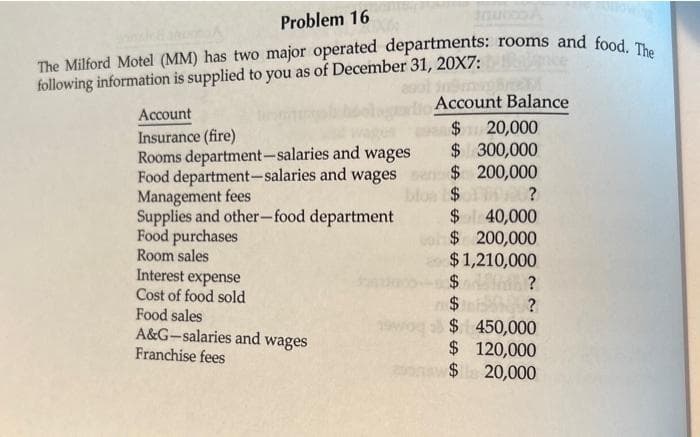

Problem 16 The Milford Motel (MM) has two major operated departments: rooms and food. The following information is supplied to you as of December 31, 20X7: Account Insurance (fire) Rooms department-salaries and wages Food department-salaries and wages Management fees Supplies and other-food department Food purchases Room sales Interest expense Cost of food sold Food sales A&G-salaries and wages Franchise fees Account Balance $20,000 $ 300,000 $ 200,000 $? $ 40,000 $ 200,000 $1,210,000 $? $ ? $ 450,000 $ 120,000 $ 20,000

Problem 16 The Milford Motel (MM) has two major operated departments: rooms and food. The following information is supplied to you as of December 31, 20X7: Account Insurance (fire) Rooms department-salaries and wages Food department-salaries and wages Management fees Supplies and other-food department Food purchases Room sales Interest expense Cost of food sold Food sales A&G-salaries and wages Franchise fees Account Balance $20,000 $ 300,000 $ 200,000 $? $ 40,000 $ 200,000 $1,210,000 $? $ ? $ 450,000 $ 120,000 $ 20,000

Century 21 Accounting General Journal

11th Edition

ISBN:9781337680059

Author:Gilbertson

Publisher:Gilbertson

Chapter11: Accounting For Transactions Using A General Journal

Section11.1: Accounting For Purchases Transactions Using A General Journal

Problem 1OYO

Related questions

Question

PLEASE HELP ME

Transcribed Image Text:Problem 16

The Milford Motel (MM) has two major operated departments: rooms and food. The

following information is supplied to you as of December 31, 20X7:

Account

Insurance (fire)

Rooms department-salaries and wages

Food department-salaries and wages

Management fees

Supplies and other-food department

Food purchases

Room sales

Interest expense

Cost of food sold

Food sales

A&G-salaries and wages

Franchise fees

Account Balance

$ 20,000

$300,000

$ 200,000

$?

$ 40,000

$ 200,000

$1,210,000

$

$

?

?

$ 450,000

$ 120,000

$

20,000

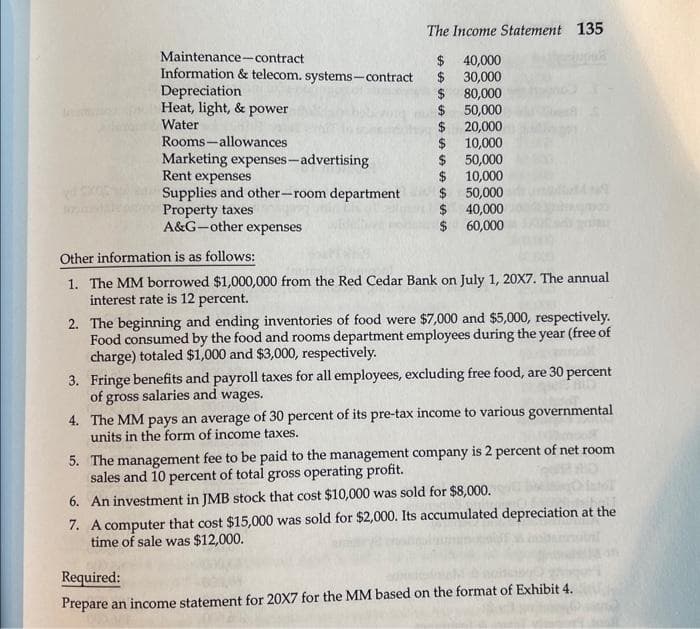

Transcribed Image Text:Maintenance-contract

Information & telecom. systems-contract

Depreciation

Heat, light, & power

Water

Rooms-allowances

Marketing expenses-advertising

Rent expenses

Supplies and other-room department

Property taxes

A&G-other expenses

The Income Statement 135.

$ 40,000

$

30,000

$

80,000

50,000

20,000

10,000

50,000

10,000

50,000

$

$

$

$ 40,000

$

60,000

Other information is as follows:

1. The MM borrowed $1,000,000 from the Red Cedar Bank on July 1, 20X7. The annual

interest rate is 12 percent.

2.

The beginning and ending inventories of food were $7,000 and $5,000, respectively.

Food consumed by the food and rooms department employees during the year (free of

charge) totaled $1,000 and $3,000, respectively.

3. Fringe benefits and payroll taxes for all employees, excluding free food, are 30 percent

of gross salaries and wages.

4. The MM pays an average of 30 percent of its pre-tax income to various governmental

units in the form of income taxes.

5.

The management fee to be paid to the management company is 2 percent of net room

sales and 10 percent of total gross operating profit.

6. An investment in JMB stock that cost $10,000 was sold for $8,000.

7. A computer that cost $15,000 was sold for $2,000. Its accumulated depreciation at the

time of sale was $12,000.

Required:

Prepare an income statement for 20X7 for the MM based on the format of Exhibit 4.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning