Problem 2-18 (IAA) During the current year, Jolly Company offered a P20 cash rebate coupon to customers who purchased one of its new line of products. The entity sold 10,000 of these products during the current year. By year-end, 7,600 of the rebates had been claimed and 7,100 had been paid. The historical experience with such rebates indicated that 85% of customers claim the rebates. What amount should be reported as rebate expense for the current year? a. 142,000 b. 152,000 170,000 d. 200,000 C. -

Problem 2-18 (IAA) During the current year, Jolly Company offered a P20 cash rebate coupon to customers who purchased one of its new line of products. The entity sold 10,000 of these products during the current year. By year-end, 7,600 of the rebates had been claimed and 7,100 had been paid. The historical experience with such rebates indicated that 85% of customers claim the rebates. What amount should be reported as rebate expense for the current year? a. 142,000 b. 152,000 170,000 d. 200,000 C. -

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

ChapterA2: Investments

Section: Chapter Questions

Problem 11MCQ

Related questions

Question

Transcribed Image Text:b. 1,050,000

0000

c. 1,225,000

d.

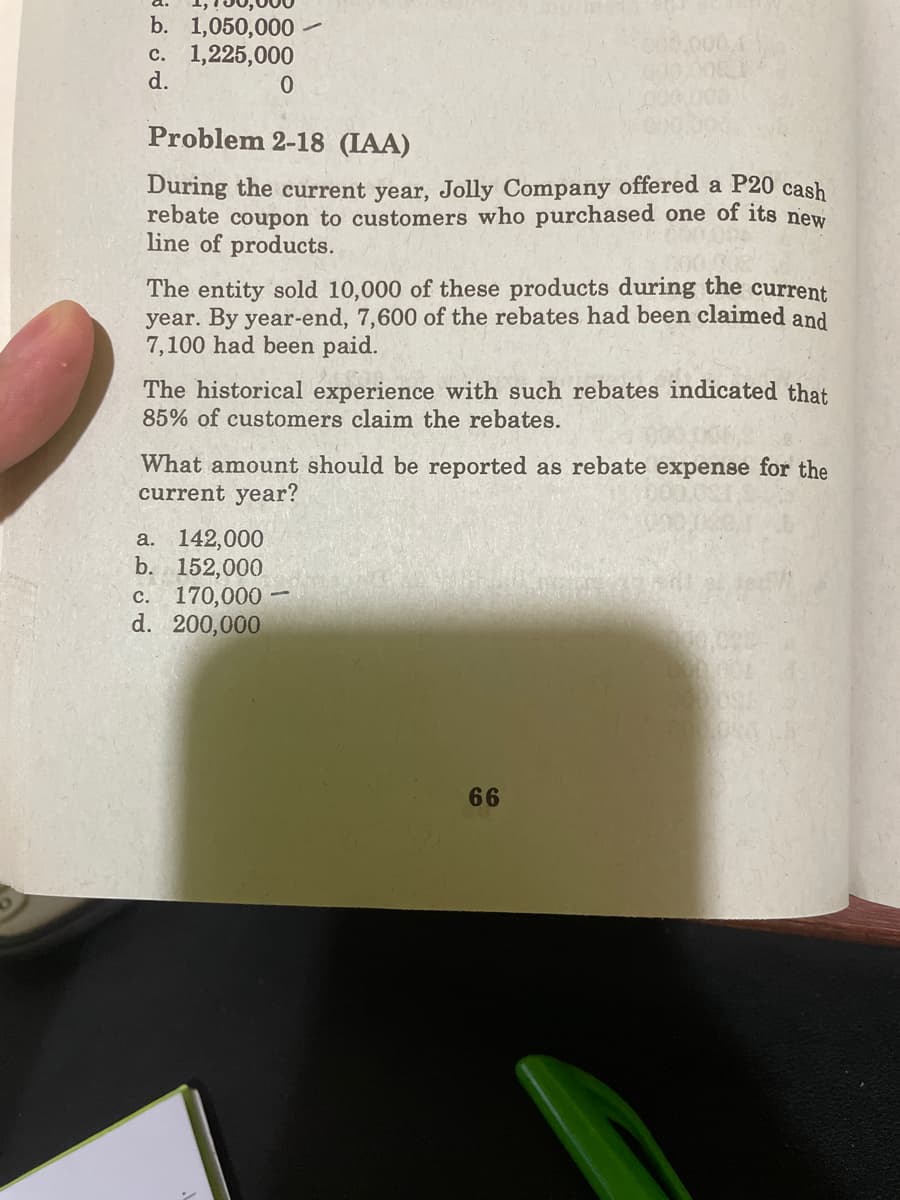

Problem 2-18 (IAA)

During the current year, Jolly Company offered a P20 cash

rebate coupon to customers who purchased one of its new

line of products.

The entity sold 10,000 of these products during the current

year. By year-end, 7,600 of the rebates had been claimed and

7,100 had been paid.

The historical experience with such rebates indicated that

85% of customers claim the rebates.

What amount should be reported as rebate expense for the

current year?

142,000

b. 152,000

c. 170,000

d. 200,000

a.

66

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning