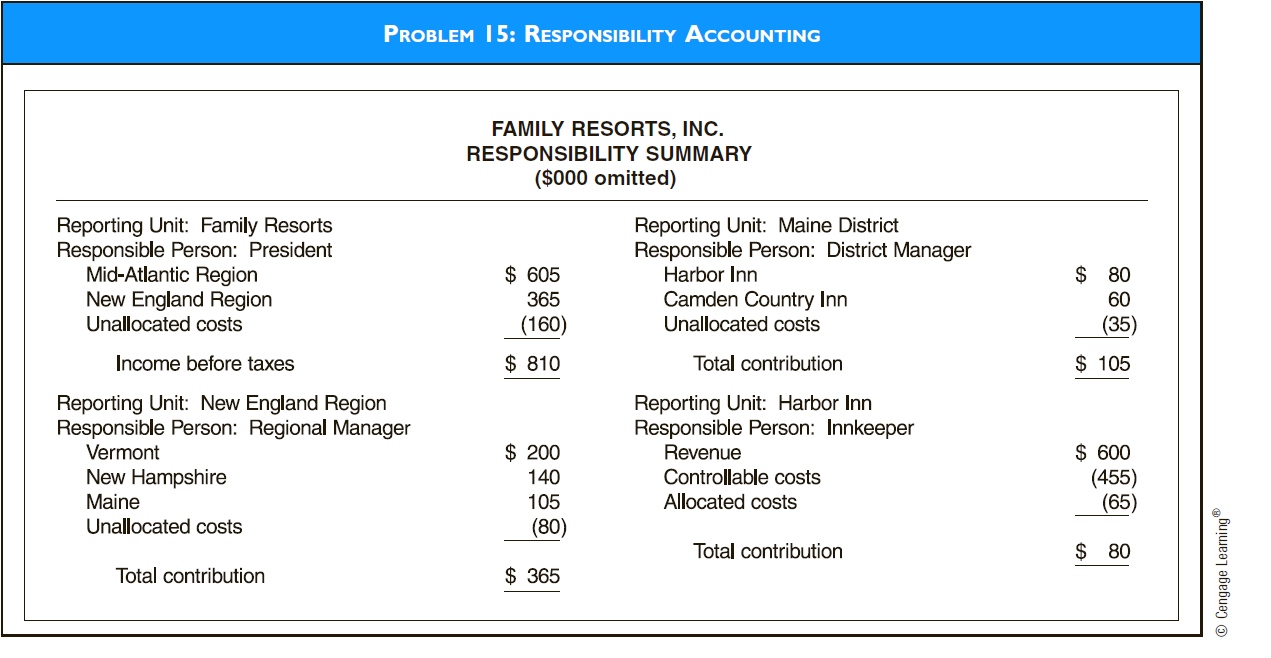

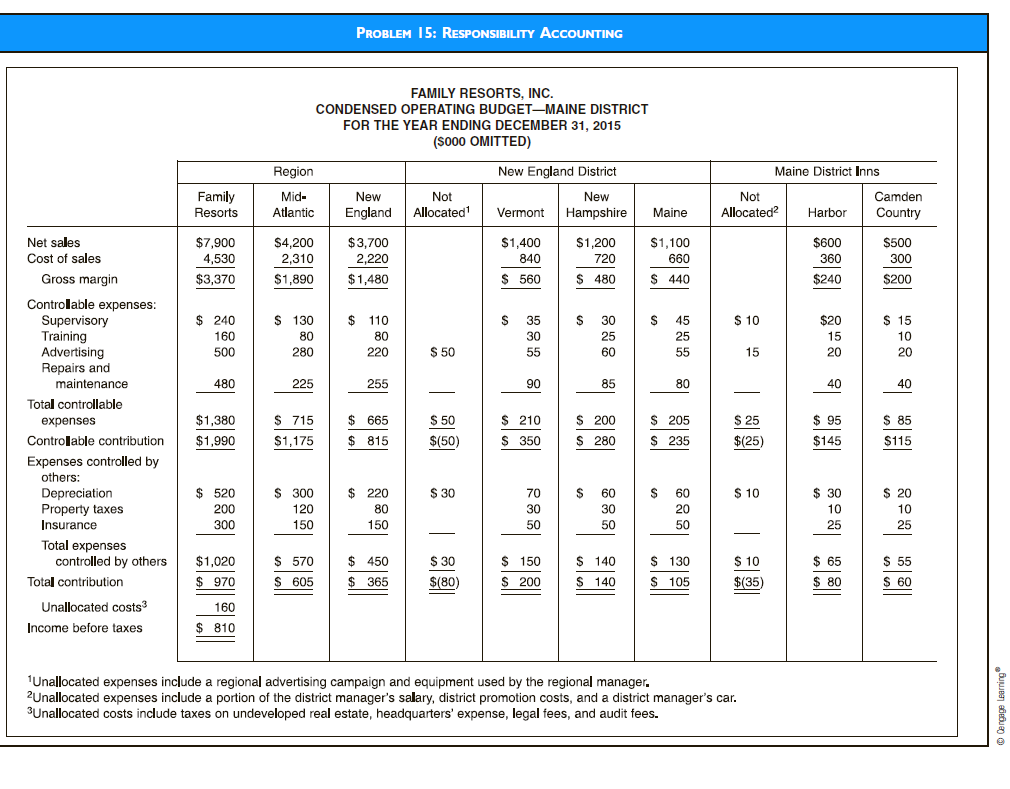

PROBLEM 15: RESPONSIBILITY ACCOUNTING FAMILY RESORTS, INC. RESPONSIBILITY SUMMARY ($000 omitted) Reporting Unit: Maine District Responsible Person: District Manager Harbor Inn Reporting Unit: Family Resorts Responsible Person: President Mid-Atlantic Region New England Region Unallocated costs $ 605 $ 80 Camden Country Inn Unallocated costs 60 365 (160) (35) $ 105 $ 810 Income before taxes Total contribution Reporting Unit: Harbor Inn Responsible Person: Innkeeper Revenue Reporting Unit: New England Region Responsible Person: Regional Manager Vermont $ 600 (455) (65) $ 200 New Hampshire Maine 140 Controllable costs Allocated costs 105 Unallocated costs (80) $ 80 Total contribution $ 365 Total contribution © Cengage Learning® PROBLEM 15: RESPONSIBILITY ACCOUNTING FAMILY RESORTS, INC. CONDENSED OPERATING BUDGET-MAINE DISTRICT FOR THE YEAR ENDING DECEMBER 31, 2015 (So00 OMITTED) New England District Region Maine District Inns Family Resorts Camden Mid- Atlantic New Not New Not Allocated? Allocated' England Vermont Hampshire Maine Harbor Country Net sales Cost of sales $7,900 4,530 $4,200 $3,700 2,220 $1,400 $1,200 $1,100 660 $600 $500 2,310 840 720 360 300 $ 480 Gross margin $ 560 $3,370 $1,480 $ 440 $1,890 $240 $200 Controlable expenses: Supervisory Training Advertising Repairs and maintenance $ 35 $ 240 $ 130 $ 110 $ 45 $ 10 $20 $ 15 30 80 30 25 15 160 80 25 10 $ 50 500 280 220 55 60 15 20 20 55 480 225 255 90 85 80 40 40 Total controllable $ 665 $ 715 $ 210 $ 205 $ 50 $ 200 $ 25 $1,380 $ 95 $ 85 expenses $ 235 $1,990 $1,175 $ 815 $(50) $ 350 $ 280 $(25) $145 Controlable contribution $115 Expenses controlled by others: $ 520 $ 220 $ 300 $ 60 $ 10 $ 30 $ 30 $ 60 $ 20 Depreciation Property taxes Insurance 70 200 120 80 150 30 30 20 10 10 300 150 50 50 50 25 25 Total expenses controlled by others $ 150 $ 200 $ 65 $ 450 $ 130 $ 10 $ 5 $ 570 $ 140 $1,020 $ 30 $ 970 $ 80 $ 605 $ 365 $ 140 $ 105 $(80) $(35) Total contribution $60 Unallocated costs 160 Income before taxes $ 810 1Unallocated expenses include a regional advertising campaign and equipment used by the regional manager. 2Unallocated expenses include a portion of the district manager's salary, district promotion costs, and a district manager's car. 3Unallocated costs include taxes on undeveloped real estate, headquarters' expense, legal fees, and audit fees.

CMA-ADAPTED RESPONSIBILITY

ACCOUNTING

Family Resorts, Inc., is a holding company for several

vacation hotels in the northeastern and mid-

Atlantic states. The firm originally purchased several

old inns, restored the buildings, and upgraded the

recreational facilities. Vacationing families have

been well pleased with the inns because many services

are provided that accommodate children and

afford parents time for themselves. Since the completion

of the restoration 10 years ago, the company has

been profitable.

Family Resorts has just concluded its annual

meeting of regional and district managers. This

meeting is held each November to review the results

of the previous season and to help the managers prepare

for the upcoming year. Before the meeting, the

managers submitted proposed budgets for their districts

or regions, as appropriate. These budgets are

reviewed and consolidated into an annual operating

budget for the entire company. The 2015 budget has

been presented at the meeting, and the managers

accepted it.

To evaluate the performance of its managers, Family

Resorts uses responsibility accounting. Therefore,

the preparation of the budget is given close attention

at headquarters. If major changes need to be made to

the budgets that the managers submitted, all affected

parties are consulted before the changes are incorporated.

The two figures designated Problem 15 present

two reports from the budget booklet that all managers

received at the meeting.

Required

a. Responsibility accounting has been used effectively

by many companies, both large and small.

1. Define responsibility accounting.

2. Discuss the benefits that accrue to a company

using responsibility accounting.

3. Describe the advantages of responsibility

b. The regional and district managers accepted

Family Resort’s budget. Based on the facts presented,

evaluate the budget process Family

Resorts employs by addressing the following:

1. What features of the budget presentation

shown are likely to make the budget attractive

to managers?

2. What recommendations, if any, could be

made to the budget preparers to improve the

budget process? Explain your answer.

Trending now

This is a popular solution!

Step by step

Solved in 4 steps