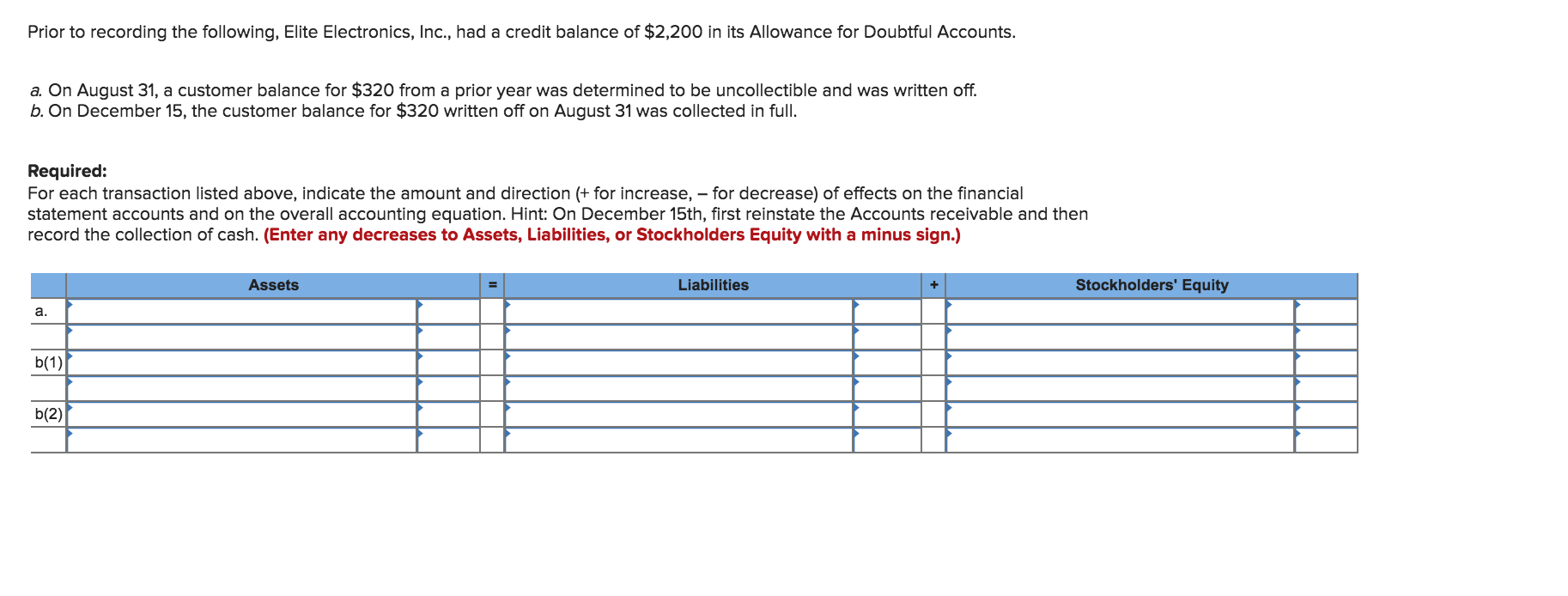

Prior to recording the following, Elite Electronics, Inc., had a credit balance of $2,200 in its Allowance for Doubtful Accounts a. On August 31, a customer balance for $320 from a prior year was determined to be uncollectible and was written off. b. On December 15, the customer balance for $320 written off on August 31 was collected in full. Required: For each transaction listed above, indicate the amount and direction (+for increase, - for decrease) of effects on the financial statement accounts and on the overall accounting equation. Hint: On December 15th, first reinstate the Accounts receivable and then record the collection of cash. (Enter any decreases to Assets, Liabilities, or Stockholders Equity with a minus sign.) Assets Liabilities Stockholders' Equity b(2)

Prior to recording the following, Elite Electronics, Inc., had a credit balance of $2,200 in its Allowance for Doubtful Accounts a. On August 31, a customer balance for $320 from a prior year was determined to be uncollectible and was written off. b. On December 15, the customer balance for $320 written off on August 31 was collected in full. Required: For each transaction listed above, indicate the amount and direction (+for increase, - for decrease) of effects on the financial statement accounts and on the overall accounting equation. Hint: On December 15th, first reinstate the Accounts receivable and then record the collection of cash. (Enter any decreases to Assets, Liabilities, or Stockholders Equity with a minus sign.) Assets Liabilities Stockholders' Equity b(2)

Financial Accounting

14th Edition

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Carl Warren, Jim Reeve, Jonathan Duchac

Chapter9: Receivables

Section: Chapter Questions

Problem 12E: Using the data in Exercise 9-11, assume that the allowance for doubtful accounts for Selbys Bike Co....

Related questions

Question

Transcribed Image Text:Prior to recording the following, Elite Electronics, Inc., had a credit balance of $2,200 in its Allowance for Doubtful Accounts

a. On August 31, a customer balance for $320 from a prior year was determined to be uncollectible and was written off.

b. On December 15, the customer balance for $320 written off on August 31 was collected in full.

Required:

For each transaction listed above, indicate the amount and direction (+for increase, - for decrease) of effects on the financial

statement accounts and on the overall accounting equation. Hint: On December 15th, first reinstate the Accounts receivable and then

record the collection of cash. (Enter any decreases to Assets, Liabilities, or Stockholders Equity with a minus sign.)

Assets

Liabilities

Stockholders' Equity

b(2)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 8 images

Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,