Step by step

Solved in 2 steps with 2 images

- 1.How much is the carrying amount of property, plant and equipment as of December 31, 2020?a. P435,160 c. P763,440b. P729,840 d. P860,400A. Any amount in excess of P198,667 B. Any amount in excess of P117,000 C. Any amount in excess of P175,000 D. Any amount in excess of P183,000Q10.9 During 2020, Sunland Company incurred weighted-average accumulated expenditures of $1570000 during construction of assets that qualified for capitalization of interest. The only debt outstanding during 2020 was a $2040000, 9%, 5-year note payable dated January 1, 2020. What is the amount of interest that should be capitalized by Sunland during 2020? $0. $42300. $183600. $141300.

- Entity XYZ is a national government agency. Some of the major transactions of the agency for the year 202X were as follows: 1.The approved legislative appropriation for the year was 1 Billion. 10% of this appropriation was alloted by the Department of Budget and Management (DBM) to Entity XYZ.This allotment is broken down as follows: Capital Outlay 50% Maintenance and other operating expenses (MOOE) 40% Personnel Services (PS) 10% 2.Received Notice of Cash Allocation (NCA) from DBM, P20 million,net of tax 3.Obligations were incurred as follows: Capital Outlay 5million Obligation for (MOOE) 3million Personnel Services (PS) 2million 4. Delivery of office equipment and office supplies on account: office equipment 3million office supplies 200,000 5.Payable to officers and employees upon approval of payroll: Salaries and wages P1,000,000 Personnel economic relief allowance(PERA) 150,000 Gross Payroll 1,150,000 Less:Deductions Withholding Tax P35,000 Government service Insurance…Entity XYZ is a national government agency. Some of the major transactions of the agency for the year 202X were as follows: 1.The approved legislative appropriation for the year was 1 Billion. 10% of this appropriation was alloted by the Department of Budget and Management (DBM) to Entity XYZ.This allotment is broken down as follows: Capital Outlay 50% Maintenance and other operating expenses (MOOE) 40% Personnel Services (PS) 10% 2.Received Notice of Cash Allocation (NCA) from DBM, P20 million,net of tax 3.Obligations were incurred as follows: Capital Outlay 5million Obligation for (MOOE) 3million Personnel Services (PS) 2million 4. Delivery of office equipment and office supplies on account: office equipment 3million office supplies 200,000 5.Payable to officers and employees upon approval of payroll: Salaries and wages P1,000,000 Personnel economic relief allowance(PERA) 150,000 Gross Payroll 1,150,000 Less:Deductions Withholding Tax P35,000 Government service Insurance…What amount was recognized as actuarial gain on PBO during the year? 100 000 200 000 240 000 0 What is the benefit expense for 2019? 500 000 795 000 295 000 195 000

- The balance of the investment account at December 31,2021 is: a. P5,924,000b. P5,000,000c. P5,744,000d. P7,660,000*see attached What is the compensation expense for 2021?a. 120,000b. 240,000c. 200,000d. 660,000The carrying amount of the intangible assets as of December 31,2020 is A) 7,400,000 B) 9,000,000 C) 9,070,000 D) 8,850,000

- 4. What is the carrying value of the right of use asset on December 31, 2021? ₱ 2,488,889 ₱ 2,750,000 ₱ 2,520,000 ₱ 2,666,667What amount of interest revenue should be recorded in 2021? *a. 490,000b. 480,000c. 438,000d. 391,800May I ask for an explanation and solution to the question for a better understanding. Thank you! 11. What is the amount of Sculler's working capital at December 31, 2021? a. P41,000 b. P45,000 c. P50,000 d. P91,000