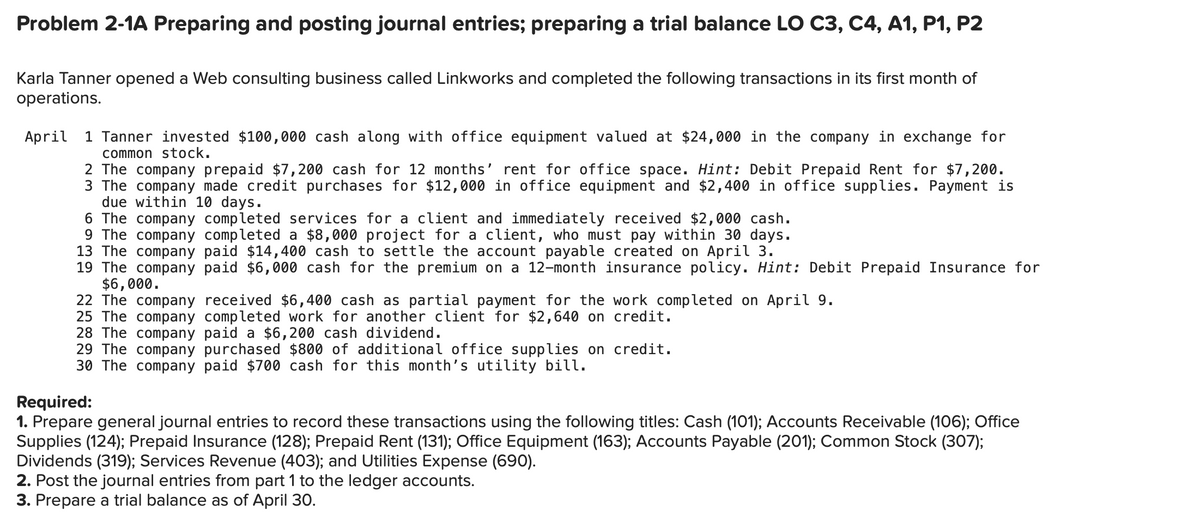

Problem 2-1A Preparing and posting journal entries; preparing a trial balance LO C3, C4, A1, P1, P2 Karla Tanner opened a Web consulting business called Linkworks and completed the following transactions in its first month of operations. April 1 Tanner invested $100,000 cash along with office equipment valued at $24,000 in the company in exchange for common stock. 2 The company prepaid $7,200 cash for 12 months' rent for office space. Hint: Debit Prepaid Rent for $7,200. 3 The company made credit purchases for $12,000 in office equipment and $2,400 in office supplies. Payment is due within 10 days. 6 The company completed services for a client and immediately received $2,000 cash. 9 The company completed a $8,000 project for a client, who must pay within 30 days. 13 The company paid $14,400 cash to settle the account payable created on April 3. 19 The company paid $6,000 cash for the premium on a 12-month insurance policy. Hint: Debit Prepaid Insurance for $6,000. 22 The company received $6,400 cash as partial payment for the work completed on April 9. 25 The company completed work for another client for $2,640 on credit. 28 The company paid a $6,200 cash dividend. 29 The company purchased $800 of additional office supplies on credit. 30 The company paid $700 cash for this month's utility bill. Required: 1. Prepare general journal entries to record these transactions using the following titles: Cash (101); Accounts Receivable (106); Office Supplies (124); Prepaid Insurance (128); Prepaid Rent (131); Office Equipment (163); Accounts Payable (201); Common Stock (307); Dividends (319); Services Revenue (403); and Utilities Expense (690). 2. Post the journal entries from part 1 to the ledger accounts. 3. Prepare a trial balance as of April 30.

Problem 2-1A Preparing and posting journal entries; preparing a trial balance LO C3, C4, A1, P1, P2 Karla Tanner opened a Web consulting business called Linkworks and completed the following transactions in its first month of operations. April 1 Tanner invested $100,000 cash along with office equipment valued at $24,000 in the company in exchange for common stock. 2 The company prepaid $7,200 cash for 12 months' rent for office space. Hint: Debit Prepaid Rent for $7,200. 3 The company made credit purchases for $12,000 in office equipment and $2,400 in office supplies. Payment is due within 10 days. 6 The company completed services for a client and immediately received $2,000 cash. 9 The company completed a $8,000 project for a client, who must pay within 30 days. 13 The company paid $14,400 cash to settle the account payable created on April 3. 19 The company paid $6,000 cash for the premium on a 12-month insurance policy. Hint: Debit Prepaid Insurance for $6,000. 22 The company received $6,400 cash as partial payment for the work completed on April 9. 25 The company completed work for another client for $2,640 on credit. 28 The company paid a $6,200 cash dividend. 29 The company purchased $800 of additional office supplies on credit. 30 The company paid $700 cash for this month's utility bill. Required: 1. Prepare general journal entries to record these transactions using the following titles: Cash (101); Accounts Receivable (106); Office Supplies (124); Prepaid Insurance (128); Prepaid Rent (131); Office Equipment (163); Accounts Payable (201); Common Stock (307); Dividends (319); Services Revenue (403); and Utilities Expense (690). 2. Post the journal entries from part 1 to the ledger accounts. 3. Prepare a trial balance as of April 30.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter2: The Accounting Information System

Section: Chapter Questions

Problem 56APSA: Problem 2-56A Analyzing Transactions Luis Madero, after working for several years with a large...

Related questions

Question

Transcribed Image Text:Problem 2-1A Preparing and posting journal entries; preparing a trial balance LO C3, C4, A1, P1, P2

Karla Tanner opened a Web consulting business called Linkworks and completed the following transactions in its first month of

operations.

April 1 Tanner invested $100,000 cash along with office equipment valued at $24,000 in the company in exchange for

common stock.

2 The company prepaid $7,200 cash for 12 months' rent for office space. Hint: Debit Prepaid Rent for $7,200.

3 The company made credit purchases for $12,000 in office equipment and $2,400 in office supplies. Payment is

due within 10 days.

6 The company completed services for a client and immediately received $2,000 cash.

9 The company completed a $8,000 project for a client, who must pay within 30 days.

13 The company

aid 4,400 cash to settle the account payable created on April 3.

19 The company

paid $6,000 cash for the premium on a 12-month insurance policy. Hint: Debit Prepaid Insurance for

$6,000.

22 The company received $6,400 cash as partial payment for the work completed on April 9.

25 The company completed work for another client for $2,640 on credit.

28 The company paid a $6,200 cash dividend.

29 The company purchased $800 of additional office supplies on credit.

30 The company paid $700 cash for this month's utility bill.

Required:

1. Prepare general journal entries to record these transactions using the following titles: Cash (101); Accounts Receivable (106); Office

Supplies (124); Prepaid Insurance (128); Prepaid Rent (131); Office Equipment (163); Accounts Payable (201); Common Stock (307);

Dividends (319); Services Revenue (403); and Utilities Expense (690).

2. Post the journal entries from part 1 to the ledger accounts.

3. Prepare a trial balance as of April 30.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning