Problem 17-2O Payout Policy (LO3) Little Oil has outstanding 1 million shares with a total market value of $33 million. The firm is expected to pay $1.00 million of dividends next year, and thereafter, the amount paid out is expected to grow.by 4% a year in perpetuity. Thus, the expected dividend is $104 million in year 2, $1.0816 million in year 3, and so on However, the company has heard that the value of a share depends on the flow of dividends, and therefore, it announces that next year's dividend will be increased to $2 million and that the extra cash will be raised immediately afterward by an issue of shares. After that, the total amount paid out each year will be as previously forecasted, that is. $104 million in year 2 and increasing by 4% in each subsequent year a. At what price will the new shares be issuedin year 1? (Do not round intermediate calculations. Round your answer to 2 decimal places.) b. How many shares will the firm need to issue? (Do not round intermediate calculations. Round your answer to the nearest whole number.)

Problem 17-2O Payout Policy (LO3) Little Oil has outstanding 1 million shares with a total market value of $33 million. The firm is expected to pay $1.00 million of dividends next year, and thereafter, the amount paid out is expected to grow.by 4% a year in perpetuity. Thus, the expected dividend is $104 million in year 2, $1.0816 million in year 3, and so on However, the company has heard that the value of a share depends on the flow of dividends, and therefore, it announces that next year's dividend will be increased to $2 million and that the extra cash will be raised immediately afterward by an issue of shares. After that, the total amount paid out each year will be as previously forecasted, that is. $104 million in year 2 and increasing by 4% in each subsequent year a. At what price will the new shares be issuedin year 1? (Do not round intermediate calculations. Round your answer to 2 decimal places.) b. How many shares will the firm need to issue? (Do not round intermediate calculations. Round your answer to the nearest whole number.)

Fundamentals of Financial Management, Concise Edition (MindTap Course List)

9th Edition

ISBN:9781305635937

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter14: Distributions To Shareholders:Dividends And Share Repurchases

Section: Chapter Questions

Problem 8P

Related questions

Question

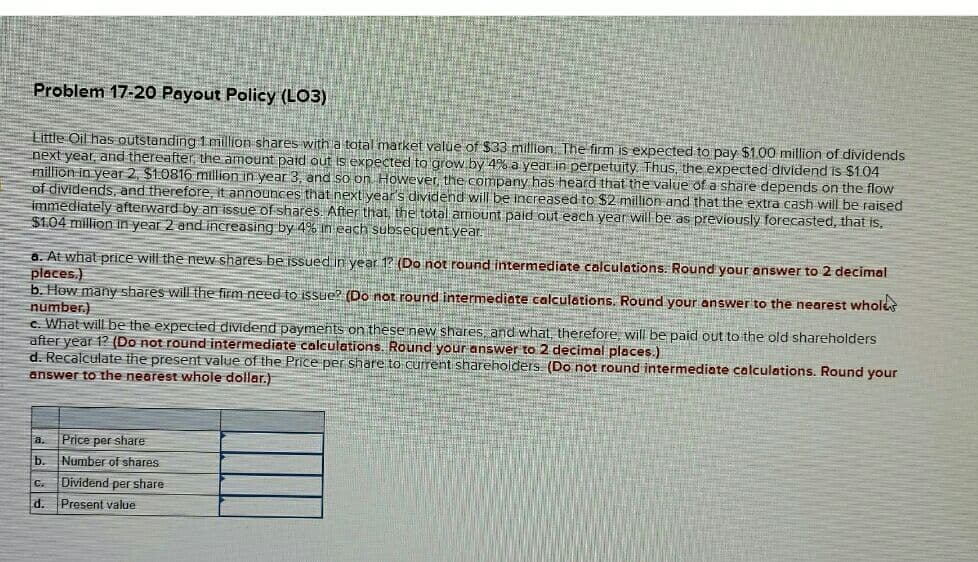

Transcribed Image Text:Problem 17-2O Payout Policy (LO3)

Little Oil has outstanding 1 million shares with a total market value of $33 million. The firm is expected to pay $1.00 million of dividends

next year, and thereafter, the amount paid out is expected to grow by 4% a year in perpetuity. Thus, the expected dividend is $104

million in year2, $1.0816 million in year 3, and so on However, the company has heard that the value of a share depends on the flow

of dividends, and therefore, it announces that next year's dividend will be increased to $2 million and that the extra cash will be raised

immediately afterward by an issue of shares. After that, the total amount paid out each year will be as previously forecasted, that is.

$1.04 million in year 2 and increasing by 4% in each subsequent year.

a. At what price will the new shares be jssued in year 1? (Do not round intermediate calculations. Round your answer to 2 decimal

places.)

b. How many shares will the firm need to issue? (Do not round intermediate calculations. Round your answer to the nearest wholes

number.)

c. What will be the expected dividend payments on these new shares and what, therefore, will be paid out to the old shareholders

after year 1? (Do not round intermediate calculations. Round your answer to 2 decimal places.)

d. Recalculate the present value of the Price per share to current shareholders (Do not round intermediate calculations. Round your

answer to the nearest whole dollar.)

a. Price per share

Number of shares

b.

C.

Dividend per share

d. Present value

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Recommended textbooks for you

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning