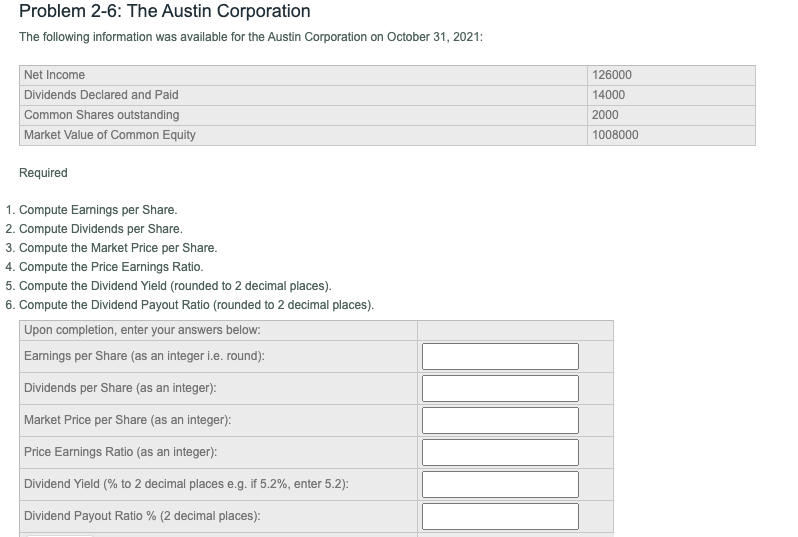

Problem 2-6: The Austin Corporation The following information was available for the Austin Corporation on October 31, 2021: Net Income 126000 Dividends Declared and Paid 14000 2000 1008000 Common Shares outstanding Market Value of Common Equity Required 1. Compute Earnings per Share. 2. Compute Dividends per Share. 3. Compute the Market Price per Share. 4. Compute the Price Earnings Ratio. 5. Compute the Dividend Yield (rounded to 2 decimal places). 6. Compute the Dividend Payout Ratio (rounded to 2 decimal places). Upon completion, enter your answers below: Earnings per Share (as an integer i.e. round): Dividends per Share (as an integer): Market Price per Share (as an integer): Price Earnings Ratio (as an integer): Dividend Yield (% to 2 decimal places e.g. if 5.2%, enter 5.2): Dividend Payout Ratio % (2 decimal places):

Problem 2-6: The Austin Corporation The following information was available for the Austin Corporation on October 31, 2021: Net Income 126000 Dividends Declared and Paid 14000 2000 1008000 Common Shares outstanding Market Value of Common Equity Required 1. Compute Earnings per Share. 2. Compute Dividends per Share. 3. Compute the Market Price per Share. 4. Compute the Price Earnings Ratio. 5. Compute the Dividend Yield (rounded to 2 decimal places). 6. Compute the Dividend Payout Ratio (rounded to 2 decimal places). Upon completion, enter your answers below: Earnings per Share (as an integer i.e. round): Dividends per Share (as an integer): Market Price per Share (as an integer): Price Earnings Ratio (as an integer): Dividend Yield (% to 2 decimal places e.g. if 5.2%, enter 5.2): Dividend Payout Ratio % (2 decimal places):

Chapter2: Analysis Of Financial Statements

Section: Chapter Questions

Problem 20PROB

Related questions

Question

Practice Pack

Please list the final answer with their related name

Transcribed Image Text:Problem 2-6: The Austin Corporation

The following information was available for the Austin Corporation on October 31, 2021:

Net Income

Dividends Declared and Paid

126000

14000

Common Shares outstanding

2000

Market Value of Common Equity

1008000

Required

1. Compute Earnings per Share.

2. Compute Dividends per Share.

3. Compute the Market Price per Share.

4. Compute the Price Earnings Ratio.

5. Compute the Dividend Yield (rounded to 2 decimal places).

6. Compute the Dividend Payout Ratio (rounded to 2 decimal places).

Upon completion, enter your answers below:

Earnings per Share (as an integer i.e. round):

Dividends per Share (as an integer):

Market Price per Share (as an integer):

Price Earnings Ratio (as an integer):

Dividend Yield (% to 2 decimal places e.g. if 5.2%, enter 5.2):

Dividend Payout Ratio % (2 decimal places):

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Includes step-by-step video

Trending now

This is a popular solution!

Learn your way

Includes step-by-step video

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning