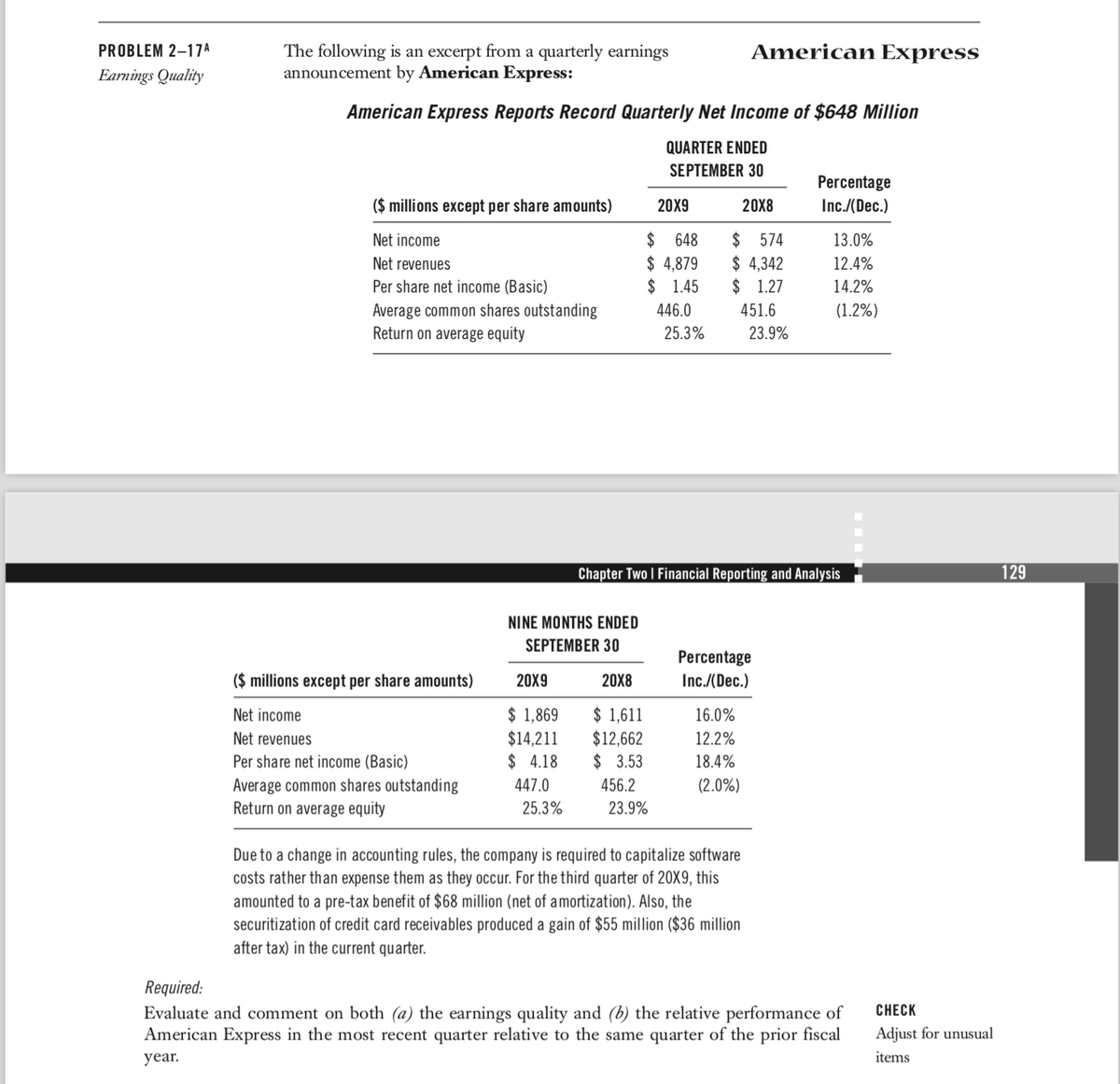

PROBLEM 2-17A Earnings Quality The following is an excerpt from a quarterly earnings announcement by American Express: American Express Reports Record Quarterly Net Income of $648 Million QUARTER ENDED SEPTEMBER 30 ($ millions except per share amounts) Net income Net revenues Per share net income (Basic) Average common shares outstanding Return on average equity ($ millions except per share amounts) Net income Net revenues Per share net income (Basic) Average common shares outstanding Return on average equity NINE MONTHS ENDED SEPTEMBER 30 20X9 20X8 $1,869 $ 1,611 $14,211 $12,662 $4.18 $3.53 447.0 456.2 25.3% 20X9 20X8 $ 574 $648 $4,879 $4,342 $ 1.45 $ 1.27 446.0 23.9% 25.3% American Express 451.6 Chapter Two | Financial Reporting and Analysis 16.0% 12.2% 18.4% (2.0%) 23.9% Percentage Inc./(Dec.) Due to a change in accounting rules, the company is required to capitalize software costs rather than expense them as they occur. For the third quarter of 20X9, this amounted to a pre-tax benefit of $68 million (net of amortization). Also, the securitization of credit card receivables produced a gain of $55 million ($36 million after tax) in the current quarter. Percentage Inc./(Dec.) 13.0% 12.4% 14.2% (1.2%) Required: Evaluate and comment on both (a) the earnings quality and (b) the relative performance of American Express in the most recent quarter relative to the same quarter of the prior fiscal year. CHECK Adjust for unusual items 129

PROBLEM 2-17A Earnings Quality The following is an excerpt from a quarterly earnings announcement by American Express: American Express Reports Record Quarterly Net Income of $648 Million QUARTER ENDED SEPTEMBER 30 ($ millions except per share amounts) Net income Net revenues Per share net income (Basic) Average common shares outstanding Return on average equity ($ millions except per share amounts) Net income Net revenues Per share net income (Basic) Average common shares outstanding Return on average equity NINE MONTHS ENDED SEPTEMBER 30 20X9 20X8 $1,869 $ 1,611 $14,211 $12,662 $4.18 $3.53 447.0 456.2 25.3% 20X9 20X8 $ 574 $648 $4,879 $4,342 $ 1.45 $ 1.27 446.0 23.9% 25.3% American Express 451.6 Chapter Two | Financial Reporting and Analysis 16.0% 12.2% 18.4% (2.0%) 23.9% Percentage Inc./(Dec.) Due to a change in accounting rules, the company is required to capitalize software costs rather than expense them as they occur. For the third quarter of 20X9, this amounted to a pre-tax benefit of $68 million (net of amortization). Also, the securitization of credit card receivables produced a gain of $55 million ($36 million after tax) in the current quarter. Percentage Inc./(Dec.) 13.0% 12.4% 14.2% (1.2%) Required: Evaluate and comment on both (a) the earnings quality and (b) the relative performance of American Express in the most recent quarter relative to the same quarter of the prior fiscal year. CHECK Adjust for unusual items 129

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter5: The Income Statement And The Statement Of Cash Flows

Section: Chapter Questions

Problem 5E: Multiple-Step and Single-Step In coin Statements The following items were derived from Gold...

Related questions

Question

Evaluate and comment on both (a) the earnings quality and (b) the relative performance of American Express in the most recent quarter relative to the same quarter of the prior fiscal year.

Transcribed Image Text:PROBLEM 2-17A

Earnings Quality

The following is an excerpt from a quarterly earnings

announcement by American Express:

American Express Reports Record Quarterly Net Income of $648 Million

QUARTER ENDED

SEPTEMBER 30

($ millions except per share amounts)

Net income

Net revenues

Per share net income (Basic)

Average common shares outstanding

Return on average equity

($ millions except per share amounts)

Net income

Net revenues

Per share net income (Basic)

Average common shares outstanding

Return on average equity

NINE MONTHS ENDED

SEPTEMBER 30

20X9

$ 1,869

$14,211

$4.18

447.0

25.3%

20X9

$ 648

$4,879

$1.45

446.0

20X8

$1,611

$12,662

$ 3.53

456.2

25.3%

23.9%

American Express

20X8

$ 574

$ 4,342

$ 1.27

451.6

23.9%

Chapter Two I Financial Reporting and Analysis

Percentage

Inc./(Dec.)

16.0%

12.2%

18.4%

(2.0%)

Due to a change in accounting rules, the company is required to capitalize software

costs rather than expense them as they occur. For the third quarter of 20X9, this

amounted to a pre-tax benefit of $68 million (net of amortization). Also, the

securitization of credit card receivables produced a gain of $55 million ($36 million

after tax) in the current quarter.

Percentage

Inc./(Dec.)

13.0%

12.4%

14.2%

(1.2%)

Required:

Evaluate and comment on both (a) the earnings quality and (b) the relative performance of

American Express in the most recent quarter relative to the same quarter of the prior fiscal

year.

CHECK

Adjust for unusual

items

129

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning