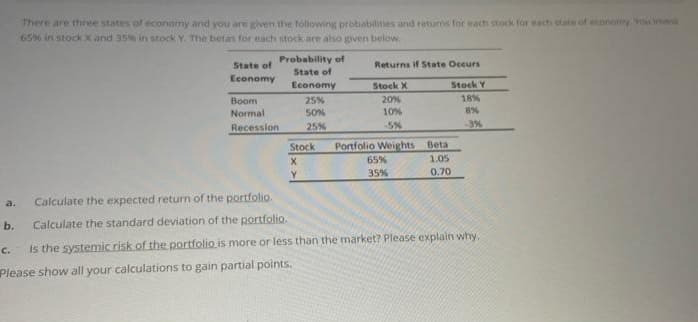

Probability of State of State of Returns if State Occurs Economy Economy Stock X Stock Y Boom 25% 20% 18% Normal 50% 10% -3% Recession 25% Portfolio Weights Beta 105 Stock GEO

Q: Consider two identical systems A and B are connected to each other. At constant volumes V and V3, th...

A:

Q: 32 to the aceofenmeh * are th mnles wwVcarI. .. Obtain Galilean transformation equations and show th...

A: (a) The Galilean transformation equations. (b) Show that the distances between two points is invaria...

Q: A solenoid with 485 turns has a length of 5.00 cm and a cross-sectional area of 2.90 ✕ 10−9 m2. Find...

A:

Q: (Q) Consider a system of three noninteracting particles that are confined to move in a one-dimension...

A: A particle in a one-dimensional infinite potential well or particle in a box in quantum mechanics is...

Q: A circular disc of mass M and radius R is rotating about its axis with angular speed ω1 . If another...

A:

Q: When the pressure applied to one liter of a liquid is increased by 2 x 106 N/m? its volume decrease ...

A: Bulk modulus is a measure of the ability of a substance to withstand changes in volume when under co...

Q: 6 : The elastic limit of copper is 1.5 x 10' N/m². Find the maximum radius of the copper wire must h...

A: Given Data : F=10 kg ωt=10×9...

Q: 14. Derive the Lorentz transformations for electromagnetic potential four vector and current density...

A: Solution: Maxwell's field equation is given as Where The second equation can be written as

Q: Do not copy other chegg answer i already have ..give me correct answer The energy levels of hydrogen...

A: The energy levels of hydrogen atom. Given, Energy E=-13.6eVn21+α2n2nj+1/2-34 n=3

Q: The displacement of a wave is given by the equation Y = 0.05 sin 40n (100 t – x) in S.I. units. Find...

A: In this case we have to find the wavelength of wave and the wave velocity by having the equation of ...

Q: A body of mass m falls from the rest in a medium offering resistance proportional to the square of t...

A: mass= m R=kv2 the differential equation becomes mdvdt=mg-kv2mmg-kv2=dtintegrating both side we get1g...

Q: If the electron is positioned in the region of width 10-12 m then calculate the time constant of the...

A: The width of the region in which the electron is positioned can be related to the wavelength of the ...

Q: You can find the temperature inside your refrigerator without putting a thermometer inside. Take a c...

A: Given that, T(0.5)=45°F T(1)=55°FT Room temperature =70o We know that, dv/dT=K(T0−T) Equatio...

Q: Problem 1. Find the Young diagrams corresponding to the matrices 0 0 1 1 0 0 0 1 0 100 0 0 0 0 0 1 1...

A: Given, Two matrices of order 4 x 4 as 0011000101000000 & 0110000000010000

Q: What is the force on the charge q at the upper-right-hand corner of the square shown here? (Use the ...

A: To calculate the force acting on charge q at the upper right hand corner of the square, The Schemati...

Q: 의으

A: The given circuit in the figure is an LC circuit, with an inductor and a capacitor connected in seri...

Q: football player punts the ball at a 45 angle. Without an effect from the w ravel 60.0 m horizontally...

A: Given: The angle of football player punts the ball is 45o The ball travel to (R) 60 m The horizontal...

Q: 10. Establish the covariant form of Maxwell's electromagnetic field equations by four vectors. Does ...

A:

Q: give two important reasons why lithography is one of the most critical technologies in semiconductor...

A:

Q: 1Ω 2Ω 3 N 18.1 V 4Ω 19.9V In the circuit above, what is the magnitude of the current through the 19....

A: Let the current in the loop with the 4-ohm resistance be I. For this, refer to the following figure ...

Q: If in problem 3, q = (10 - 10e24) mC, find the current at t = 1.0s.

A: Relation between charge, current and time is current is equal to rate of change of charge per unit t...

Q: A pin is forced to move along a parabola shaped guide by a connected collar that moves along the r-a...

A: Given data, At x = 0.5 vx = -2.6 m/s ax = 2.6 m/s2 Parabolic path is :- y=-1.25x2+5x or, ...

Q: are inside of an 88 m building, to relieve stress you throw a ball vertically upward from the edge o...

A: Given: The height of the building is 88 m. The height of the hand is 2 m above the buildi...

Q: Three charged marbles are glued to a nonconducting surface and are placed in the diagram as shown. T...

A: Given: The charge of marble at r1 = -3 cm is q1 = 6.1 μC The charge of marble at r2 = 0 cm is q2 = 1...

Q: The loading is generally acting upon the centroid of the body Select one: True False

A: We know Generally the loads are applied on the centroid of the body. Also The moment of the b...

Q: What is the maximum charge on the capacitor of an L-C circuit, where, L = 85.0 mH and C = 3.20 uF. D...

A: Given that, Inductance, L=85×10-3HCapacitance, C=3.2×10-6FMaximum current, I0=8.5×10-3 AAngular freq...

Q: Given the mass of the cart m,=50 kg and the mass of the wheel mw=25 kg and its radius r=0.25 m. The ...

A: Given data, Mass of the wheel = 25 kg Mass of the cart = 50 kg Radius of the wheel = 0.25 m Stiffnes...

Q: 5. Two frames of reference S and S' are such v = i Ug - jvy + k v, relative to S. If the origin of t...

A:

Q: An electric field of magnitude 5.25 ✕ 105 N/C points due east at a certain location. Find the magnit...

A:

Q: te 93 (a) W = U = 41 42 -e 4TE0\13 23. 4περ 2α

A: Given: Work done and energy as, W=U=q34π∈0q1r13+q2r23=+e4π∈0-e2a++ea To find: Solution of the above ...

Q: A particle moves in horizontal circle of radius 36 cm with a speed of 5 m/s. If it is declerated uni...

A: Given Data : r = 36 cm = 0.36 m υ = 5 m/s at = 0.14...

Q: 9. Explain time dilation in special theory of relativity. What is proper time interval ? How is time...

A:

Q: A body of mass m falls from the rest in a medium offering resistance proportional to the square of t...

A: Given,mass =mResistance Fr=kv2k=proportionality constantFrom equation of motion,mdvdt=mg-Frmdvdt=mg-...

Q: b) The ground state of the fluorine atom is represented by the level 2P3/2. It is subject to a weak ...

A: Since you have posted a question with multiple subpart, we will solve first 3 subpart for you. To ge...

Q: What is the law of conservation of linear momentum? Establish this law with the help of Galilean inv...

A:

Q: Two monochromatic and coherent point sources of light s, and s, of wavelength 4000 , are placed at a...

A: These two light sources would superimpose on each other as these are coherent sources. And this woul...

Q: Explain with suitable examples the meaning of inertial and non-inertial frame of reference. Explain ...

A:

Q: 10 - Bölüm 9- soru-9 A car of mass m moving at a speed y = 20.0 m/s collides and couples with the ba...

A: Answer : If a mass m1 with velocity v1collides inelastically with a mass m2 with velocity v2 , then...

Q: A high-speed photograph of a club hitting a golf ball is shown in the figure below. The club was in ...

A: Impluse: The integral of a force, F, over the time interval, t, over which it acts is called impulse...

Q: -1 μC, +1 μC +> A charge of -1.0 µC is located in a Cartesian coordinate system at (-1, 2, 0) while ...

A: The magnitude of first charge is given as, q1=-1 μC (or) q1=-1×10-6 C The position of first charge i...

Q: A rifle with a weight of 25 N fires a 4.0 g bullet with a speed of 290 m/s. (a) Find the recoil spee...

A: Given Rifle mass mr = 25 N Bullet mass mb = 4.0 g = 0.004 kg Bullet velocity vb...

Q: Let E := Egi+ E4j+ E2k and H := Hi+ Hyj+H¿k be two vectors assumed to have continuous partial deriva...

A: Given,∇.E=0∇.H=0∇×E=-1c∂H∂t∇×H=1c∂E∂t

Q: A 10 g bullet moving at 1,000 m/s goes through a 1.0 kg block. If the bullet goes through the block ...

A: Given that,Mass of the bullet : m1 = 10(g) = 101000(kg)Block of mass : m2 = 1 (kg)Initial velocity :...

Q: An electromagnetic wave with frequency 5.70 * 1014 Hz propagates with a speed of 2.17 * 108 m/s in a...

A: Given that, The frequency of the EM wave, f=5.70×1014 HzSpeed of the wave, v=2.17×108 m/sWavelength ...

Q: In elastic collision which of the following is correct: O A. Linear Momentum and Kinetic energy are ...

A: Solution:-(A) Linear momentum and kinetic energy are conserved.Best option (A) is correct as it is a...

Q: What factors affect image quality in transmission imaging?

A: Given, Image quality in transmission imaging

Q: Q8. The points A, B and C in the circuit below can be individually switched to connect either to +V ...

A: In the logic Function GND =0+V=1

Q: Two charges, +9 µC and +15 µC, are fixed 1 m apart, with the second one to the right. Find the magni...

A:

Q: A 5.00-kg block is initially moving to the right with a speed of 2 m/s. It was pushed to the left wh...

A: Given Mass (m) = 5.00 kg Initial velocity vi = 2 m/s Final velocity vf = 1 m/s

Q: Calculate the energy of the nth excited state to first-order perturbation theory for a spinless part...

A: Given: The potential of the one-dimensional well of length 2L is given by V(x) = 0 ; 0≤ x ≤ 2L∞ ; ot...

3

Step by step

Solved in 3 steps with 3 images