Cornerstones of Financial Accounting

4th Edition

ISBN: 9781337690881

Author: Jay Rich, Jeff Jones

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 1, Problem 65APSA

Problem 1-65A Relationships Among Financial Statements

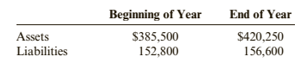

Carson Corporation reported the following amounts for assets and liabilities at the beginning and end of a recent year.

Required:

Calculate Carson’s net income or net loss for the year in each of the following independent situations:

- Carson declared no dividends. and its common stock remained unchanged.

- Carson declared no dividends and issued additional common stock for $40,000 cash.

- Carson declared dividends totaling $5000 and its common stack remained unchanged.

- Carson declared dividends totaling $20,000 and issued additional common stock for $35,000.

Expert Solution & Answer

Trending nowThis is a popular solution!

Chapter 1 Solutions

Cornerstones of Financial Accounting

Ch. 1 - Define accounting. How does accounting differ from...Ch. 1 - Prob. 2DQCh. 1 - What is accounting entity?Ch. 1 - Prob. 4DQCh. 1 - Prob. 5DQCh. 1 - Prob. 6DQCh. 1 - Define the terms revenue and expense. How are...Ch. 1 - Name and briefly describe the purpose of the four...Ch. 1 - What types of questions are answered by the...Ch. 1 - Prob. 10DQ

Ch. 1 - Write the fundamental accounting equation. Why is...Ch. 1 - What information is included in the heading of...Ch. 1 - Define current assets and current liabilities. Why...Ch. 1 - Prob. 14DQCh. 1 - Name the two main components of stockholders;...Ch. 1 - Prob. 16DQCh. 1 - How does the multiple-step income statement differ...Ch. 1 - Explain the items reported on a retained earnings...Ch. 1 - Name and describe the three categories of the...Ch. 1 - Prob. 20DQCh. 1 - Prob. 21DQCh. 1 - Prob. 22DQCh. 1 - Prob. 1MCQCh. 1 - Prob. 2MCQCh. 1 - At December 31, Pitt Inc. has assets of $12,900...Ch. 1 - Prob. 4MCQCh. 1 - Prob. 5MCQCh. 1 - Prob. 6MCQCh. 1 - Use the following information for Multiple-Choice...Ch. 1 - Use the following information for Multiple-Choice...Ch. 1 - Which of the following statements regarding the...Ch. 1 - Prob. 10MCQCh. 1 - Which of the following statements concerning...Ch. 1 - Which of the following sentences regarding the...Ch. 1 - Prob. 13MCQCh. 1 - Prob. 14CECh. 1 - Cornerstone Exercise 1-15 Using the Accounting...Ch. 1 - Cornerstone Exercise 1-16 Financial Statements...Ch. 1 - Prob. 17CECh. 1 - Cornerstone Exercise 1-18 Balance Sheet An...Ch. 1 - Cornerstone Exercise 1-19 Income Statement An...Ch. 1 - Cornerstone Exercise 1-20 Retained Earnings...Ch. 1 - Prob. 21BECh. 1 - Prob. 22BECh. 1 - Brief Exercise 1-23 Business Activities Marni...Ch. 1 - Brief Exercise 1-24 The Accounting Equation...Ch. 1 - Prob. 25BECh. 1 - Brief Exercise 1-26 Income Statement An analysis...Ch. 1 - Retained Earnings Statement Listed below are...Ch. 1 - Brief 1-28 Statement of Cash Flows Listed are...Ch. 1 - Prob. 29BECh. 1 - Prob. 30BECh. 1 - Exercise 1-31 Decisions Based on Accounting...Ch. 1 - Prob. 32ECh. 1 - Prob. 33ECh. 1 - Exercise 1-34 Business Activities Bill and Steve...Ch. 1 - Exercise 1-35 Accounting Concepts OBJECTIVE 06° A...Ch. 1 - Exercise 1-36 The Fundamental Accounting Equation...Ch. 1 - Exercise 1-37 Balance Sheet Structure The...Ch. 1 - Exercise 1-38 Identifying Current Assets and...Ch. 1 - Exercise 1-39 Current Assets and Current...Ch. 1 - Exercise 1-40 Depreciation OBJECTIVE 0° Swanson...Ch. 1 - Exercise 1-41 Stockholders Equity OBJECTIVE o On...Ch. 1 - Prob. 42ECh. 1 - Prob. 43ECh. 1 - Prob. 44ECh. 1 - Prob. 45ECh. 1 - OBJECTIVE 6 Exercise 1-46 Income Statement ERS...Ch. 1 - Exercise 1-47 Multiple-Step Income Statement The...Ch. 1 - Exercise 1-48 Income Statement The following...Ch. 1 - Prob. 49ECh. 1 - Exercise 1-50 Statement of Cash Flows OBJECTIVE o...Ch. 1 - Exercise 1-51 Relationships Among the Financial...Ch. 1 - Exercise 1-52 Relationships Among the Financial...Ch. 1 - Exercise 1-53 Relationships Among the Financial...Ch. 1 - Prob. 54ECh. 1 - Prob. 55ECh. 1 - Problem 1-56A Applying the Fundamental Accounting...Ch. 1 - Problem 1-57A Accounting Relationships Information...Ch. 1 - Prob. 58APSACh. 1 - Prob. 59APSACh. 1 - Problem 1-60A Income Statement and Balance Sheet...Ch. 1 - Problem 1-61A Retained Earnings Statement Dittman...Ch. 1 - Problem 1-62A Retained Earnings Statements The...Ch. 1 - Problem 1-63A Income Statement, Retained Earnings...Ch. 1 - Problem 1-64A Stockholders' Equity Relationships...Ch. 1 - Problem 1-65A Relationships Among Financial...Ch. 1 - Problem 1-563 Applying the Fundamental Accounting...Ch. 1 - Problem 1-57B The Fundamental Accounting Equation...Ch. 1 - Problem 1-583 Arrangement of the Income Statement...Ch. 1 - Prob. 59BPSBCh. 1 - Problem 1-60B Income Statement and Balance Sheet...Ch. 1 - Problem 1-61B Retained Earnings Statement Magical...Ch. 1 - Problem 1-62B Retained Earnings Statements The...Ch. 1 - Problem1-63B Income Statement, Retained Earnings...Ch. 1 - Prob. 64BPSBCh. 1 - Problem 1-65B Relationships Among Financial...Ch. 1 - Prob. 66CCh. 1 - Prob. 67.1CCh. 1 - Prob. 67.2CCh. 1 - Prob. 68.1CCh. 1 - Prob. 68.2CCh. 1 - Prob. 69.1CCh. 1 - Prob. 69.2CCh. 1 - Case 1-70 Financial Statement Analysis Reproduced...Ch. 1 - Prob. 70.2CCh. 1 - Case 1-70 Financial Statement Analysis Reproduced...Ch. 1 - Prob. 71CCh. 1 - Prob. 72CCh. 1 - Prob. 73.1CCh. 1 - Prob. 73.2CCh. 1 - Prob. 73.3CCh. 1 - Case 1-73 Research and Analysis Using the Annual...Ch. 1 - Prob. 73.5CCh. 1 - Prob. 73.6CCh. 1 - Prob. 73.7CCh. 1 - Prob. 74.1CCh. 1 - Case 1-74 Comparative Analysis: Under Armour,...Ch. 1 - Prob. 74.3CCh. 1 - Case 1-74 Comparative Analysis: Under Armour,...Ch. 1 - Case 1-74 Comparative Analysis: Under Armour,...Ch. 1 - Case 1-74 Comparative Analysis: Under Armour,...Ch. 1 - Prob. 75.1CCh. 1 - Prob. 75.2CCh. 1 - Case 1-75 CONTINUING PROBLEM: FRONT ROW...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Brief Exercise 1-24 The Accounting Equation Financial information for three independent cases is as follows: The liabilities of Dent Company are $82,000, and its stockholders' equity is $120,000. What is the amount of Dents total assets? The total assets of Wayne Inc. are $55,000, and its stockholders' equity is $22,500. What is the amount of Waynes total liabilities? Gordon Companys total assets increased by $60,000 during the year, and its liabilities decreased by $35,000. Did Gordons stockholders' equity increase or decrease? By how much? Required: Determine the missing amount for each case.arrow_forwardProblem 1-56A Applying the Fundamental Accounting Equation At the beginning of 2019 Huffer Corporation had total assets of $232,400 total liabilities of $94,200 common stock of 5501000. and retained earnings of $88,200. During 2019, Huffer had net income of $51,1501 paid dividends of 510,000. and issued additional common stock for $15,000. Huffers total assets at the end 01'2019 were $285,500. Required: Calculate the amount of liabilities that Huffer must have at the end of 2019 m order for the balance sheet equation to balance.arrow_forwardRetained Earnings Statement Listed below are events that affect stockholders equity. Reported net income of $85,000. Paid a cash dividend of $10,000. Reported sales revenue of $120,000. Issued common stock of $50,000 Reported a net loss of $20,000. Reported of S35,000. Required: For each of the events, indicate whether it increases retained earnings (I), decreases retained earnings (D), or has no effect on retained earnings (NE).arrow_forward

- Problem 1-563 Applying the Fundamental Accounting Equation At the beginning of 2019, KJ Corporation had total assets of $525,100, total liabilities of $290,800. common stock of $100000. and retained earnings of $134,900. During 2019. KJ had net income of $205,500. paid dividends of $70,000. and 1ssued additional common stock for $36,000 KJs total assets at the end of 2019 were $10,100. Required: Calculate the amount of Liabilities that KJ must have at the end of 2019 in order for the balance sheet equation to balance.arrow_forwardProblem 1-62B Retained Earnings Statements The table below presents the retained earnings statements for Dillsboro Corporation for 3 successive years. Certain number are missing. Required: Use your understanding of the relationship between successive retained earnings statements to calculate the missing values (a-g).arrow_forwardExercise 1-53 Relationships Among the Financial Statements During 2019, Moore Corporation paid $20,000 of dividends. Moores assets, liabilities, and common stock at the end 012018 and 2019 were: Required: Using the information provided. compute Moores net income for 2019.arrow_forward

- Problem 1-62A Retained Earnings Statements The table below presents the retained earnings statements for Bass Corporation for 3 successive years. Certain numbers are missing. Required: Use your understanding of the relationship between successive retained earnings statements to calculate the missing values (a-g).arrow_forwardThe Accounting Equation Using the accounting equation, answer each of the following independent questions. Burlin Company starts the year with $100,000 in assets and $80,000 in liabilities. Net income for the year is $25,000, and no dividends are paid. How much is owners equity at the end of the year? Chapman Inc. doubles the amount of its assets from the beginning to the end of the year. Liabilities at the end of the year amount to $40,000, and owners equity is $20,000. What is the amount of Chapmans assets at the beginning of the year? During the year, the liabilities of Dixon Enterprises triple in amount. Assets at the beginning of the year amount to $30,000, and owners equity is $10,000. What is the amount of liabilities at the end of the year?arrow_forwardFinancial statements The assets and liabilities of Global Travel Agency on December 31, 20Y5, and its revenue and expenses for the year are as follows: Common stock was 525,000 and retained earnings was 1,250,000 as of January 1, 20Y5. During the year, additional common stock of 50,000 was issued for cash, and dividends of 90,000 were paid. Instructions 1. Prepare an income statement for the year ended December 31, 20Y5. 2. Prepare a statement of stockholders equity for the year ended December 31, 20Y5. 3. Prepare a balance sheet as of December 31, 20Y5. 4. What items appears on both the statement of stockholders equity and the balance sheet?arrow_forward

- MASTERY PROBLEM Financial statements for Peachfield Corporation as well as additional information relevant to cash flows during the period follow. Additional information: 1. Office equipment was sold during the year for 75,000. 2. Depreciation expense for the year was 62,400 as follows: 3. No other equipment was sold during the year. The following purchases were made for cash. 4. Declared and paid cash dividends of 20,000. 5. Issued 11,200 shares of 10 par common stock for 118,000. 6. Issued a note payable for 10,700. 7. Additional store equipment was acquired by issuing a long-term note payable for 20,000. REQUIRED 1. Prepare a statement of cash flows explaining the change in cash and cash equivalents. 2. Reconcile cash and cash equivalents at the bottom of the statement of cash flows.arrow_forwardFinancial statements We-Sell Realty, organized as a corporation on August 1, 2018, is owned and operated by Omar Farah, the sole stockholder. How many errors can you find in the following statements for We-Sell Realty, prepared after its first month of operations? We-Sell Realty Income Statement August 31, 2018 Sales commissions 140,000 Expenses: Office salaries expense 87,000 Rent expense 18,000 Automobile expense 7,500 Miscellaneous expense 2,200 Supplies expense 1,150 Total expenses 115,850 Net income 25,000 Omar Farah Retained Earnings Statement August 31, 2017 Retained earnings, August 1,2018 0 Dividends (10,000) (10,000) Issued additional common stock August 1,2018 15,000 5,000 Net income 25,000 Retained earnings, August 31, 2018 30,000 Balance Sheet For the Month Ended August 31, 2018 Cash Assets 8,900 Accounts payable 22,350 Total assets 31,250 Liabilities Accounts receivable 38,600 Supplies 4,000 Stockholders Equity Retained earnings 30,000 Total liabilities and stockholders equity 72,600arrow_forwardIncome statement, retained earnings statement, and balance sheet The amounts of the assets and liabilities of Glacier Travel Service as of September 30, 20Y6, the end of the current year, and its revenue and expenses for the year are listed below. The retained earnings were $150000 and the common stock was $50000 as of October 1, 20Y5, the beginning of the current year. Dividends of $10000 were paid during the year. Instructions Prepare a balance sheet as of September 30, 20Y6.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:9781285866307

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Corporate Financial Accounting

Accounting

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:9781337119207

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial ratio analysis; Author: The Finance Storyteller;https://www.youtube.com/watch?v=MTq7HuvoGck;License: Standard Youtube License