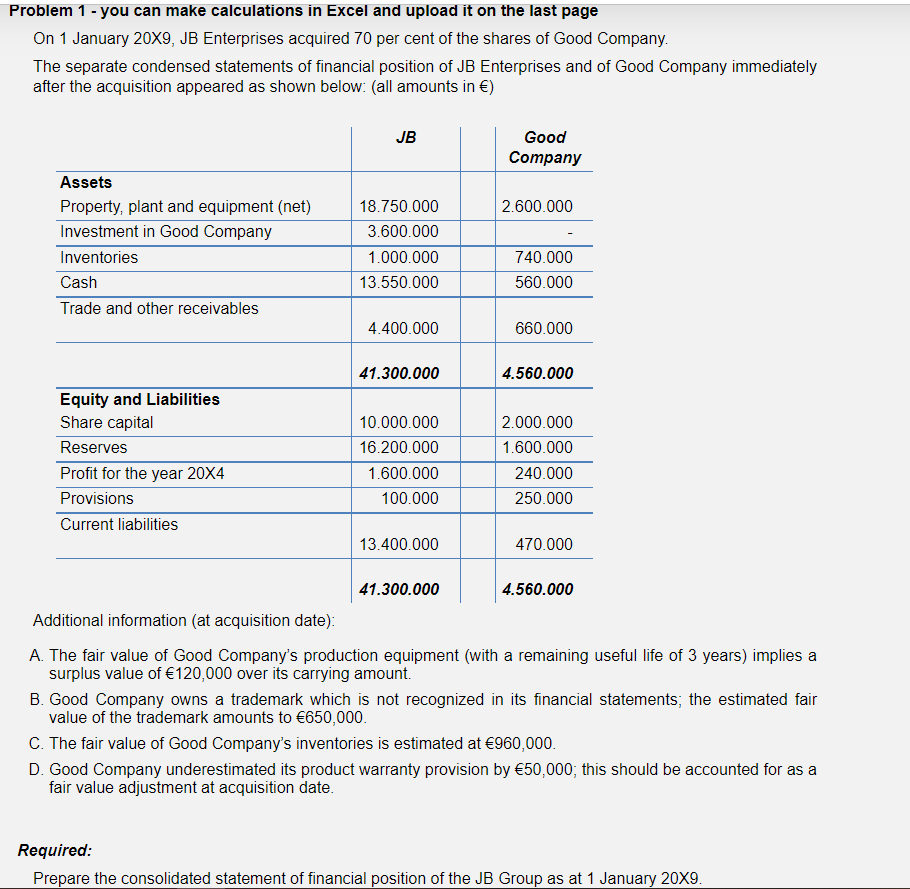

Problem 1 - you can make calculations in Excel and upload it on the last page On 1 January 20X9, JB Enterprises acquired 70 per cent of the shares of Good Company. The separate condensed statements of financial position of JB Enterprises and of Good Company immediately after the acquisition appeared as shown below: (all amounts in €) JB Good Company Assets Property, plant and equipment (net) 18.750.000 2.600.000 Investment in Good Company Inventories Cash 3.600.000 1.000.000 740.000 13.550.000 560.000 Trade and other receivables 4.400.000 660.000 41.300.000 4.560.000 Equity and Liabilities Share capital 10.000.000 2.000.000 Reserves 16.200.000 1.600.000 Profit for the year 20X4 1.600.000 240.000 Provisions 100.000 250.000 Current liabilities 13.400.000 470.000 41 300 000 4560 000

Problem 1 - you can make calculations in Excel and upload it on the last page On 1 January 20X9, JB Enterprises acquired 70 per cent of the shares of Good Company. The separate condensed statements of financial position of JB Enterprises and of Good Company immediately after the acquisition appeared as shown below: (all amounts in €) JB Good Company Assets Property, plant and equipment (net) 18.750.000 2.600.000 Investment in Good Company Inventories Cash 3.600.000 1.000.000 740.000 13.550.000 560.000 Trade and other receivables 4.400.000 660.000 41.300.000 4.560.000 Equity and Liabilities Share capital 10.000.000 2.000.000 Reserves 16.200.000 1.600.000 Profit for the year 20X4 1.600.000 240.000 Provisions 100.000 250.000 Current liabilities 13.400.000 470.000 41 300 000 4560 000

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter14: Intercorporate Investments In Common Stock

Section: Chapter Questions

Problem 28P

Related questions

Question

Transcribed Image Text:Problem 1 - you can make calculations in Excel and upload it on the last page

On 1 January 20X9, JB Enterprises acquired 70 per cent of the shares of Good Company.

The separate condensed statements of financial position of JB Enterprises and of Good Company immediately

after the acquisition appeared as shown below: (all amounts in €)

JB

Good

Company

Assets

Property, plant and equipment (net)

18.750.000

2.600.000

Investment in Good Company

3.600.000

Inventories

1.000.000

740.000

Cash

13.550.000

560.000

Trade and other receivables

4.400.000

660.000

41.300.000

4.560.000

Equity and Liabilities

Share capital

10.000.000

2.000.000

Reserves

16.200.000

1.600.000

Profit for the year 20X4

1.600.000

240.000

Provisions

100.000

250.000

Current liabilities

13.400.000

470.000

41.300.000

4.560.000

Additional information (at acquisition date):

A. The fair value of Good Company's production equipment (with a remaining useful life of 3 years) implies a

surplus value of €120,000 over its carrying amount.

B. Good Company owns a trademark which is not recognized in its financial statements; the estimated fair

value of the trademark amounts to €650,000.

C. The fair value of Good Company's inventories is estimated at €960,000.

D. Good Company underestimated its product warranty provision by €50,000; this should be accounted for as a

fair value adjustment at acquisition date.

Required:

Prepare the consolidated statement of financial position of the JB Group as at 1 January 20X9.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning