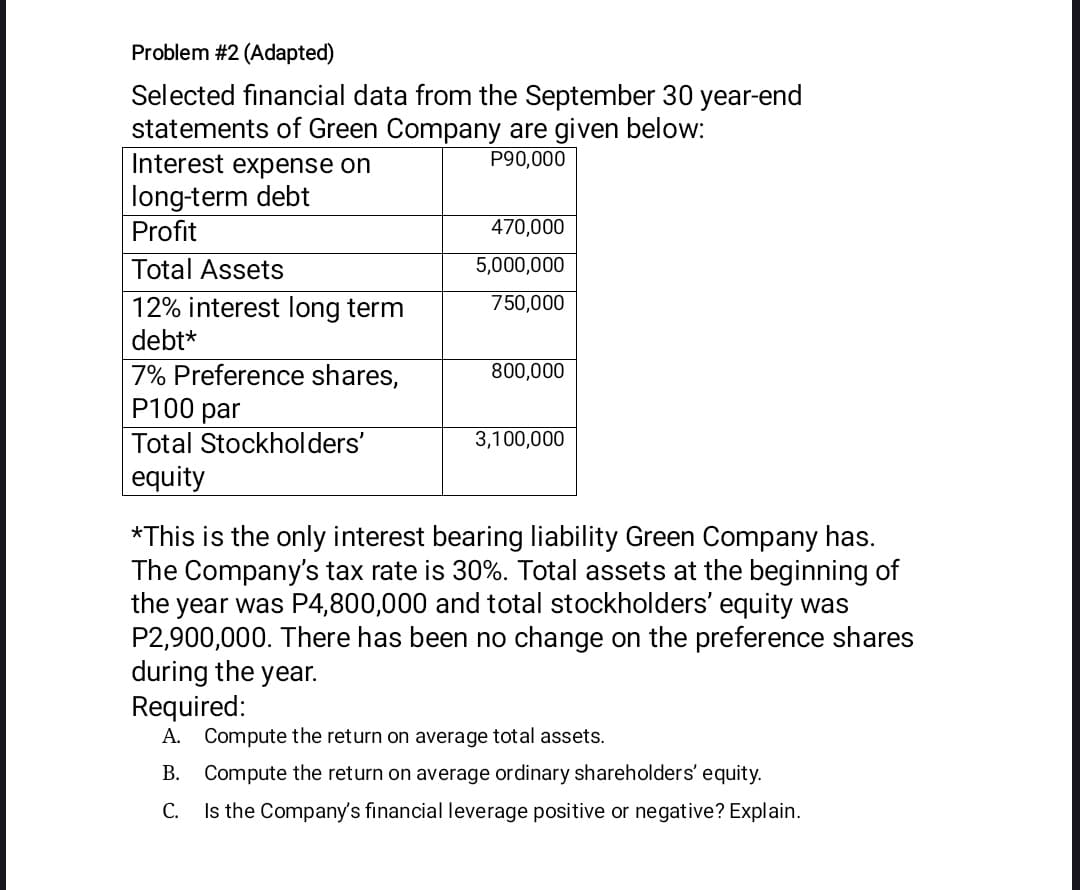

Problem #2 (Adapted) Selected financial data from the September 30 year-end statements of Green Company are given below: Interest expense on long-term debt Profit P90,000 470,000 Total Assets 5,000,000 750,000 12% interest long term debt* 7% Preference shares, P100 par 800,000 Total Stockholders' 3,100,000 equity *This is the only interest bearing liability Green Company has. The Company's tax rate is 30%. Total assets at the beginning of the year was P4,800,000 and total stockholders' equity was P2,900,000. There has been no change on the preference shares during the year. Required: A. Compute the return on average total assets. В. Compute the return on average ordinary shareholders' equity. С. Is the Company's financial leverage positive or negative? Explain.

Problem #2 (Adapted) Selected financial data from the September 30 year-end statements of Green Company are given below: Interest expense on long-term debt Profit P90,000 470,000 Total Assets 5,000,000 750,000 12% interest long term debt* 7% Preference shares, P100 par 800,000 Total Stockholders' 3,100,000 equity *This is the only interest bearing liability Green Company has. The Company's tax rate is 30%. Total assets at the beginning of the year was P4,800,000 and total stockholders' equity was P2,900,000. There has been no change on the preference shares during the year. Required: A. Compute the return on average total assets. В. Compute the return on average ordinary shareholders' equity. С. Is the Company's financial leverage positive or negative? Explain.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter9: Long-term Liabilities

Section: Chapter Questions

Problem 103.2C

Related questions

Question

Please answer in excel form

Transcribed Image Text:Problem #2 (Adapted)

Selected financial data from the September 30 year-end

statements of Green Company are given below:

Interest expense on

long-term debt

Profit

P90,000

470,000

Total Assets

5,000,000

12% interest long term

750,000

debt*

7% Preference shares,

P100 par

800,000

Total Stockholders'

3,100,000

| equity

*This is the only interest bearing liability Green Company has.

The Company's tax rate is 30%. Total assets at the beginning of

the year was P4,800,000 and total stockholders' equity was

P2,900,000. There has been no change on the preference shares

during the year.

Required:

A. Compute the return on average total assets.

B. Compute the return on average ordinary shareholders' equity.

С.

Is the Company's financial leverage positive or negative? Explain.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning