Case A: On January 1, 2021, your company purchased 60,000 shares of Freeze Company's $10 par common stock for $26 per share in cash plus paid $10,000 of broker's fees. On that date, Freeze Company's assets and liabilities had a book value equal to market value except for their building which had a market value which was $80,000 higher than its book value and had a 20-year remaining life. 2021 a. Purchased 60,000 shares of Freeze Company's $10 par common stock for $26 per share in cash plus paid $10,000 in broker's fees.. b. Received $30,000 in cash dividends. On December 31, 2021: 1. Freeze Company's stock had a market value of $25 per share. с. 2. Freeze Company reported net income of $400,000. 2022 d. Received a 10% stock dividend. On December 31, 2022: 1. Freeze Company's stock had a market value of $24 per share. е. 2. Freeze Company reported net income of $500,000. Assume the 60,000 shares you purchased represented 30% of the outstanding shares of Freeze Company so you were using he EQUITY method. Your company plans to hold on to the shares for several years. Prepare all entries for 2021 and 2022 for the above information Case B: You purchased $300,000 of 8%, 6-year bonds of Amazing Company on May 1, 2021, for $206,000 in cash. These bonds pay interest annually on April 30. You use the straight-line method of amortization. You plan to sell these bonds in 2022. Your year ends on December 31. Prepare the journal entries: To buy these bonds on May 1, 2021. а. b. To accrue interest and amortize the premium or discount on December 31, 2021. To mark to market on December 31, 2021 when the market value of these bonds was 101. с. d. To reverse the accrual on January 1, 2022 To collect the interest and amortize the premium or discount on April 30, 2022. е. f. To sell all of these bonds on June 1, 2022, for 101.5 plus accrued interest.

Case A: On January 1, 2021, your company purchased 60,000 shares of Freeze Company's $10 par common stock for $26 per share in cash plus paid $10,000 of broker's fees. On that date, Freeze Company's assets and liabilities had a book value equal to market value except for their building which had a market value which was $80,000 higher than its book value and had a 20-year remaining life. 2021 a. Purchased 60,000 shares of Freeze Company's $10 par common stock for $26 per share in cash plus paid $10,000 in broker's fees.. b. Received $30,000 in cash dividends. On December 31, 2021: 1. Freeze Company's stock had a market value of $25 per share. с. 2. Freeze Company reported net income of $400,000. 2022 d. Received a 10% stock dividend. On December 31, 2022: 1. Freeze Company's stock had a market value of $24 per share. е. 2. Freeze Company reported net income of $500,000. Assume the 60,000 shares you purchased represented 30% of the outstanding shares of Freeze Company so you were using he EQUITY method. Your company plans to hold on to the shares for several years. Prepare all entries for 2021 and 2022 for the above information Case B: You purchased $300,000 of 8%, 6-year bonds of Amazing Company on May 1, 2021, for $206,000 in cash. These bonds pay interest annually on April 30. You use the straight-line method of amortization. You plan to sell these bonds in 2022. Your year ends on December 31. Prepare the journal entries: To buy these bonds on May 1, 2021. а. b. To accrue interest and amortize the premium or discount on December 31, 2021. To mark to market on December 31, 2021 when the market value of these bonds was 101. с. d. To reverse the accrual on January 1, 2022 To collect the interest and amortize the premium or discount on April 30, 2022. е. f. To sell all of these bonds on June 1, 2022, for 101.5 plus accrued interest.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter16: Retained Earnings And Earnings Per Share

Section: Chapter Questions

Problem 23E

Related questions

Question

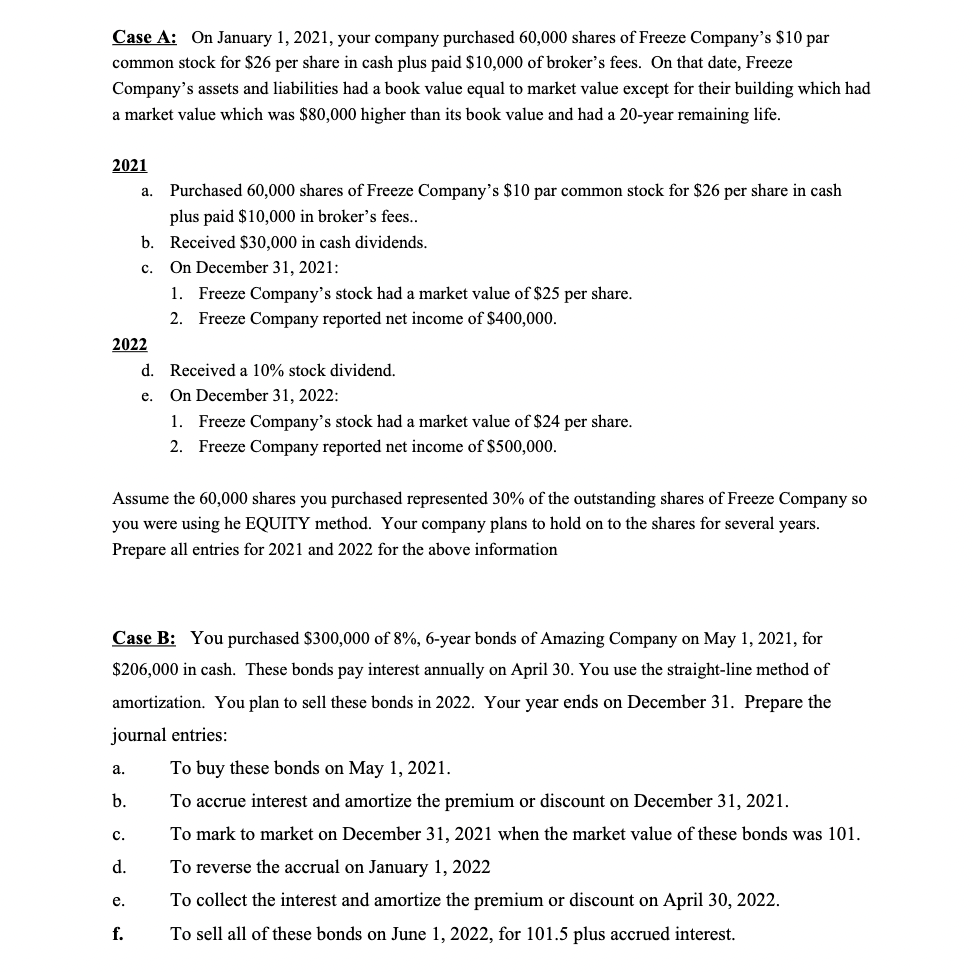

Transcribed Image Text:Case A: On January 1, 2021, your company purchased 60,000 shares of Freeze Company's $10 par

common stock for $26 per share in cash plus paid $10,000 of broker's fees. On that date, Freeze

Company's assets and liabilities had a book value equal to market value except for their building which had

a market value which was $80,000 higher than its book value and had a 20-year remaining life.

2021

a. Purchased 60,000 shares of Freeze Company's $10 par common stock for $26 per share in cash

plus paid $10,000 in broker's fees..

b. Received $30,000 in cash dividends.

On December 31, 2021:

1. Freeze Company's stock had a market value of $25 per share.

с.

2. Freeze Company reported net income of $400,000.

2022

d. Received a 10% stock dividend.

On December 31, 2022:

1. Freeze Company's stock had a market value of $24 per share.

е.

2. Freeze Company reported net income of $500,000.

Assume the 60,000 shares you purchased represented 30% of the outstanding shares of Freeze Company so

you were using he EQUITY method. Your company plans to hold on to the shares for several years.

Prepare all entries for 2021 and 2022 for the above information

Case B: You purchased $300,000 of 8%, 6-year bonds of Amazing Company on May 1, 2021, for

$206,000 in cash. These bonds pay interest annually on April 30. You use the straight-line method of

amortization. You plan to sell these bonds in 2022. Your year ends on December 31. Prepare the

journal entries:

To buy these bonds on May 1, 2021.

а.

b.

To accrue interest and amortize the premium or discount on December 31, 2021.

To mark to market on December 31, 2021 when the market value of these bonds was 101.

с.

d.

To reverse the accrual on January 1, 2022

To collect the interest and amortize the premium or discount on April 30, 2022.

е.

f.

To sell all of these bonds on June 1, 2022, for 101.5 plus accrued interest.

Expert Solution

Step 1

Entries for the year 2021

a. Investment a/c dr. 166000

to bank 166000

b.bank a/c dr. Â Â 30000

to dividends 30000

b.dividends a/c dr 30000

to P&L 30000

c P&L a/c dr. 16000

To investments 16000

c income A/c dr 400000.

to P&l 400000

Entries for the year 2022

d.dividends a/c dr 60000

to P&L 60000

e. P&L a/c dr. 6000

To investments 6000

e.income A/c dr 500000.

to P&l 500000

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning