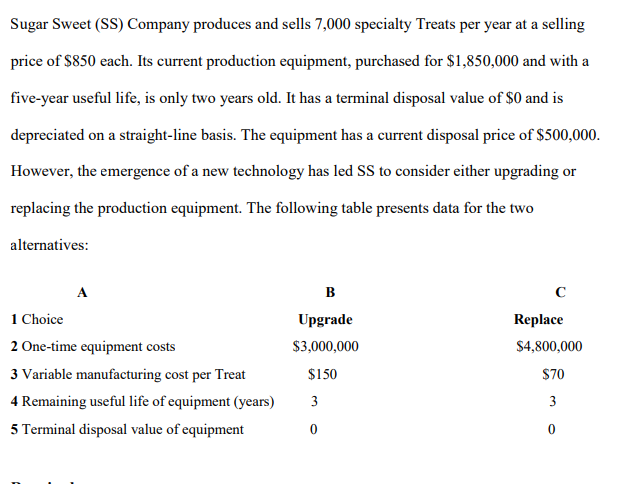

eet (SS) Company produces and sells 7,000 specialty Treats per year at a se 350 each. Its current production equipment, purchased for $1,850,000 and v useful life, is only two years old. It has a terminal disposal value of $0 and i d on a straight-line basis. The equipment has a current disposal price of $50

Q: Baker & Co. has applied for a loan from the Trust Us Bank in order to invest in several potential…

A: The question is related to Ratio Analysis. The details are given regarding the same. The comparison…

Q: Use the Stockholders' Equity section of FSB's Balance Sheet to answer the questions below. FSB…

A: Answer 3) Calculation of Average Price per share of Preferred Stock Total Paid-in Capital = (Number…

Q: The $5-bill in your pocket (Canadian) is: (check all that apply Select all that apply:

A: The balance sheet shows the financial statement of the company that includes the assets,…

Q: Calculate conversion cost given the following information: Account Balance (Alphabetical Order) ($)…

A: Conversion costs is the costs that convert raw materials into the finished goods. The calculation of…

Q: Mr. Hamed of Baltimore Company is contemplating to invest Samsung, Inc., a Korean based company. He…

A: ANSWER )GAAP guidelines require businesses to prepare financial statements according to the…

Q: Pretty Pillows, Mfg., manufactures silk throw pillows. Last month the company produced 3,890…

A: Cost of goods manufactured: It means total manufacturing costs, including all direct materials,…

Q: Lincoln Corporation used the following data to evaluate their current operating system. The company…

A: Working note: ActualResults StaticBudget Static-budgetvariance Units sold 42000…

Q: Wisconsin also paid $32,600 to a broker for arranging the transaction. In addition, Wisconsin paid…

A: Introduction:- A corporation's shares are units of equity ownership. Shares serve as a financial…

Q: Additional Information for Journal Entries Brian Burns records accruals for utilities expense as…

A: LIFO (last in, first out) is an inventory management system. Under LIFO, the costs of the most…

Q: Prepare the journal entry Apr. 8 Sold merchandise for $1,900, with credit terms of 1/10, n/30;…

A: Introduction: Journals: Recording of a business transactions in a chronological order. First step in…

Q: On January 2, 2021, A Corporation offers to sell a P100,000 bond coming due in 10 years. The bond…

A: Answer - The beginning carrying value of the bond is its purchase price of $80K. Calculation of…

Q: D6) Describe and explain the matters which the remuneration committee should consider when preparing…

A: Remuneration- Remuneration is the whole amount paid to an employee. It may contain a salary or…

Q: On January 2, 2021, A Corporation offers to sell a P100,000 bond coming due in 10 years. The bond…

A: Interest expense is calculated by taking the beginning period carrying value by the yield rate. In…

Q: Safe Dog Company makes dog crates. The budgeted selling price is $30 per crate, the variable rate…

A: Operating income is presented in the income statement that is calculated by deducting the fixed cost…

Q: reliminary judgment of P300,000 was issued and is under appeal. The entity’s attorney agrees…

A: The Accrued liability and liability that are associated with expenses that will be made by the firm…

Q: What is true of budgets?

A: Budget: Budget is an estimation of revenue and expenses over a specific period of time. It's a…

Q: Golding's finishing department had the following data for July: Transferred-In Materials…

A: Process costing is a costing method that is employed by the firms involved in the production of…

Q: safety manager recommends spending $3,000 on an initiative to reduce accidents in an organization.…

A: Concept of Present value of investment ( Cash flow)

Q: Mary Maywood opened Maywood Cleaners on March 1, 2022. During March, the following transactions…

A: Note: Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the question…

Q: will give thumbs up if correct #1. Given: The manager of a sporting goods store receives an…

A: Amount (in Php) Total Cost 980 Percentage of Markup 35% Markup (Total…

Q: the following information: Account Balance (Alphabetical Order) ($) Direct Labor Cost 400 Direct…

A: The conversion cost comprises of direct labor and manufacturing overhead cost.

Q: 32. Determine the monthly breakeven sales in dollars before adding nachos. 33. Determine the monthly…

A: Aydesurv Company currently sells hot dogs. During a typical month, the stand reports a profit of…

Q: The City of Waterman established a capital projects fund for the construction of an access ramp from…

A: Dear student as per bartleby guidelines we are supposed to answer only one question. kindly post…

Q: 1. Use the high-low method to compute the function relating advertising costs and revenues…

A: High-low method refers to a technique used by the company to determine the variable cost component…

Q: If Apple won an order to sell 500 of its new minicomputers to Australia, but the Australian…

A: The question is related to find the content required for the given question.

Q: Mary Maywood opened Maywood Cleaners on March 1, 2022. During March, the following transactions…

A: Since you have posted question with multiple sub-parts we will do the first three sub-parts for you.…

Q: Whirlpool Corporation's most recent income statement is shown below: Total Per Unit Sales (10,000…

A: Calculation of Net Operating Income if Sales volume increases by 100 units Amount Sales…

Q: July 1 Investment of the owner 3 cash sales 13 loan 15 Collection of accounts 20 Purchase returns 29…

A: The cash flow from investing activities includes the cash flow due to sale or purchase of non cash…

Q: The following information is given to you relating to the operations of PrincehallCorporation: The…

A: Formulas: Gross margin = Net sales - Cost of sales Income from operations = Gross margin - Total…

Q: Salaries and wages expense 51,800 Cash 13,400 Utilities expense 22,500 Accounts receivable 9,500…

A: Income Statement is a part of Financial Statements. It includes all the revenues earned and expenses…

Q: Q.2- Mr. Abdullah's medical and personal expenses include the following: Particulars Prescription…

A: Medical expenses deduction can be claimed for the medical expenses incurred during the period…

Q: As sales manager, lohn was grven the following static budget report in the cothing dopartment of…

A: The flexible budget is prepared on the basis of actual results and standard rates. The variance is…

Q: Reporting Stockholders' Equity Using the following accounts and balances, prepare the…

A: The stockholder's equity includes common stockholder's equity and preferred stock. but it excludes…

Q: Myers Corporation has the following data related to direct materials costs for November: actual…

A: Direct material price variance = Actual quantity ×(Standard price - Actual price)

Q: Q.2- Mr. Abdullah's medical and personal expenses include the following: Particulars Prescription…

A: Income tax: Income tax is the tax that an individual is responsible for on their earned income. It…

Q: 23. A law firm began November with office supplies of P1,600. During the month, the firm purchased…

A: The supplies expense is calculated as supplies purchase plus change in inventory of supplies

Q: b. What i

A: Given as,

Q: Unit Cost and Cost Assignment, Nonuniform Inputs Loran Inc. had the following equivalent units…

A: 1. Determination of the unit cost for materials, for conversion, and in total for the fabrication…

Q: pany's contribution format income statement for June is as follows: Vulcan Company Income Statement…

A: Income Statement: It is a statement which is prepared periodical and shows the profitability of the…

Q: Which is the proper way to report a contingent asset? a. As an asset b. No disclosure and no accrua…

A: As per IAS 37, Provisions, contingent liabilities and contingent assets. A contingent asset arise…

Q: Asset value on Jan 01 is $ 500000, Salvage value after 10 years is 25000. Compute accumulated…

A: Formula: Depreciation rate = ( 100 / useful life years ) x 2

Q: Statement I: In determining the interest income for the 2nd year of non-interest-bearing notes…

A: Answer:- Interest income definition:- Interest income can be defined as the difference between the…

Q: Entry for Cash Sales; Cash Over The actual cash received from cash sales was $14,953 and the amount…

A: Introduction: Journals: Recording of a business transactions in a chronological order. First step in…

Q: During 2020, Maria Company purchased trading securities with the following cost and market value on…

A: Given information Security B = 10,000 shares Sold at p150 per share Trading investments are…

Q: Purpose: To ascertain whether service revenue recognized during December, year 7, is complete and…

A: Service revenue- Service revenue is the sales reported by a industry that relate to services…

Q: P 850,000 50,000 P S00,000 Sales Less: Sales returns Net Sales Accounts Receivable Less: Allow. for…

A: In the context of the given question, we need to journalize the ending inventory transaction in the…

Q: Cost of goods manufactured $198,240 Selling expenses 66,220 Administrative expenses 35,010 Sales…

A: Formula: Cost of goods sold = Beginning finished goods inventory + Cost of goods manufactured -…

Q: Ramirez Company installs a computerized manufacturing machine in its factory at the beginning of the…

A: Introduction: Depreciation: Decreasing value of fixed assets over its useful life period called as…

Q: A business received cash of P3,000 in advance for services that will be provided later. The cash…

A: Adjusting journal entry (AJE) refers to the entry which the business made in the general ledger due…

Q: Lester, Torres, and Hearst are members of Arcadia Sales, LLC, sharing income and losses in the ratio…

A: The term "liquidate" refers to the process of transforming assets into cash or cash equivalents by…

Assume that the capital expenditures to replace and upgrade the production equipment are

as given in the original exercise, but that the production and sales quantity is not known. For

what production and sales quantity would SS (i) upgrade the equipment or (ii) replace the equipment?

Step by step

Solved in 3 steps

- Jonfran Company manufactures three different models of paper shredders including the waste container, which serves as the base. While the shredder heads are different for all three models, the waste container is the same. The number of waste containers that Jonfran will need during the following years is estimated as follows: The equipment used to manufacture the waste container must be replaced because it is broken and cannot be repaired. The new equipment would have a purchase price of 945,000 with terms of 2/10, n/30; the companys policy is to take all purchase discounts. The freight on the equipment would be 11,000, and installation costs would total 22,900. The equipment would be purchased in December 20x4 and placed into service on January 1, 20x5. It would have a five-year economic life and would be treated as three-year property under MACRS. This equipment is expected to have a salvage value of 12,000 at the end of its economic life in 20x9. The new equipment would be more efficient than the old equipment, resulting in a 25 percent reduction in both direct materials and variable overhead. The savings in direct materials would result in an additional one-time decrease in working capital requirements of 2,500, resulting from a reduction in direct material inventories. This working capital reduction would be recognized at the time of equipment acquisition. The old equipment is fully depreciated and is not included in the fixed overhead. The old equipment from the plant can be sold for a salvage amount of 1,500. Rather than replace the equipment, one of Jonfrans production managers has suggested that the waste containers be purchased. One supplier has quoted a price of 27 per container. This price is 8 less than Jonfrans current manufacturing cost, which is as follows: Jonfran uses a plantwide fixed overhead rate in its operations. If the waste containers are purchased outside, the salary and benefits of one supervisor, included in fixed overhead at 45,000, would be eliminated. There would be no other changes in the other cash and noncash items included in fixed overhead except depreciation on the new equipment. Jonfran is subject to a 40 percent tax rate. Management assumes that all cash flows occur at the end of the year and uses a 12 percent after-tax discount rate. Required: 1. Prepare a schedule of cash flows for the make alternative. Calculate the NPV of the make alternative. 2. Prepare a schedule of cash flows for the buy alternative. Calculate the NPV of the buy alternative. 3. Which should Jonfran domake or buy the containers? What qualitative factors should be considered? (CMA adapted)Thaler Company bought 26,000 of raw materials a year ago in anticipation of producing 5,000 units of a deluxe version of its product to be priced at 75 each. Now the price of the deluxe version has dropped to 35 each, and Thaler is now deciding whether to produce 1,500 units of the deluxe version at a cost of 48,000 or to scrap the project. What is the opportunity cost of this decision? a. 175,000 b. 375,000 c. 48,000 d. 26,000Filkins Fabric Company is considering the replacement of its old, fully depreciated knitting machine. Two new models are available: Machine 190-3, which has a cost of $190,000, a 3-year expected life, and after-tax cash flows (labor savings and depreciation) of $87,000 per year; and Machine 360-6, which has a cost of $360,000, a 6-year life, and after-tax cash flows of $98,300 per year. Knitting machine prices are not expected to rise because inflation will be offset by cheaper components (microprocessors) used in the machines. Assume that Filkins’ cost of capital is 14%. Should the firm replace its old knitting machine? If so, which new machine should it use? By how much would the value of the company increase if it accepted the better machine? What is the equivalent annual annuity for each machine?

- Newmarge Products Inc. is evaluating a new design for one of its manufacturing processes. The new design will eliminate the production of a toxic solid residue. The initial cost of the system is estimated at 860,000 and includes computerized equipment, software, and installation. There is no expected salvage value. The new system has a useful life of 8 years and is projected to produce cash operating savings of 225,000 per year over the old system (reducing labor costs and costs of processing and disposing of toxic waste). The cost of capital is 16%. Required: 1. Compute the NPV of the new system. 2. One year after implementation, the internal audit staff noted the following about the new system: (1) the cost of acquiring the system was 60,000 more than expected due to higher installation costs, and (2) the annual cost savings were 20,000 less than expected because more labor cost was needed than anticipated. Using the changes in expected costs and benefits, compute the NPV as if this information had been available one year ago. Did the company make the right decision? 3. CONCEPTUAL CONNECTION Upon reporting the results mentioned in the postaudit, the marketing manager responded in a memo to the internal audit department indicating that cash inflows also had increased by a net of 60,000 per year because of increased purchases by environmentally sensitive customers. Describe the effect that this has on the analysis in Requirement 2. 4. CONCEPTUAL CONNECTION Why is a postaudit beneficial to a firm?Alfredo Company purchased a new 3-D printer for $900,000. Although this printer is expected to last for ten years, Alfredo knows the technology will become old quickly, and so they plan to replace this printer in three years. At that point, Alfredo believes it will be able to sell the printer for $15,000. Calculate yearly depreciation using the double-declining-balance method.Gelbart Company manufactures gas grills. Fixed costs amount to 16,335,000 per year. Variable costs per gas grill are 225, and the average price per gas grill is 600. Required: 1. How many gas grills must Gelbart Company sell to break even? 2. If Gelbart Company sells 46,775 gas grills in a year, what is the operating income? 3. If Gelbart Companys variable costs increase to 240 per grill while the price and fixed costs remain unchanged, what is the new break-even point?

- NoFat manufactures one product, olestra, and sells it to large potato chip manufacturers as the key ingredient in nonfat snack foods, including Ruffles, Lays, Doritos, and Tostitos brand products. For each of the past 3 years, sales of olestra have been far less than the expected annual volume of 125,000 pounds. Therefore, the company has ended each year with significant unused capacity. Due to a short shelf life, NoFat must sell every pound of olestra that it produces each year. As a result, NoFats controller, Allyson Ashley, has decided to seek out potential special sales offers from other companies. One company, Patterson Union (PU)a toxic waste cleanup companyoffered to buy 10,000 pounds of olestra from NoFat during December for a price of 2.20 per pound. PU discovered through its research that olestra has proven to be very effective in cleaning up toxic waste locations designated as Superfund Sites by the U.S. Environmental Protection Agency. Allyson was excited, noting that This is another way to use our expensive olestra plant! The annual costs incurred by NoFat to produce and sell 100,000 pounds of olestra are as follows: In addition, Allyson met with several of NoFats key production managers and discovered the following information: The special order could be produced without incurring any additional marketing or customer service costs. NoFat owns the aging plant facility that it uses to manufacture olestra. NoFat incurs costs to set up and clean its machines for each production run, or batch, of olestra that it produces. The total setup costs shown in the previous table represent the production of 20 batches during the year. NoFat leases its plant machinery. The lease agreement is negotiated and signed on the first day of each year. NoFat currently leases enough machinery to produce 125,000 pounds of olestra. PU requires that an independent quality team inspects any facility from which it makes purchases. The terms of the special sales offer would require NoFat to bear the 1,000 cost of the inspection team. Based solely on financial factors, explain why NoFat should accept or reject PUs special sales offer.NoFat manufactures one product, olestra, and sells it to large potato chip manufacturers as the key ingredient in nonfat snack foods, including Ruffles, Lays, Doritos, and Tostitos brand products. For each of the past 3 years, sales of olestra have been far less than the expected annual volume of 125,000 pounds. Therefore, the company has ended each year with significant unused capacity. Due to a short shelf life, NoFat must sell every pound of olestra that it produces each year. As a result, NoFats controller, Allyson Ashley, has decided to seek out potential special sales offers from other companies. One company, Patterson Union (PU)a toxic waste cleanup companyoffered to buy 10,000 pounds of olestra from NoFat during December for a price of 2.20 per pound. PU discovered through its research that olestra has proven to be very effective in cleaning up toxic waste locations designated as Superfund Sites by the U.S. Environmental Protection Agency. Allyson was excited, noting that This is another way to use our expensive olestra plant! The annual costs incurred by NoFat to produce and sell 100,000 pounds of olestra are as follows: In addition, Allyson met with several of NoFats key production managers and discovered the following information: The special order could be produced without incurring any additional marketing or customer service costs. NoFat owns the aging plant facility that it uses to manufacture olestra. NoFat incurs costs to set up and clean its machines for each production run, or batch, of olestra that it produces. The total setup costs shown in the previous table represent the production of 20 batches during the year. NoFat leases its plant machinery. The lease agreement is negotiated and signed on the first day of each year. NoFat currently leases enough machinery to produce 125,000 pounds of olestra. PU requires that an independent quality team inspects any facility from which it makes purchases. The terms of the special sales offer would require NoFat to bear the 1,000 cost of the inspection team. Assume for this question that NoFat rejected PUs special sales offer because the 2.20 price suggested by PU was too low. In response to the rejection, PU asked NoFat to determine the price at which it would be willing to accept the special sales offer. For its regular sales, NoFat sets prices by marking up variable costs by 10%. If Allyson decides to use NoFats 10% markup pricing method to set the price for PUs special sales offer, a. Calculate the price that NoFat would charge PU for each pound of olestra. b. Calculate the relevant profit that NoFat would earn if it set the special sales price by using its markup pricing method. (Hint: Use the estimate of relevant costs that you calculated in response to Requirement 1b.) c. Explain why NoFat should accept or reject the special sales offer if it uses its markup pricing method to set the special sales price.NoFat manufactures one product, olestra, and sells it to large potato chip manufacturers as the key ingredient in nonfat snack foods, including Ruffles, Lays, Doritos, and Tostitos brand products. For each of the past 3 years, sales of olestra have been far less than the expected annual volume of 125,000 pounds. Therefore, the company has ended each year with significant unused capacity. Due to a short shelf life, NoFat must sell every pound of olestra that it produces each year. As a result, NoFats controller, Allyson Ashley, has decided to seek out potential special sales offers from other companies. One company, Patterson Union (PU)a toxic waste cleanup companyoffered to buy 10,000 pounds of olestra from NoFat during December for a price of 2.20 per pound. PU discovered through its research that olestra has proven to be very effective in cleaning up toxic waste locations designated as Superfund Sites by the U.S. Environmental Protection Agency. Allyson was excited, noting that This is another way to use our expensive olestra plant! The annual costs incurred by NoFat to produce and sell 100,000 pounds of olestra are as follows: In addition, Allyson met with several of NoFats key production managers and discovered the following information: The special order could be produced without incurring any additional marketing or customer service costs. NoFat owns the aging plant facility that it uses to manufacture olestra. NoFat incurs costs to set up and clean its machines for each production run, or batch, of olestra that it produces. The total setup costs shown in the previous table represent the production of 20 batches during the year. NoFat leases its plant machinery. The lease agreement is negotiated and signed on the first day of each year. NoFat currently leases enough machinery to produce 125,000 pounds of olestra. PU requires that an independent quality team inspects any facility from which it makes purchases. The terms of the special sales offer would require NoFat to bear the 1,000 cost of the inspection team. Assume for this question that Allysons relevant analysis reveals that NoFat would earn a positive relevant profit of 10,000 from the special sale (i.e., the special sales alternative). However, after conducting this traditional, short-term relevant analysis, Allyson wonders whether it might be more profitable over the long term to downsize the company by reducing its manufacturing capacity (i.e., its plant machinery and plant facility). She is aware that downsizing requires a multiyear time horizon because companies usually cannot increase or decrease fixed plant assets every year. Therefore, Allyson has decided to use a 5-year time horizon in her long-term decision analysis. She has identified the following information regarding capacity downsizing (i.e., the downsizing alternative): The plant facility consists of several buildings. If it chooses to downsize its capacity, NoFat can immediately sell one of the buildings to an adjacent business for 30,000. If it chooses to downsize its capacity, NoFats annual lease cost for plant machinery will decrease to 9,000. Therefore, Allyson must choose between these two alternatives: Accept the special sales offer each year and earn a 10,000 relevant profit for each of the next 5 years or reject the special sales offer and downsize as described above. Assume that NoFat pays for all costs with cash. Also, assume a 10% discount rate, a 5-year time horizon, and all cash flows occur at the end of the year. Using an NPV approach to discount future cash flows to present value, a. Calculate the NPV of accepting the special sale with the assumed positive relevant profit of 10,000 per year (i.e., the special sales alternative). b. Calculate the NPV of downsizing capacity as previously described (i.e., the downsizing alternative). c. Based on the NPV of Requirements 5a and 5b, identify and explain which of these two alternatives is best for NoFat to pursue in the long term.

- Dauten is offered a replacement machine which has a cost of 8,000, an estimated useful life of 6 years, and an estimated salvage value of 800. The replacement machine is eligible for 100% bonus depreciation at the time of purchase- The replacement machine would permit an output expansion, so sales would rise by 1,000 per year; even so, the new machines much greater efficiency would cause operating expenses to decline by 1,500 per year The new machine would require that inventories be increased by 2,000, but accounts payable would simultaneously increase by 500. Dautens marginal federal-plus-state tax rate is 25%, and its WACC is 11%. Should it replace the old machine?Mallette Manufacturing, Inc., produces washing machines, dryers, and dishwashers. Because of increasing competition, Mallette is considering investing in an automated manufacturing system. Since competition is most keen for dishwashers, the production process for this line has been selected for initial evaluation. The automated system for the dishwasher line would replace an existing system (purchased one year ago for 6 million). Although the existing system will be fully depreciated in nine years, it is expected to last another 10 years. The automated system would also have a useful life of 10 years. The existing system is capable of producing 100,000 dishwashers per year. Sales and production data using the existing system are provided by the Accounting Department: All cash expenses with the exception of depreciation, which is 6 per unit. The existing equipment is being depreciated using straight-line with no salvage value considered. The automated system will cost 34 million to purchase, plus an estimated 20 million in software and implementation. (Assume that all investment outlays occur at the beginning of the first year.) If the automated equipment is purchased, the old equipment can be sold for 3 million. The automated system will require fewer parts for production and will produce with less waste. Because of this, the direct material cost per unit will be reduced by 25 percent. Automation will also require fewer support activities, and as a consequence, volume-related overhead will be reduced by 4 per unit and direct fixed overhead (other than depreciation) by 17 per unit. Direct labor is reduced by 60 percent. Assume, for simplicity, that the new investment will be depreciated on a pure straight-line basis for tax purposes with no salvage value. Ignore the half-life convention. The firms cost of capital is 12 percent, but management chooses to use 20 percent as the required rate of return for evaluation of investments. The combined federal and state tax rate is 40 percent. Required: 1. Compute the net present value for the old system and the automated system. Which system would the company choose? 2. Repeat the net present value analysis of Requirement 1, using 12 percent as the discount rate. 3. Upon seeing the projected sales for the old system, the marketing manager commented: Sales of 100,000 units per year cannot be maintained in the current competitive environment for more than one year unless we buy the automated system. The automated system will allow us to compete on the basis of quality and lead time. If we keep the old system, our sales will drop by 10,000 units per year. Repeat the net present value analysis, using this new information and a 12 percent discount rate. 4. An industrial engineer for Mallette noticed that salvage value for the automated equipment had not been included in the analysis. He estimated that the equipment could be sold for 4 million at the end of 10 years. He also estimated that the equipment of the old system would have no salvage value at the end of 10 years. Repeat the net present value analysis using this information, the information in Requirement 3, and a 12 percent discount rate. 5. Given the outcomes of the previous four requirements, comment on the importance of providing accurate inputs for assessing investments in automated manufacturing systems.