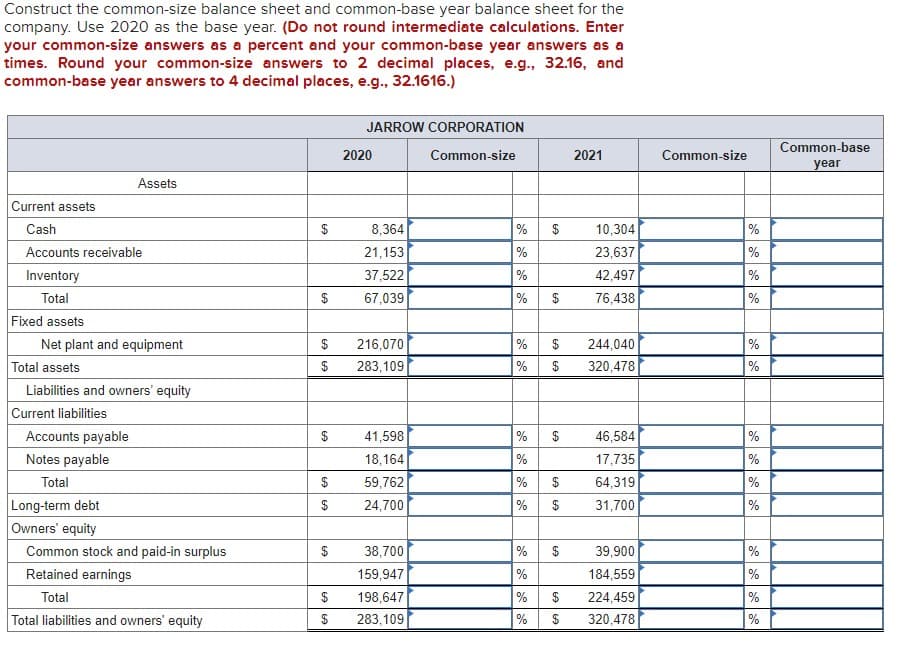

Problem 3-18 Common-Size and Common-Base Year Financial Statements In addition to common-size financial statements, common-base year financial statements are often used. Common-base year financial statements are constructed by dividing the current year account value by the base year account value. Thus, the result shows the growth rate in the account. Construct the common-size balance sheet and common-base year balance sheet for the company. Use 2020 as the base year. (Do not round intermediate calculations. Enter your common-size answers as a percent and your common-base year answers as a times. Round your common-size answers to 2 decimal places, e.g., 32.16, and common-base year answers to 4 decimal places, e.g., 32.1616.)

Problem 3-18 Common-Size and Common-Base Year Financial Statements In addition to common-size financial statements, common-base year financial statements are often used. Common-base year financial statements are constructed by dividing the current year account value by the base year account value. Thus, the result shows the growth rate in the account. Construct the common-size balance sheet and common-base year balance sheet for the company. Use 2020 as the base year. (Do not round intermediate calculations. Enter your common-size answers as a percent and your common-base year answers as a times. Round your common-size answers to 2 decimal places, e.g., 32.16, and common-base year answers to 4 decimal places, e.g., 32.1616.)

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter8: Current And Contingent Liabilities

Section: Chapter Questions

Problem 2MCQ

Related questions

Question

Problem 3-18 Common-Size and Common-Base Year Financial Statements

|

In addition to common-size financial statements, common-base year financial statements are often used. Common-base year financial statements are constructed by dividing the current year account value by the base year account value. Thus, the result shows the growth rate in the account. |

|

Construct the common-size balance sheet and common-base year balance sheet for the company. Use 2020 as the base year. (Do not round intermediate calculations. Enter your common-size answers as a percent and your common-base year answers as a times. Round your common-size answers to 2 decimal places, e.g., 32.16, and common-base year answers to 4 decimal places, e.g., 32.1616.) |

Transcribed Image Text:Construct the common-size balance sheet and common-base year balance sheet for the

company. Use 2020 as the base year. (Do not round intermediate calculations. Enter

your common-size answers as a percent and your common-base year answers as a

times. Round your common-size answers to 2 decimal places, e.g., 32.16, and

common-base year answers to 4 decimal places, e.g., 32.1616.)

Current assets

Cash

Accounts receivable

Inventory

Total

Fixed assets

Assets

Net plant and equipment

Total assets

Liabilities and owners' equity

Current liabilities

Accounts payable

Notes payable

Total

Long-term debt

Owners' equity

Common stock and paid-in surplus

Retained earnings

Total

Total liabilities and owners' equity

$

$

69

$

$

$ 216,070

$ 283,109

$

JARROW CORPORATION

Common-size

$

$

2020

8,364

21,153

37,522

67,039

41,598

18,164

59,762

24,700

38,700

159,947

198,647

283,109

% $

%

%

% $

% $

% $

% $

%

% $

% $

% $

%

% $

%

$

2021

10,304

23,637

42,497

76,438

244,040

320,478

46,584

17,735

64,319

31,700

39,900

184,559

224,459

320,478

Common-size

%

%

%

%

%

%

%

%

%

%

%

Common-base

year

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning