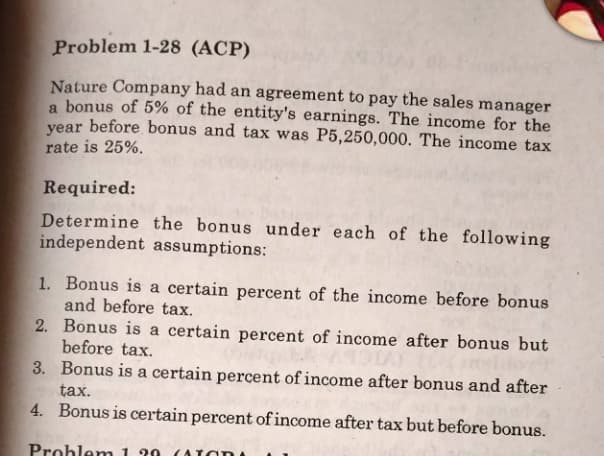

Problem 1-28 (ACP) Nature Company had an agreement to pay the sales manager a bonus of 5% of the entity's earnings. The income for the year before bonus and tax was P5,250,000. The income tax rate is 25%. Required: Determine the bonus under each of the following independent assumptions: 1. Bonus is a certain percent of the income before bonus and before tax. 2. Bonus is a certain percent of income after bonus but before tax. 3. Bonus is a certain percent of income after bonus and after tax. 4. Bonus is certain percent of income after tax but before bonus.

Problem 1-28 (ACP) Nature Company had an agreement to pay the sales manager a bonus of 5% of the entity's earnings. The income for the year before bonus and tax was P5,250,000. The income tax rate is 25%. Required: Determine the bonus under each of the following independent assumptions: 1. Bonus is a certain percent of the income before bonus and before tax. 2. Bonus is a certain percent of income after bonus but before tax. 3. Bonus is a certain percent of income after bonus and after tax. 4. Bonus is certain percent of income after tax but before bonus.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter9: Current Liabilities And Contingent Obligations

Section: Chapter Questions

Problem 15E

Related questions

Question

Transcribed Image Text:Problem 1-28 (ACP)

Nature Company had an agreement to pay the sales manager

a bonus of 5% of the entity's earnings. The income for the

year before bonus and tax was P5,250,000. The income tax

rate is 25%.

Required:

Determine the bonus under each of the following

independent assumptions:

1. Bonus is a certain percent of the income before bonus

and before tax.

2.

Bonus is a certain percent of income after bonus but

before tax.

3.

Bonus is a certain percent of income after bonus and after

tax.

4. Bonus is certain percent of income after tax but before bonus.

Problem 139 (Tar

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,