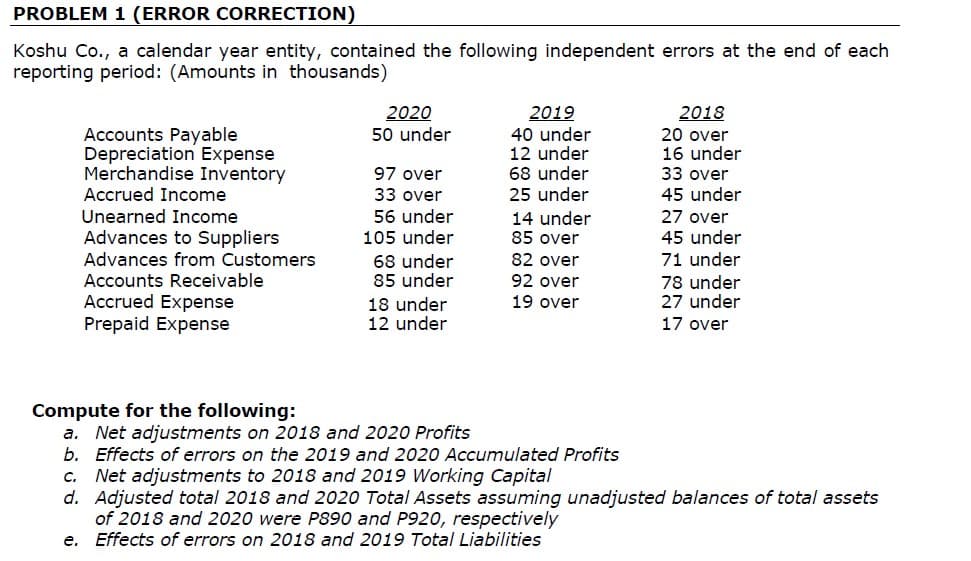

PROBLEM 1 (ERROR CORRECTION) Koshu Co., a calendar year entity, contained the following independent errors at the end of each reporting period: (Amounts in thousands) 2019 40 under 12 under 68 under 2020 50 under Accounts Payable Depreciation Expense Merchandise Inventory 2018 20 over 16 under 33 over 45 under 97 over Accrued Income 33 over 25 under Unearned Income 56 under 14 under 85 over 27 over 45 under Advances to Suppliers 105 under Advances from Customers 82 over 71 under 68 under 85 under Accounts Receivable Accrued Expense Prepaid Expense 92 over 78 under 27 under 19 over 18 under 12 under 17 over Compute for the following: a. Net adjustments on 2018 and 2020 Profits b. Effects of errors on the 2019 and 2020 Accumulated Profits c. Net adjustments to 2018 and 2019 Working Capital d. Adjusted total 2018 and 2020 Total Assets assuming unadjusted balances of total assets of 2018 and 2020 were P890 and P920, respectively e. Effects of errors on 2018 and 2019 Total Liabilities

PROBLEM 1 (ERROR CORRECTION) Koshu Co., a calendar year entity, contained the following independent errors at the end of each reporting period: (Amounts in thousands) 2019 40 under 12 under 68 under 2020 50 under Accounts Payable Depreciation Expense Merchandise Inventory 2018 20 over 16 under 33 over 45 under 97 over Accrued Income 33 over 25 under Unearned Income 56 under 14 under 85 over 27 over 45 under Advances to Suppliers 105 under Advances from Customers 82 over 71 under 68 under 85 under Accounts Receivable Accrued Expense Prepaid Expense 92 over 78 under 27 under 19 over 18 under 12 under 17 over Compute for the following: a. Net adjustments on 2018 and 2020 Profits b. Effects of errors on the 2019 and 2020 Accumulated Profits c. Net adjustments to 2018 and 2019 Working Capital d. Adjusted total 2018 and 2020 Total Assets assuming unadjusted balances of total assets of 2018 and 2020 were P890 and P920, respectively e. Effects of errors on 2018 and 2019 Total Liabilities

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter22: Accounting For Changes And Errors.

Section: Chapter Questions

Problem 14E: Refer to the information in E22-13. Required: Prepare the correcting journal entries if the company...

Related questions

Question

Transcribed Image Text:PROBLEM 1 (ERROR CORRECTION)

Koshu Co., a calendar year entity, contained the following independent errors at the end of each

reporting period: (Amounts in thousands)

2020

50 under

2019

40 under

12 under

68 under

25 under

2018

Accounts Payable

Depreciation Expense

Merchandise Inventory

20 over

16 under

33 over

45 under

97 over

Accrued Income

33 over

56 under

Unearned Income

14 under

85 over

27 over

45 under

Advances to Suppliers

105 under

Advances from Customers

Accounts Receivable

Accrued Expense

Prepaid Expense

82 over

71 under

68 under

85 under

92 over

78 under

27 under

17 over

19 over

18 under

12 under

Compute for the following:

a. Net adjustments on 2018 and 2020 Profits

b. Effects of errors on the 2019 and 2020 Accumulated Profits

c. Net adjustments to 2018 and 2019 Working Capital

d. Adjusted total 2018 and 2020 Total Assets assuming unadjusted balances of total assets

of 2018 and 2020 were P890 and P920, respectively

e. Effects of errors on 2018 and 2019 Total Liabilities

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,