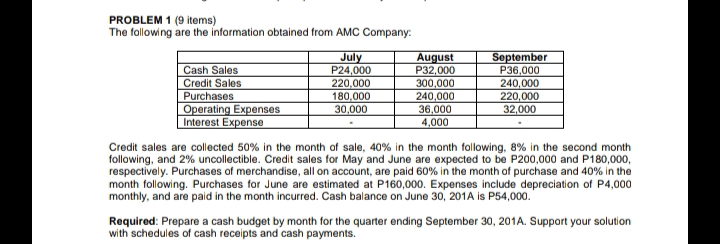

PROBLEM 1 (9 items) The following are the information obtained from AMC Company: Cash Sales Credit Sales Purchases Operating Expenses Interest Expense July P24,000 220,000 180,000 30,000 August P32,000 300,000 240,000 36,000 4,000 September P36,000 240,000 220,000 32,000 Credit sales are collected 50% in the month of sale, 40% in the month following, 8% in the second month following, and 2% uncollectible. Credit sales for May and June are expected to be P200,000 and P180,000, respectively. Purchases of merchandise, all on account, are paid 60% in the month of purchase and 40% in the month following. Purchases for June are estimated at P160,000. Expenses include depreciation of P4,000 monthly, and are paid in the month incurred. Cash balance on June 30, 201A is P54,000." Required: Prepare a cash budget by month for the quarter ending September 30, 201A. Support your solution with schedules of cash receipts and cash payments.

PROBLEM 1 (9 items) The following are the information obtained from AMC Company: Cash Sales Credit Sales Purchases Operating Expenses Interest Expense July P24,000 220,000 180,000 30,000 August P32,000 300,000 240,000 36,000 4,000 September P36,000 240,000 220,000 32,000 Credit sales are collected 50% in the month of sale, 40% in the month following, 8% in the second month following, and 2% uncollectible. Credit sales for May and June are expected to be P200,000 and P180,000, respectively. Purchases of merchandise, all on account, are paid 60% in the month of purchase and 40% in the month following. Purchases for June are estimated at P160,000. Expenses include depreciation of P4,000 monthly, and are paid in the month incurred. Cash balance on June 30, 201A is P54,000." Required: Prepare a cash budget by month for the quarter ending September 30, 201A. Support your solution with schedules of cash receipts and cash payments.

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter9: Metric-analysis Of Financial Statements

Section: Chapter Questions

Problem 9.2.1P

Related questions

Question

Transcribed Image Text:PROBLEM 1 (9 items)

The following are the information obtained from AMC Company:

July

P24,000

220,000

180,000

30,000

August

P32,000

300,000

240,000

36,000

4,000

September

P36,000

240,000

220,000

32,000

Cash Sales

Credit Sales

Purchases

Operating Expenses

Interest Expense

Credit sales are collected 50% in the month of sale, 40% in the month following, 8% in the second month

following, and 2% uncollectible. Credit sales for May and June are expected to be P200,000 and P180,000,

respectively. Purchases of merchandise, all on account, are paid 60% in the month of purchase and 40% in the

month following. Purchases for June are estimated at P160,000. Expenses include depreciation of P4,000

monthly, and are paid in the month incurred. Cash balance on June 30, 201A is P54,000.

Required: Prepare a cash budget by month for the quarter ending September 30, 201A. Support your solution

with schedules of cash receipts and cash payments.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning