Problem 1 2018 Jan 1- Nadayag Company purchased 20.000 shares of Cortez Company P100 par at P110 pr Mar 1-Cortez Company issued rights to Nadayag Company each permitting the purchase of price of the share was P140 and there waso quoted price for the rightS April 1 Nadayag Company paid the new shares charging the payment to the investment acco been assessed by Cortez Company, the dividends received from Cortez Company in 2017 anc account until the debit for payment of the new share was fully offset

Problem 1 2018 Jan 1- Nadayag Company purchased 20.000 shares of Cortez Company P100 par at P110 pr Mar 1-Cortez Company issued rights to Nadayag Company each permitting the purchase of price of the share was P140 and there waso quoted price for the rightS April 1 Nadayag Company paid the new shares charging the payment to the investment acco been assessed by Cortez Company, the dividends received from Cortez Company in 2017 anc account until the debit for payment of the new share was fully offset

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

ChapterD: Investments

Section: Chapter Questions

Problem D.7EX

Related questions

Question

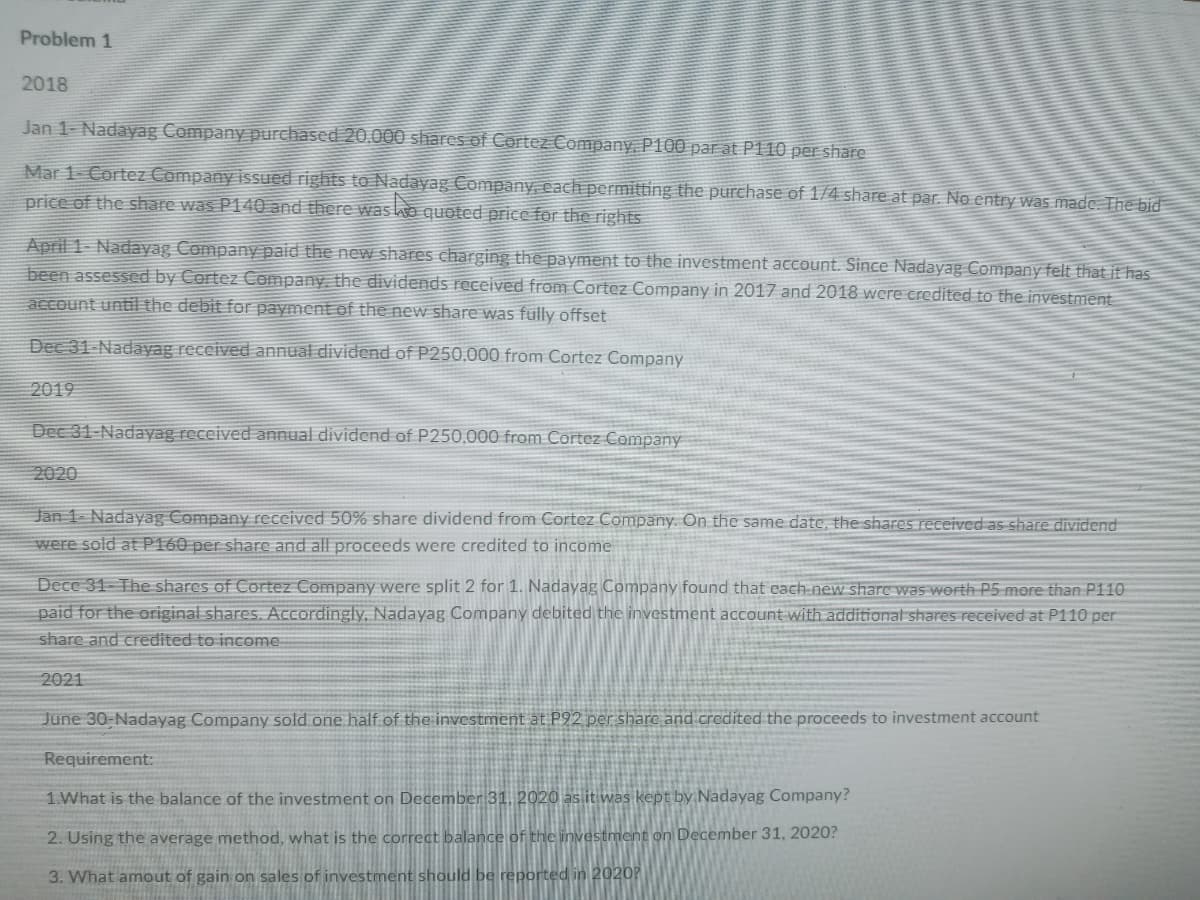

Transcribed Image Text:Problem 1

2018

Jan 1- Nadayag Company purchased 20.000 shares of Cortez Company P100 par at P110 per share

Mar 1 Cortez Company issued rights to Nadayag Company, each permitting the purchase of 1/4 share at par. No entry was made. The bid

price of the share was P140 and there was lo quoted price for the rights

April 1 Nadayag Company paid the new shares charging the payment to the investment account. Since Nadayag Company felt that it has

been assessed by Cortez Company, the dividends received from Cortez Company in 2017 and 2018 wcre credited to the investment

account until the debit for payment of the new share was fully offset

Dec 31 Nadayag received annual dividend of P250,000 from Cortez Company

2019

Dec 31-Nadayag received annual dividend of P250,000 from Cortez Company

2020

Jan 1- Nadayag Company received 50% share dividend from Cortcz Company. On the same date, the shares received as share dividend

were sold at P160 per share and all proceeds were credited to income

Dece 31- The shares of Cortez Company were split 2 for 1. Nadayag Company found that each-new share was worth P5 more than P110

paid for the original shares. Accordingly, Nadayag Company debited the investment account with additional shares received at P110 per

share and credited to income

2021

June 30-Nadayag Company sold one half of the investment at P92 per share and credited the proceeds to investment account

Requirement:

1.What is the balance of the investment on December 31, 2020 as it was kept by Nadayag Company?

2. Using the average method, what is the correct balance of the investment on December 31, 2020?

3. What amout of gain on sales of investment should be reported in 202o?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning