Problem 10-01 West Wind, Inc. has 5,200,000 shares of common stock outstanding with a market value of $70 per share. Net income for the coming year is expected to be $7,000,000. What impact will a two-for-one stock split have on the earnings per share and on the price of the stock? Round the earnings per share to the nearest cent and the prices of the stock to the nearest dollar. EPS before the split: $ EPS after the split: $ Price of the stock before the split: $ Price of the stock after the split: $ per share per share

Problem 10-01 West Wind, Inc. has 5,200,000 shares of common stock outstanding with a market value of $70 per share. Net income for the coming year is expected to be $7,000,000. What impact will a two-for-one stock split have on the earnings per share and on the price of the stock? Round the earnings per share to the nearest cent and the prices of the stock to the nearest dollar. EPS before the split: $ EPS after the split: $ Price of the stock before the split: $ Price of the stock after the split: $ per share per share

Chapter11: The Cost Of Capital

Section: Chapter Questions

Problem 14PROB

Related questions

Question

100%

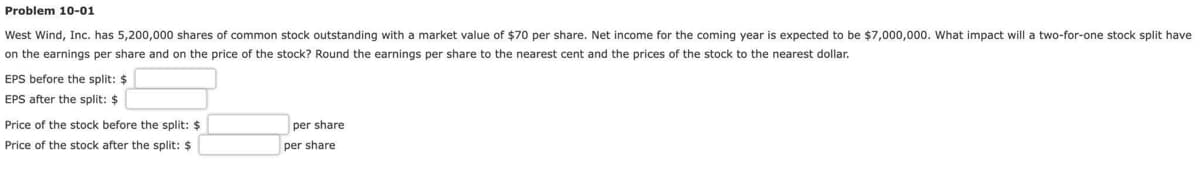

Transcribed Image Text:Problem 10-01

West Wind, Inc. has 5,200,000 shares of common stock outstanding with a market value of $70 per share. Net income for the coming year is expected to be $7,000,000. What impact will a two-for-one stock split have

on the earnings per share and on the price of the stock? Round the earnings per share to the nearest cent and the prices of the stock to the nearest dollar.

EPS before the split: $

EPS after the split: $

Price of the stock before the split: $

Price of the stock after the split: $

per share

per share

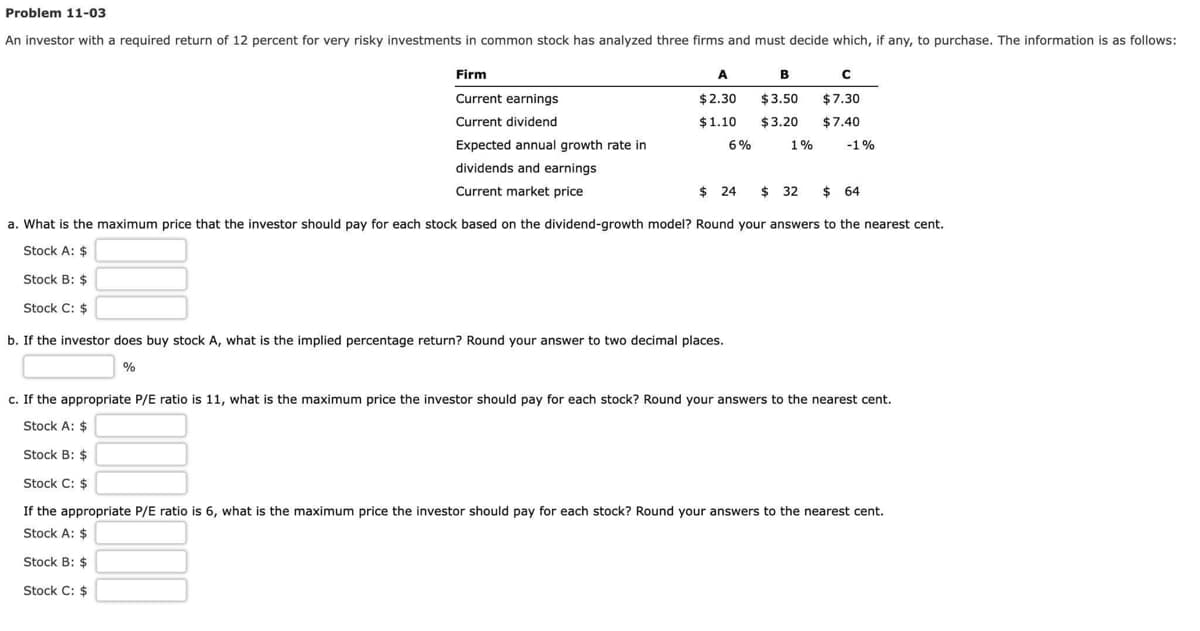

Transcribed Image Text:Problem 11-03

An investor with a required return of 12 percent for very risky investments in common stock has analyzed three firms and must decide which, if any, to purchase. The information is as follows:

Firm

Current earnings

Current dividend

Expected annual growth rate in

dividends and earnings

Current market price

A

B

C

$2.30 $3.50 $7.30

$1.10 $3.20 $7.40

-1%

6%

b. If the investor does buy stock A, what is the implied percentage return? Round your answer to two decimal places.

%

1%

$24 $ 32

$ 32 $ 64

a. What is the maximum price that the investor should pay for each stock based on the dividend-growth model? Round your answers to the nearest cent.

Stock A: $

Stock B: $

Stock C: $

c. If the appropriate P/E ratio is 11, what is the maximum price the investor should pay for each stock? Round your answers to the nearest cent.

Stock A: $

Stock B: $

Stock C: $

If the appropriate P/E ratio is 6, what is the maximum price the investor should pay for each stock? Round your answers to the nearest cent.

Stock A: $

Stock B: $

Stock C: $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Recommended textbooks for you

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning