Pretend that you are saving up for a down payment on a car or house. Pretend that we get an inheritance of $4,000 so we put the inheritance in a special bank account that pays 4.00% APR compounded quarterly for four-years. We also decide to save $400 a quarter into this savings account to help grow our down payment. a. How much money do we have in our savings account at the end of all these years? b. How much interest do we earn in total?

Pretend that you are saving up for a down payment on a car or house. Pretend that we get an inheritance of $4,000 so we put the inheritance in a special bank account that pays 4.00% APR compounded quarterly for four-years. We also decide to save $400 a quarter into this savings account to help grow our down payment. a. How much money do we have in our savings account at the end of all these years? b. How much interest do we earn in total?

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter22: Providing And Obtaining Credit

Section: Chapter Questions

Problem 2P: Cost of Bank Loan Mary Jones recently obtained an equipment loan from a local bank. The loan is for...

Related questions

Question

Pretend that you are saving up for a down payment on a car or house.

Pretend that we get an inheritance of $4,000 so we put the inheritance

in a special bank account that pays 4.00% APR compounded

quarterly for four-years. We also decide to save $400 a quarter into

this savings account to help grow our down payment.

a. How much money do we have in our savings account at the end

of all these years?

b. How much interest do we earn in total?

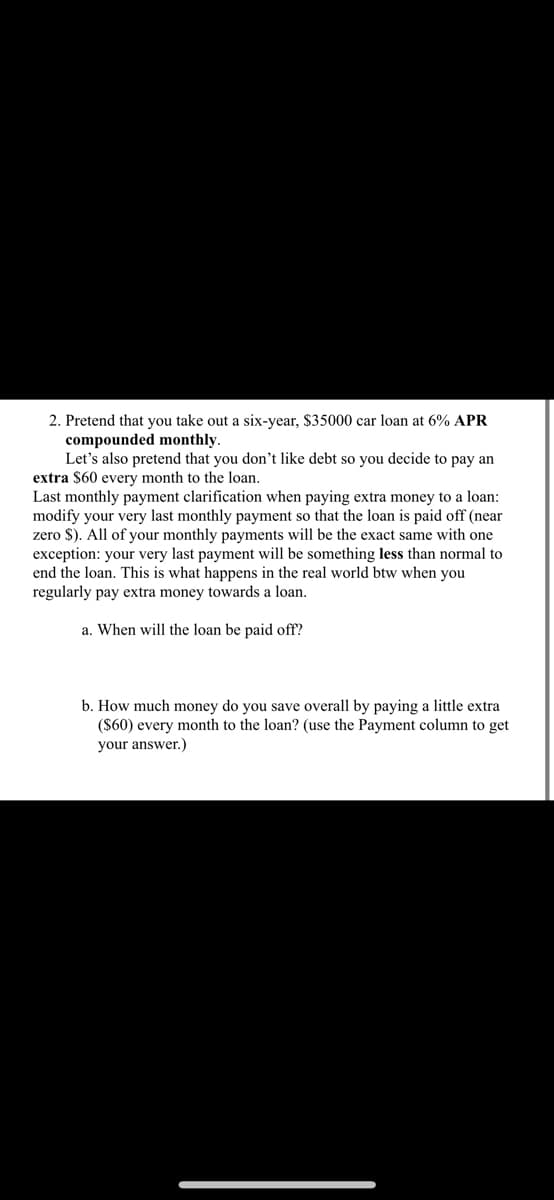

Transcribed Image Text:2. Pretend that you take out a six-year, $35000 car loan at 6% APR

compounded monthly.

Let's also pretend that you don't like debt so you decide to pay an

extra $60 every month to the loan.

Last monthly payment clarification when paying extra money to a loan:

modify your very last monthly payment so that the loan is paid off (near

zero $). All of your monthly payments will be the exact same with one

exception: your very last payment will be something less than normal to

end the loan. This is what happens in the real world btw when you

regularly pay extra money towards a loan.

a. When will the loan be paid off?

b. How much money do you save overall by paying a little extra

($60) every month to the loan? (use the Payment column to get

your answer.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College