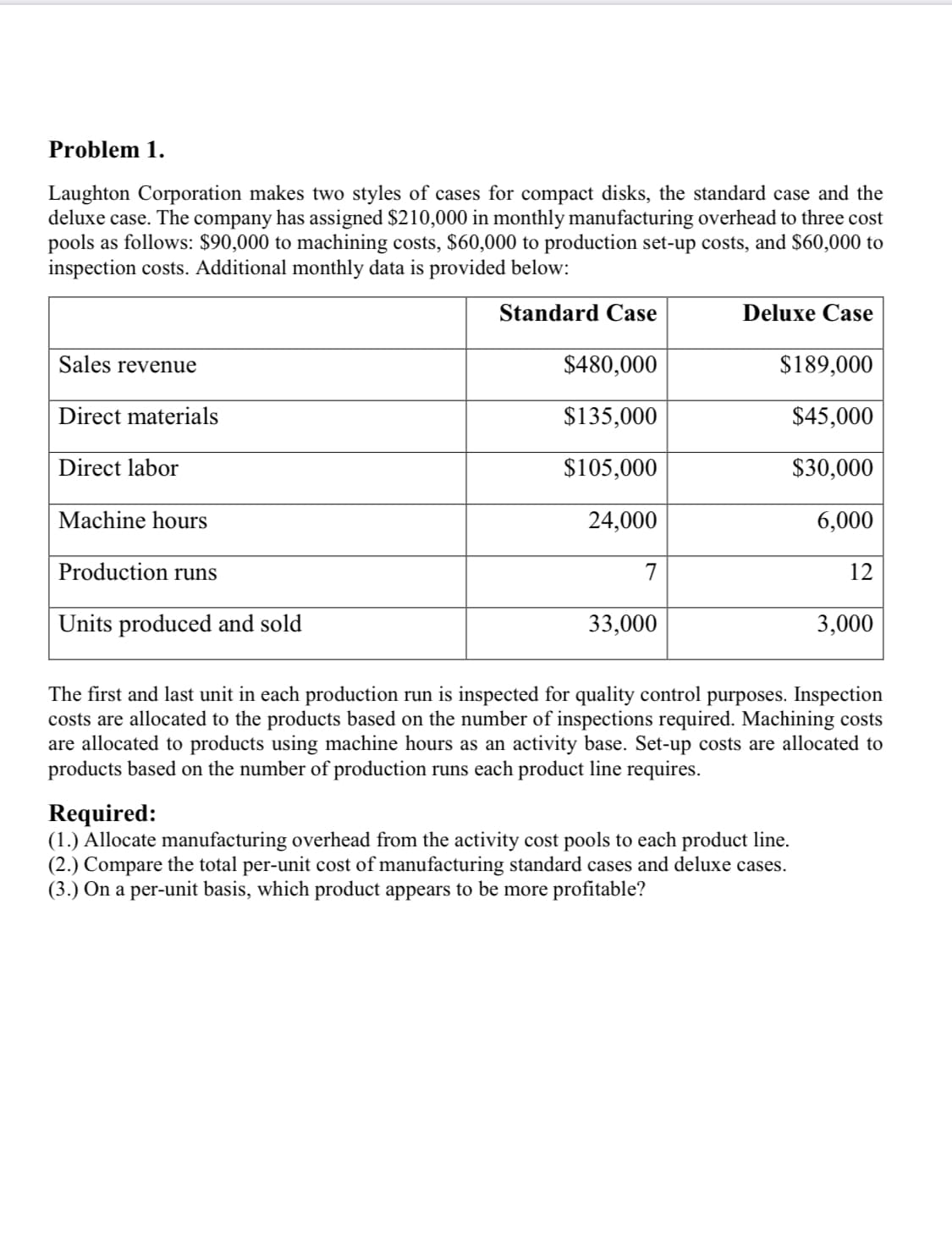

Problem 1 Laughton Corporation makes two styles of cases for compact disks, the standard case and the deluxe case. The company has assigned $210,000 in monthly manufacturing overhead to three cost pools as follows: $90,000 to machining costs, $60,000 to production set-up costs, and $60,000 to inspection costs. Additional monthly data is provided below: Standard Case Deluxe Case $480,000 $189,000 Sales revenue Direct materials $135,000 $45,000 $105,000 $30,000 Direct labor 24,000 Machine hours 6,000 Production runs 7 12 3,000 Units produced and sold 33,000 The first and last unit in each production run is inspected for quality control purposes. Inspection costs are allocated to the products based on the number of inspections required. Machining costs are allocated to products using machine hours as an activity base. Set-up costs are allocated to products based on the number of production runs each product line requires Required: (1) Allocate manufacturing overhead from the activity cost pools to each product line (2.) Compare the total per-unit cost of manufacturing standard cases and deluxe cases (3.) On a per-unit basis, which product appears to be more profitable?

Problem 1 Laughton Corporation makes two styles of cases for compact disks, the standard case and the deluxe case. The company has assigned $210,000 in monthly manufacturing overhead to three cost pools as follows: $90,000 to machining costs, $60,000 to production set-up costs, and $60,000 to inspection costs. Additional monthly data is provided below: Standard Case Deluxe Case $480,000 $189,000 Sales revenue Direct materials $135,000 $45,000 $105,000 $30,000 Direct labor 24,000 Machine hours 6,000 Production runs 7 12 3,000 Units produced and sold 33,000 The first and last unit in each production run is inspected for quality control purposes. Inspection costs are allocated to the products based on the number of inspections required. Machining costs are allocated to products using machine hours as an activity base. Set-up costs are allocated to products based on the number of production runs each product line requires Required: (1) Allocate manufacturing overhead from the activity cost pools to each product line (2.) Compare the total per-unit cost of manufacturing standard cases and deluxe cases (3.) On a per-unit basis, which product appears to be more profitable?

Chapter4: Preparing And Using Financial Statements

Section: Chapter Questions

Problem 2EP

Related questions

Question

Transcribed Image Text:Problem 1

Laughton Corporation makes two styles of cases for compact disks, the standard case and the

deluxe case. The company has assigned $210,000 in monthly manufacturing overhead to three cost

pools as follows: $90,000 to machining costs, $60,000 to production set-up costs, and $60,000 to

inspection costs. Additional monthly data is provided below:

Standard Case

Deluxe Case

$480,000

$189,000

Sales revenue

Direct materials

$135,000

$45,000

$105,000

$30,000

Direct labor

24,000

Machine hours

6,000

Production runs

7

12

3,000

Units produced and sold

33,000

The first and last unit in each production run is inspected for quality control purposes. Inspection

costs are allocated to the products based on the number of inspections required. Machining costs

are allocated to products using machine hours as an activity base. Set-up costs are allocated to

products based on the number of production runs each product line requires

Required:

(1) Allocate manufacturing overhead from the activity cost pools to each product line

(2.) Compare the total per-unit cost of manufacturing standard cases and deluxe cases

(3.) On a per-unit basis, which product appears to be more profitable?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning