Problem 3-63 (Algo) CVP, Operating Leverage, and Margin of Safety (LO 3-1, 2, 4) Maryland Manufacturing (M2) produces a part using an expensive proprietary machine that can only be leased. The leasing company offers two contracts. The first (unit-rate lease) is one where M2 would pay $20 per unit produced, regardless of the number of units. The second lease option (flat-rate lease) is one where M2 would pay $450,000 annually, regardless of the number produced. The lease will run one year and the lease option chosen cannot be changed during the lease. All other lease terms are the same. M2 sells the part for $218 per unit and unit variable cost (excluding any machine lease costs) are $118. Annual fixed costs (excluding any machine lease costs) are $1,458,000. Required: a. What is the annual break-even level assuming 1. The unit-rate lease? 2. The flat-rate lease? b. At what annual volume would the operating profit be the same regardless of the royalty option chosen? c. Suppose M2 is unsure of the pricing and costs for the part (other than the costs of the lease under the two payment options). At what annual volume would the operating profit be the same regardless of the lease payment option chosen? d. Assume an annual volume of 34,500 parts. What is the operating leverage assuming 1. The unit-rate lease? 2. The flat-rate lease? e. Assume an annual volume of 34,500 parts. What is the margin of safety assuming 1. The unit-rate lease? 2. The flat-rate lease?

Problem 3-63 (Algo) CVP, Operating Leverage, and Margin of Safety (LO 3-1, 2, 4) Maryland Manufacturing (M2) produces a part using an expensive proprietary machine that can only be leased. The leasing company offers two contracts. The first (unit-rate lease) is one where M2 would pay $20 per unit produced, regardless of the number of units. The second lease option (flat-rate lease) is one where M2 would pay $450,000 annually, regardless of the number produced. The lease will run one year and the lease option chosen cannot be changed during the lease. All other lease terms are the same. M2 sells the part for $218 per unit and unit variable cost (excluding any machine lease costs) are $118. Annual fixed costs (excluding any machine lease costs) are $1,458,000. Required: a. What is the annual break-even level assuming 1. The unit-rate lease? 2. The flat-rate lease? b. At what annual volume would the operating profit be the same regardless of the royalty option chosen? c. Suppose M2 is unsure of the pricing and costs for the part (other than the costs of the lease under the two payment options). At what annual volume would the operating profit be the same regardless of the lease payment option chosen? d. Assume an annual volume of 34,500 parts. What is the operating leverage assuming 1. The unit-rate lease? 2. The flat-rate lease? e. Assume an annual volume of 34,500 parts. What is the margin of safety assuming 1. The unit-rate lease? 2. The flat-rate lease?

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter19: Lease Financing

Section: Chapter Questions

Problem 1P: Reynolds Construction (RC) needs a piece of equipment that costs 200. RC can either lease the...

Related questions

Question

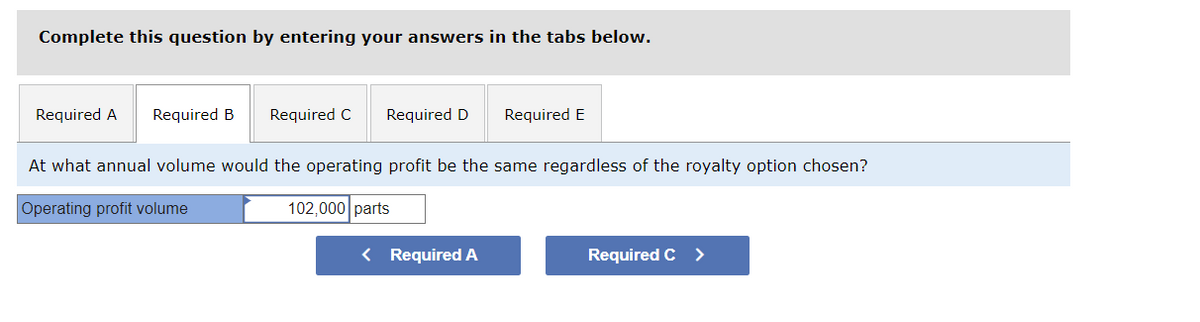

Transcribed Image Text:Complete this question by entering your answers in the tabs below.

Required A Required B Required C Required D

At what annual volume would the operating profit be the same regardless of the royalty option chosen?

Operating profit volume

102,000 parts

< Required A

Required E

Required C >

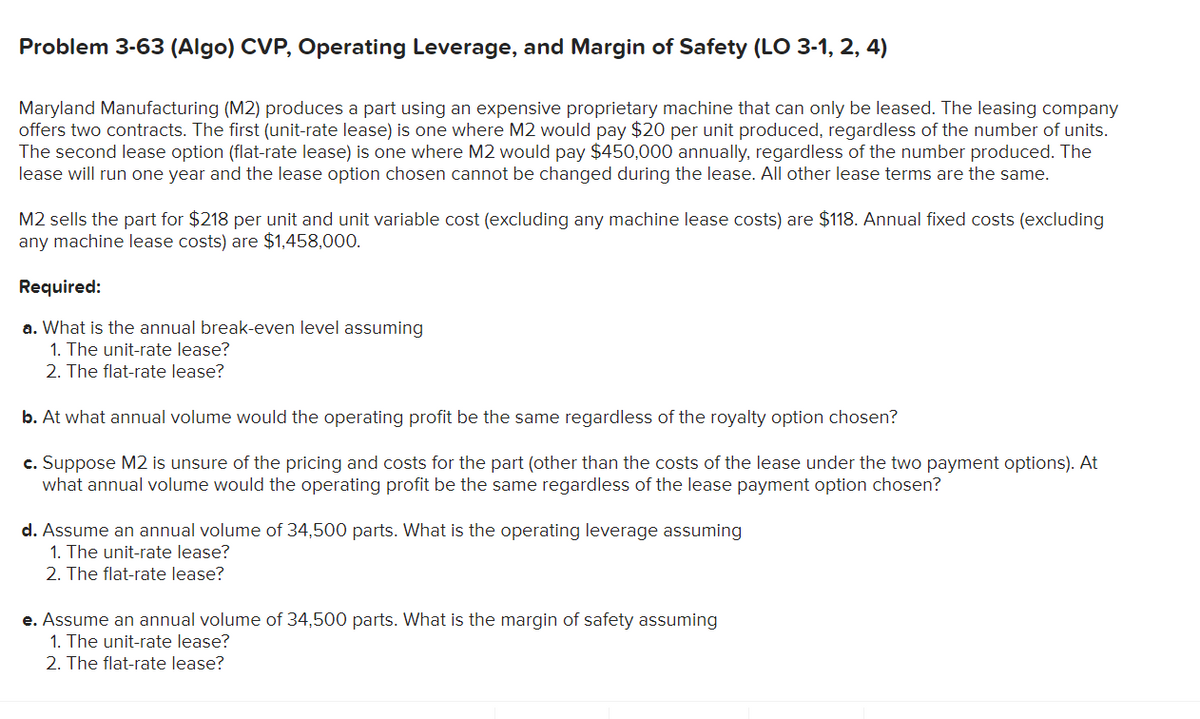

Transcribed Image Text:Problem 3-63 (Algo) CVP, Operating Leverage, and Margin of Safety (LO 3-1, 2, 4)

Maryland Manufacturing (M2) produces a part using an expensive proprietary machine that can only be leased. The leasing company

offers two contracts. The first (unit-rate lease) is one where M2 would pay $20 per unit produced, regardless of the number of units.

The second lease option (flat-rate lease) is one where M2 would pay $450,000 annually, regardless of the number produced. The

lease will run one year and the lease option chosen cannot be changed during the lease. All other lease terms are the same.

M2 sells the part for $218 per unit and unit variable cost (excluding any machine lease costs) are $118. Annual fixed costs (excluding

any machine lease costs) are $1,458,000.

Required:

a. What is the annual break-even level assuming

1. The unit-rate lease?

2. The flat-rate lease?

b. At what annual volume would the operating profit be the same regardless of the royalty option chosen?

c. Suppose M2 is unsure of the pricing and costs for the part (other than the costs of the lease under the two payment options). At

what annual volume would the operating profit be the same regardless of the lease payment option chosen?

d. Assume an annual volume of 34,500 parts. What is the operating leverage assuming

1. The unit-rate lease?

2. The flat-rate lease?

e. Assume an annual volume of 34,500 parts. What is the margin of safety assuming

1. The unit-rate lease?

2. The flat-rate lease?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub