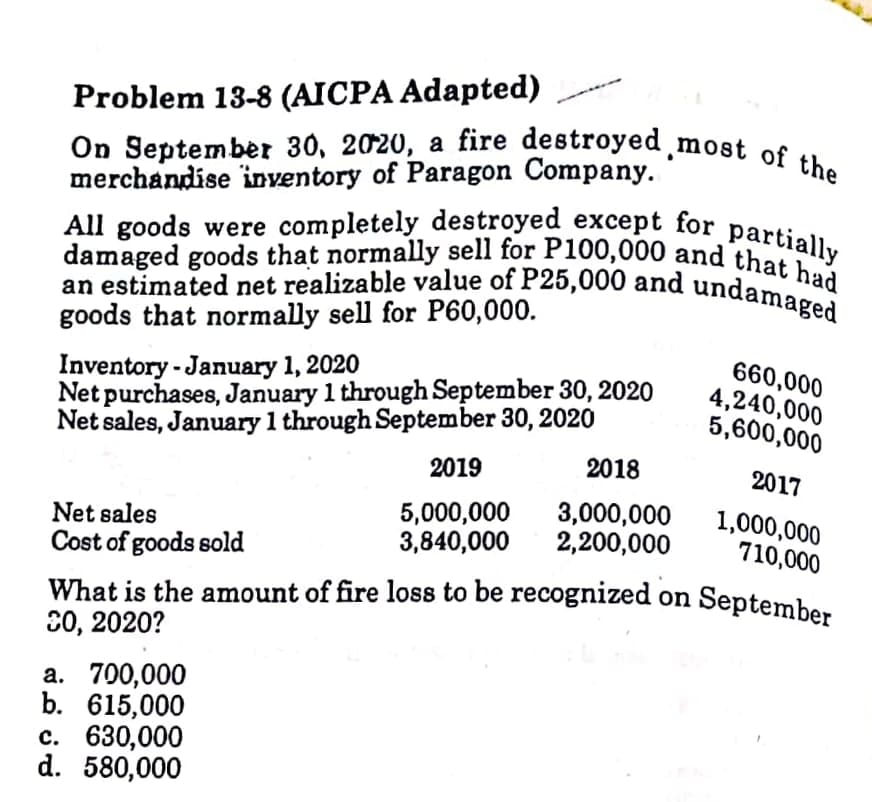

Problem 13-8 (AICPA Adapted) On September 30, 2020, a fire destroyed̟most of the merchandise inventory of Paragon Company. All goods were completely destroyed except for partially damaged goods that normally sell for P100,000 and that had an estimated net realizable value of P25,000 and undamaged goods that normally sell for P60,000. Inventory - January 1, 2020 Net purchases, January 1 through September 30, 2020 Net sales, January 1 through September 30, 2020 660,000 4,240,000 5,600,000 2019 2018 2017 Net sales Cost of goods sold 5,000,000 3,840,000 3,000,000 2,200,000 1,000,000 710,000 What is the amount of fire loss to be recognized on September 20, 2020? a. 700,000 b. 615,000 с. 630,000 d. 580,000

Problem 13-8 (AICPA Adapted) On September 30, 2020, a fire destroyed̟most of the merchandise inventory of Paragon Company. All goods were completely destroyed except for partially damaged goods that normally sell for P100,000 and that had an estimated net realizable value of P25,000 and undamaged goods that normally sell for P60,000. Inventory - January 1, 2020 Net purchases, January 1 through September 30, 2020 Net sales, January 1 through September 30, 2020 660,000 4,240,000 5,600,000 2019 2018 2017 Net sales Cost of goods sold 5,000,000 3,840,000 3,000,000 2,200,000 1,000,000 710,000 What is the amount of fire loss to be recognized on September 20, 2020? a. 700,000 b. 615,000 с. 630,000 d. 580,000

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter8: Inventories: Special Valuation Issues

Section: Chapter Questions

Problem 7E

Related questions

Question

Transcribed Image Text:On September 30, 2020, a fire destroyed̟most of the

All goods were completely destroyed except for partially

damaged goods that normally sell for P100,000 and that had

an estimated net realizable value of P25,000 and undamaged

What is the amount of fire loss to be recognized on September

Problem 13-8 (AICPA Adapted)

merchandise inventory of Paragon Company.

an estimated net realizable value of P26,000 and undamacd

goods that normally sell for P60,000.

Inventory -January 1, 2020

Net purchases, January 1 through September 30, 2020

Net sales, January 1 through September 30, 2020

660,000

4,240,000

5,600,000

2019

2018

2017

Net sales

Cost of goods sold

5,000,000

3,840,000

3,000,000

2,200,000

1,000,000

710,000

What is the amount of fire loss to be recognized on

20, 2020?

a. 700,000

b. 615,000

с. 630,000

d. 580,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage