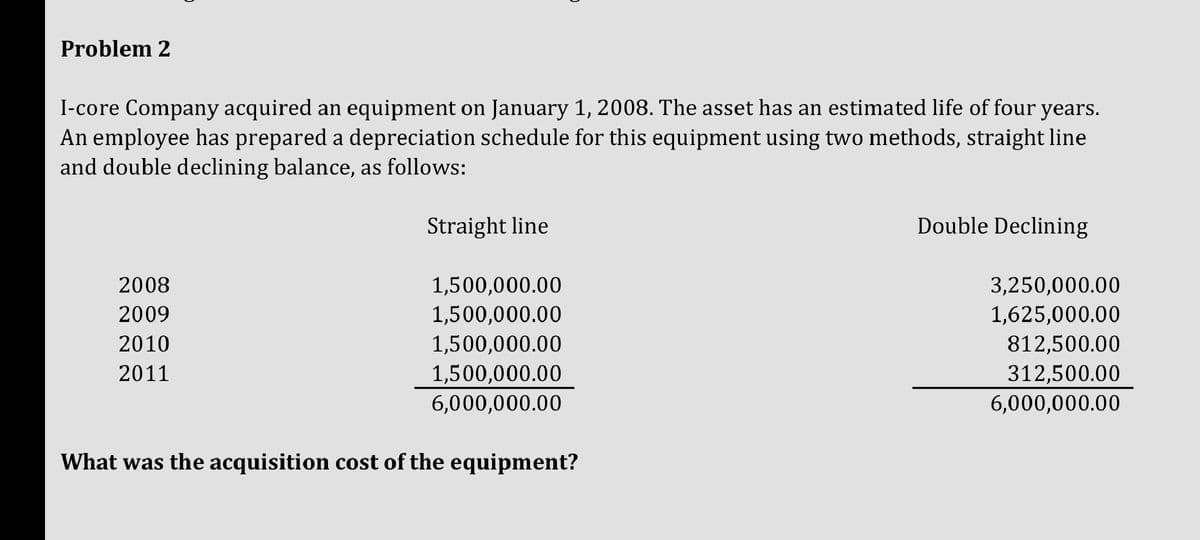

Problem 2 I-core Company acquired an equipment on January 1, 2008. The asset has an estimated life of four years. An employee has prepared a depreciation schedule for this equipment using two methods, straight line and double declining balance, as follows: 2008 2009 2010 2011 Straight line 1,500,000.00 1,500,000.00 1,500,000.00 1,500,000.00 6,000,000.00 What was the acquisition cost of the equipment? Double Declining 3,250,000.00 1,625,000.00 812,500.00 312,500.00 6,000,000.00

Problem 2 I-core Company acquired an equipment on January 1, 2008. The asset has an estimated life of four years. An employee has prepared a depreciation schedule for this equipment using two methods, straight line and double declining balance, as follows: 2008 2009 2010 2011 Straight line 1,500,000.00 1,500,000.00 1,500,000.00 1,500,000.00 6,000,000.00 What was the acquisition cost of the equipment? Double Declining 3,250,000.00 1,625,000.00 812,500.00 312,500.00 6,000,000.00

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter7: Operating Assets

Section: Chapter Questions

Problem 71BPSB: Depreciation Schedules Dunn Corporation acquired a new depreciable asset for $135,000. The asset has...

Related questions

Question

Transcribed Image Text:Problem 2

I-core Company acquired an equipment on January 1, 2008. The asset has an estimated life of four years.

An employee has prepared a depreciation schedule for this equipment using two methods, straight line

and double declining balance, as follows:

2008

2009

2010

2011

Straight line

1,500,000.00

1,500,000.00

1,500,000.00

1,500,000.00

6,000,000.00

What was the acquisition cost of the equipment?

Double Declining

3,250,000.00

1,625,000.00

812,500.00

312,500.00

6,000,000.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,