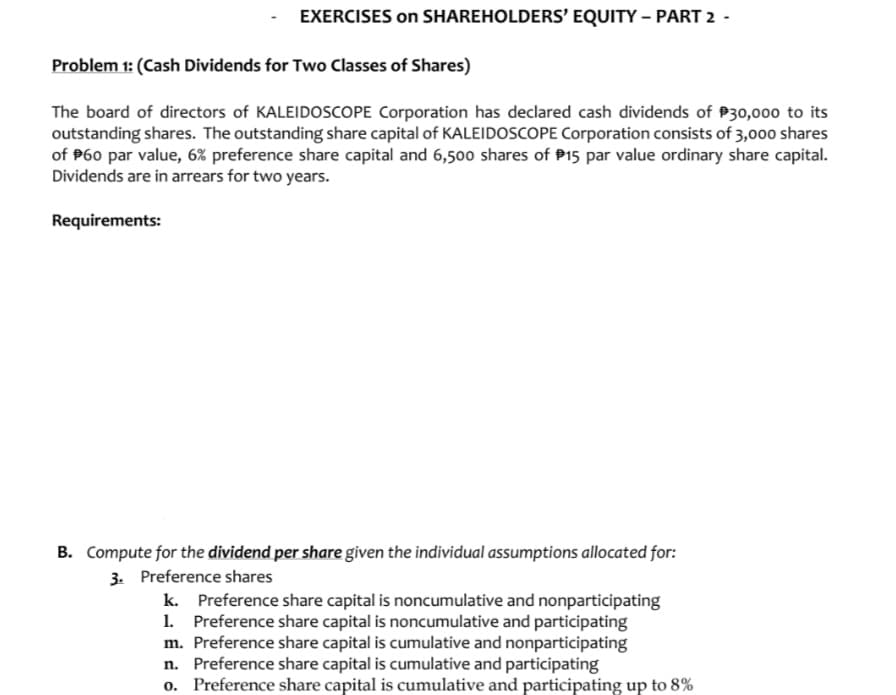

Problem 1: (Cash Dividends for Two Classes of Shares) The board of directors of KALEIDOSCOPE Corporation has declared cash dividends of P30,000 to its outstanding shares. The outstanding share capital of KALEIDOSCOPE Corporation consists of 3,000 shares of P60 par value, 6% preference share capital and 6,500 shares of P15 par value ordinary share capital. Dividends are in arrears for two years. Requirements:

Problem 1: (Cash Dividends for Two Classes of Shares) The board of directors of KALEIDOSCOPE Corporation has declared cash dividends of P30,000 to its outstanding shares. The outstanding share capital of KALEIDOSCOPE Corporation consists of 3,000 shares of P60 par value, 6% preference share capital and 6,500 shares of P15 par value ordinary share capital. Dividends are in arrears for two years. Requirements:

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter21: Corporations: Taxes, Earnings, Distributions, And The Statement Of Retained Earnings

Section: Chapter Questions

Problem 3SEA

Related questions

Question

Please answer it in good accounting form. Thankyou

Transcribed Image Text:EXERCISES on SHAREHOLDERS’ EQUITY – PART 2

Problem 1: (Cash Dividends for Two Classes of Shares)

The board of directors of KALEIDOSCOPE Corporation has declared cash dividends of P30,000 to its

outstanding shares. The outstanding share capital of KALEIDOSCOPE Corporation consists of 3,000 shares

of P60 par value, 6% preference share capital and 6,500 shares of P15 par value ordinary share capital.

Dividends are in arrears for two years.

Requirements:

B. Compute for the dividend per share given the individual assumptions allocated for:

3. Preference shares

k. Preference share capital is noncumulative and nonparticipating

1. Preference share capital is noncumulative and participating

m. Preference share capital is cumulative and nonparticipating

n. Preference share capital is cumulative and participating

o. Preference share capital is cumulative and participating up to 8%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning