Problem 1: Susan Company experienced the ff. transaction during the current year. 1. Purchased machinery for P500, 000 cash. 2. Purchased land and building for P5,500, 000 cash, including an appraiser's fee of P100,000. An appraisal indicated fair value as follows. Land 2,000,000

Problem 1: Susan Company experienced the ff. transaction during the current year. 1. Purchased machinery for P500, 000 cash. 2. Purchased land and building for P5,500, 000 cash, including an appraiser's fee of P100,000. An appraisal indicated fair value as follows. Land 2,000,000

Chapter18: Accounting Periods And Methods

Section: Chapter Questions

Problem 10DQ

Related questions

Question

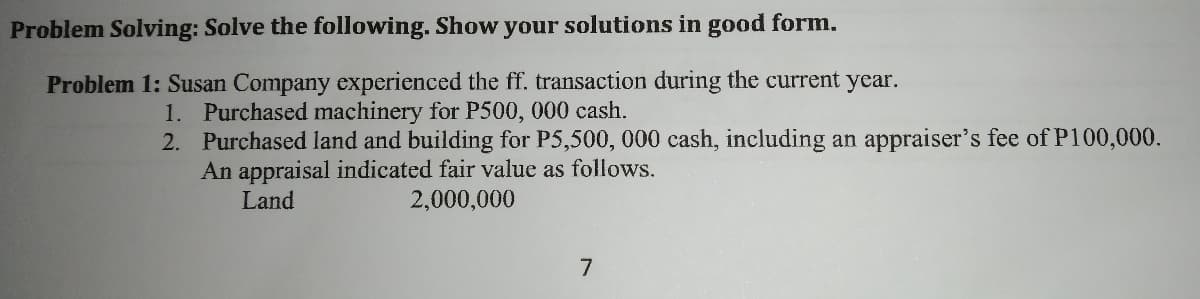

Transcribed Image Text:Problem Solving: Solve the following. Show your solutions in good form.

Problem 1: Susan Company experienced the ff. transaction during the current year.

1. Purchased machinery for P500, 000 cash.

2. Purchased land and building for P5,500, 000 cash, including an appraiser's fee of P100,000.

An appraisal indicated fair value as follows.

Land

2,000,000

7

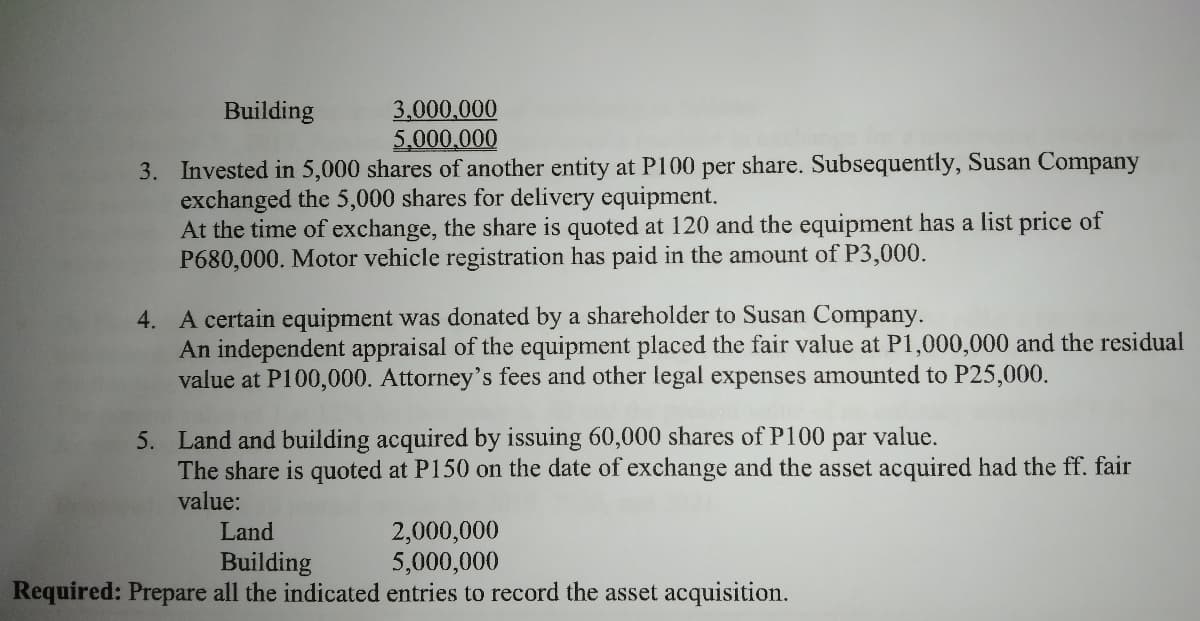

Transcribed Image Text:3,000,000

5,000,000

Building

3. Invested in 5,000 shares of another entity at P100 per share. Subsequently, Susan Company

exchanged the 5,000 shares for delivery equipment.

At the time of exchange, the share is quoted at 120 and the equipment has a list price of

P680,000. Motor vehicle registration has paid in the amount of P3,000.

4. A certain equipment was donated by a shareholder to Susan Company.

An independent appraisal of the equipment placed the fair value at P1,000,000 and the residual

value at P100,000. Attorney's fees and other legal expenses amounted to P25,000.

5. Land and building acquired by issuing 60,000 shares of P100 par value.

The share is quoted at P150 on the date of exchange and the asset acquired had the ff. fair

value:

2,000,000

5,000,000

Required: Prepare all the indicated entries to record the asset acquisition.

Land

Building

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning