PROBLEM 1: MULTIPLE CHOICE 1. During the period, an entity acquires an investment. The entity has a "hold to collect and sell" business model. The investment should be classified as a. investment measured at fair value through other comprehensive income. b. investment measured at amortized cost. investment measured at fair value through profit or loss. C. d. any of these 2. If an entity's business model's objective is to hold investments in order to collect contractual cash flows that are solebu payments for principal and interests, then investments should be classified as a. investment measured at fair value through other comprehensive income. b. investment measured at amortized cost. investment measured at fair value through profit or loss. of these C. d. any 3. A permanent decline in the fair value of an investment in equity securities that the entity made an irrevocable election at initial recognition to subsequently measure at FVOCI is recognized in a. profit or loss. b. other comprehensive income. c. either a or b d. not recognized

PROBLEM 1: MULTIPLE CHOICE 1. During the period, an entity acquires an investment. The entity has a "hold to collect and sell" business model. The investment should be classified as a. investment measured at fair value through other comprehensive income. b. investment measured at amortized cost. investment measured at fair value through profit or loss. C. d. any of these 2. If an entity's business model's objective is to hold investments in order to collect contractual cash flows that are solebu payments for principal and interests, then investments should be classified as a. investment measured at fair value through other comprehensive income. b. investment measured at amortized cost. investment measured at fair value through profit or loss. of these C. d. any 3. A permanent decline in the fair value of an investment in equity securities that the entity made an irrevocable election at initial recognition to subsequently measure at FVOCI is recognized in a. profit or loss. b. other comprehensive income. c. either a or b d. not recognized

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter18: Comparative Forms Of Doing Business

Section: Chapter Questions

Problem 12P

Related questions

Question

Transcribed Image Text:2. If an entity's business model's objective is to hold investments

entity has a "hold to collect and sell" business model. The

1. During the period, an entity acquires an investment. The

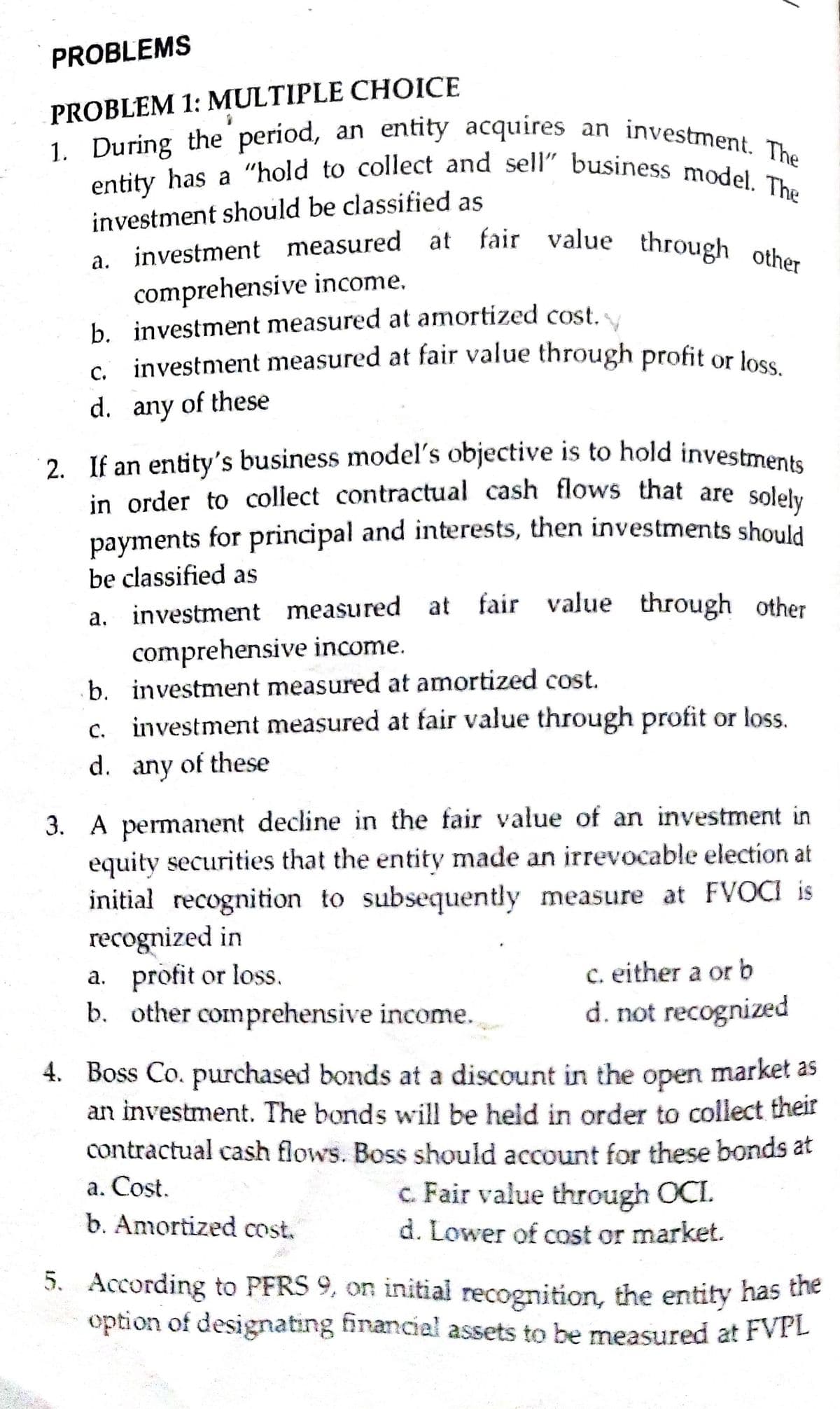

PROBLEMS

PROBLEM 1: MULTIPLE CHOICE

1. During the period, an entity acquires an investment

investment should be classified as

a investment measured at fair value through O

comprehensive income.

b. investment measured at amortized cost.

investment measured at fair value through profit or loss

С.

d. any of these

in order to collect contractual cash flows that are solehy

payments for principal and interests, then investments should

be classified as

а.

investment measured at fair value through other

comprehensive income.

b. investment measured at amortized cost.

C.

c. investment measured at fair value through profit or loss.

d.

any

of these

3. A permanent decline in the fair value of an investment in

equity securities that the entity made an irrevocable election at

initial recognition to subsequently measure at FVOCI is

recognized in

a. profit or loss.

b. other comprehensive income.

c. either a or b

d. not recognized

4. Boss Co. purchased bonds at a discount in the open market as

an investment. The bonds will be held in order to collect their

contractual cash flows. Boss should account for these bonds at

оpen

a. Cost.

b. Amortized cost.

c. Fair value through OCI.

d. Lower of cost or market.

5. According to PFRS 9, on initial recognition, the entity has e

option of designating financial assets to be measured at FVPL

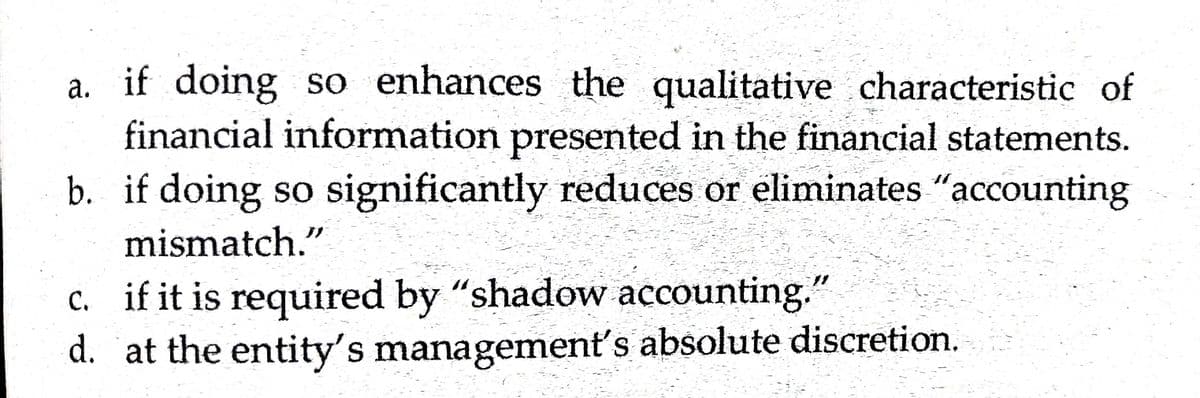

Transcribed Image Text:a. if doing so enhances the qualitative characteristic of

financial information presented in the financial statements.

b. if doing so significantly reduces or eliminates "accounting

mismatch."

c. if it is required by "shadow accounting.

d. at the entity's management's absolute discretion.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you