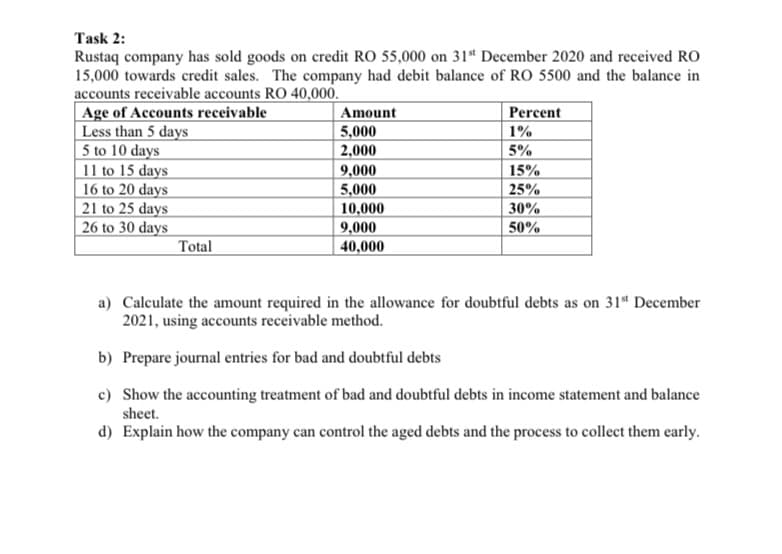

Task 2: Rustaq company has sold goods on credit RO 55,000 on 31“ December 2020 and received RO 15,000 towards credit sales. The company had debit balance of RO 5500 and the balance in accounts receivable accounts RO 40,000. Age of Accounts receivable Less than 5 days 5 to 10 days 11 to 15 days 16 to 20 days 21 to 25 days Percent Amount 5,000 1% 5% 2,000 9,000 5,000 10,000 9 000 15% 25% 30% 26 to 30 davs 50%

Task 2: Rustaq company has sold goods on credit RO 55,000 on 31“ December 2020 and received RO 15,000 towards credit sales. The company had debit balance of RO 5500 and the balance in accounts receivable accounts RO 40,000. Age of Accounts receivable Less than 5 days 5 to 10 days 11 to 15 days 16 to 20 days 21 to 25 days Percent Amount 5,000 1% 5% 2,000 9,000 5,000 10,000 9 000 15% 25% 30% 26 to 30 davs 50%

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter7: Receivables And Investments

Section: Chapter Questions

Problem 7.8E

Related questions

Topic Video

Question

Transcribed Image Text:Task 2:

Rustaq company has sold goods on credit RO 55,000 on 31* December 2020 and received RO

15,000 towards credit sales. The company had debit balance of RO 5500 and the balance in

accounts receivable accounts RO 40,000.

Age of Accounts receivable

Less than 5 days

5 to 10 days

11 to 15 days

16 to 20 days

21 to 25 days

26 to 30 days

Amount

5,000

Percent

1%

5%

2,000

9,000

5,000

10,000

9,000

| 40,000

15%

25%

30%

50%

Total

a) Calculate the amount required in the allowance for doubtful debts as on 31* December

2021, using accounts receivable method.

b) Prepare journal entries for bad and doubtful debts

c) Show the accounting treatment of bad and doubtful debts in income statement and balance

sheet.

d) Explain how the company can control the aged debts and the process to collect them early.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning