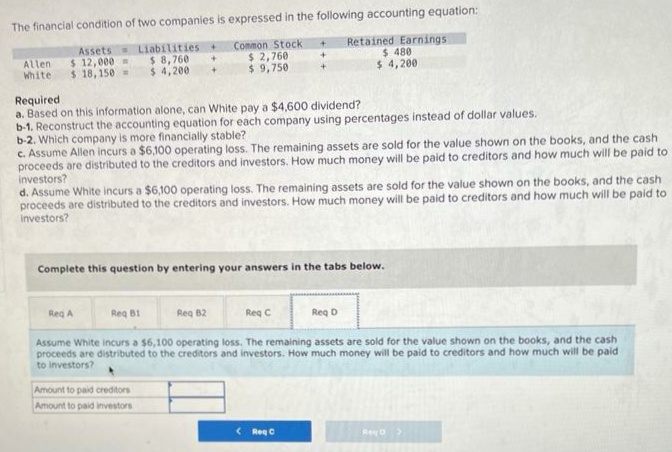

The financial condition of two companies is expressed in the following accounting equation: Assets Allen $12,000 = White Liabilities + $8,760 + $ 4,200 Common Stock + Retained Earnings $ 480 $ 2,760 $ 4,200 $ 9,750 $ 18,150 + Required a. Based on this information alone, can White pay a $4,600 dividend? b-1. Reconstruct the accounting equation for each company using percentages instead of dollar values. b-2. Which company is more financially stable? c. Assume Allen incurs a $6,100 operating loss. The remaining assets are sold for the value shown on the books, and the cash proceeds are distributed to the creditors and investors. How much money will be paid to creditors and how much will be paid to investors? d. Assume White incurs a $6,100 operating loss. The remaining assets are sold for the value shown on the books, and the cash proceeds are distributed to the creditors and investors. How much money will be paid to creditors and how much will be paid to

The financial condition of two companies is expressed in the following accounting equation: Assets Allen $12,000 = White Liabilities + $8,760 + $ 4,200 Common Stock + Retained Earnings $ 480 $ 2,760 $ 4,200 $ 9,750 $ 18,150 + Required a. Based on this information alone, can White pay a $4,600 dividend? b-1. Reconstruct the accounting equation for each company using percentages instead of dollar values. b-2. Which company is more financially stable? c. Assume Allen incurs a $6,100 operating loss. The remaining assets are sold for the value shown on the books, and the cash proceeds are distributed to the creditors and investors. How much money will be paid to creditors and how much will be paid to investors? d. Assume White incurs a $6,100 operating loss. The remaining assets are sold for the value shown on the books, and the cash proceeds are distributed to the creditors and investors. How much money will be paid to creditors and how much will be paid to

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter15: Financial Statement Analysis

Section: Chapter Questions

Problem 63P: Mike Sanders is considering the purchase of Kepler Company, a firm specializing in the manufacture...

Related questions

Question

100%

I required Only - d

Transcribed Image Text:The financial condition of two companies is expressed in the following accounting equation:

Assets

$12,000=

Liabilities +

$8,760 +

Allen

White $18, 150

Common Stock +

$ 2,760

$ 9,750

Retained Earnings

$ 480

$ 4,200

$ 4,200 +

Required

a. Based on this information alone, can White pay a $4,600 dividend?

b-1. Reconstruct the accounting equation for each company using percentages instead of dollar values.

b-2. Which company is more financially stable?

c. Assume Allen incurs a $6,100 operating loss. The remaining assets are sold for the value shown on the books, and the cash

proceeds are distributed to the creditors and investors. How much money will be paid to creditors and how much will be paid to

investors?

d. Assume White incurs a $6,100 operating loss. The remaining assets are sold for the value shown on the books, and the cash

proceeds are distributed to the creditors and investors. How much money will be paid to creditors and how much will be paid to

investors?

Complete this question by entering your answers in the tabs below.

Red A

Req B1

Req B2

Req C

Reg D

Assume White incurs a $6,100 operating loss. The remaining assets are sold for the value shown on the books, and the cash

proceeds are distributed to the creditors and investors. How much money will be paid to creditors and how much will be paid

to investors?

Amount to paid creditors

Amount to paid investors

<Req C

Reyd

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning