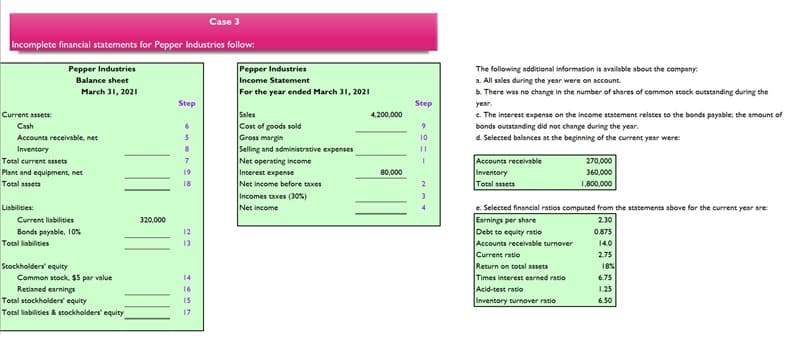

Case 3 Incomplete financial statements for Pepper Industries follow: Pepper Industries Pepper Industries The following additional information is available about the company: Income Statement For the year ended March 31, 2021 Balance sheet a. All sales during the year were on account b. There was no change in the number of shares of common stock outstanding during the March 31, 2021 Step Step year. e. The interest expense on the income statement relates to the bonds payable; the amount of bonds outstanding did not change during the year. d. Selected balances at the beginning of the current year were: Sales Cost of goods sold Gross margin Selling and administrative expenses Net operating income Interest expense Current assets: 4,200,000 Cash Accounts receivable, net 10 Inventory 270,000 Accounts receivable Inventory Total assets Total current assets Plant and equipment, net 19 80,000 360,000 Total assets 18 Net income before taxes 1,800.000 Incomes taxes (30%) Liabilities: Net income e. Selected financial ratios computed from the statements above for the current year are: Earnings per share Debt to equity ratio Accounts receivable turnover Current ratio Return on total assets Times interest earned ratio Acid-test ratio Inventory turnover ratio 4 Current liabilities 320.000 2.30 Bonds payable, 10% 12 0.875 Total labilities 13 14.0 2.75 18% Stockholders' equity Common stock, $5 par value Retianed earnings Total stockholders' equity 14 6.75 16 1.25 IS 6.50 Total liabilities & stockholders' equity 17

Case 3 Incomplete financial statements for Pepper Industries follow: Pepper Industries Pepper Industries The following additional information is available about the company: Income Statement For the year ended March 31, 2021 Balance sheet a. All sales during the year were on account b. There was no change in the number of shares of common stock outstanding during the March 31, 2021 Step Step year. e. The interest expense on the income statement relates to the bonds payable; the amount of bonds outstanding did not change during the year. d. Selected balances at the beginning of the current year were: Sales Cost of goods sold Gross margin Selling and administrative expenses Net operating income Interest expense Current assets: 4,200,000 Cash Accounts receivable, net 10 Inventory 270,000 Accounts receivable Inventory Total assets Total current assets Plant and equipment, net 19 80,000 360,000 Total assets 18 Net income before taxes 1,800.000 Incomes taxes (30%) Liabilities: Net income e. Selected financial ratios computed from the statements above for the current year are: Earnings per share Debt to equity ratio Accounts receivable turnover Current ratio Return on total assets Times interest earned ratio Acid-test ratio Inventory turnover ratio 4 Current liabilities 320.000 2.30 Bonds payable, 10% 12 0.875 Total labilities 13 14.0 2.75 18% Stockholders' equity Common stock, $5 par value Retianed earnings Total stockholders' equity 14 6.75 16 1.25 IS 6.50 Total liabilities & stockholders' equity 17

Financial And Managerial Accounting

15th Edition

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:WARREN, Carl S.

Chapter1: Introduction To Accounting And Business

Section: Chapter Questions

Problem 2PA: Financial statements The assets and liabilities of Global Travel Agency on December 31, 20Y5, and...

Related questions

Question

Compute the missing amounts on the company’s financial statements. (Hint: What’s the difference between the acid-test ratio and the

10. Gross margin

11. Selling and administrative expenses

12. Bonds payable

Transcribed Image Text:Case 3

Incomplete financial statements for Pepper Industries follow:

Pepper Industries

Pepper Industries

The following additional information is available about the company:

Income Statement

For the year ended March 31, 2021

Balance sheet

a. All sales during the year were on account

b. There was no change in the number of shares of common stock outstanding during the

March 31, 2021

Step

Step

year.

e. The interest expense on the income statement relates to the bonds payable; the amount of

bonds outstanding did not change during the year.

d. Selected balances at the beginning of the current year were:

Sales

Cost of goods sold

Gross margin

Selling and administrative expenses

Net operating income

Interest expense

Current assets:

4,200,000

Cash

Accounts receivable, net

10

Inventory

270,000

Accounts receivable

Inventory

Total assets

Total current assets

Plant and equipment, net

19

80,000

360,000

Total assets

18

Net income before taxes

1,800.000

Incomes taxes (30%)

Liabilities:

Net income

e. Selected financial ratios computed from the statements above for the current year are:

Earnings per share

Debt to equity ratio

Accounts receivable turnover

Current ratio

Return on total assets

Times interest earned ratio

Acid-test ratio

Inventory turnover ratio

4

Current liabilities

320.000

2.30

Bonds payable, 10%

12

0.875

Total labilities

13

14.0

2.75

18%

Stockholders' equity

Common stock, $5 par value

Retianed earnings

Total stockholders' equity

14

6.75

16

1.25

IS

6.50

Total liabilities & stockholders' equity

17

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning