Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 19, Problem 1P

Reynolds Construction (RC) needs a piece of equipment that costs $200. RC can either lease the equipment or borrow $200 from a local bank and buy the equipment. Reynolds’s

- a.

- (1) What is RC’s current debt ratio?

- (2) What would be the company’s debt ratio if it purchased the equipment?

- (3) What would be the debt ratio if the equipment were leased and the lease not capitalized?

- (4) What would be the debt ratio if the equipment were leased and the lease were capitalized? Assume that the present value of the lease payments is equal to the cost of the equipment.

- b. Would the company’s financial risk be different under the leasing and purchasing alternatives?

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

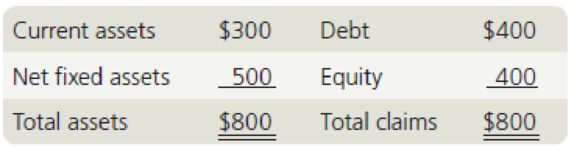

Reynolds Construction (RC) needs a piece of equipment that costs $200. RC can either lease the equipment or borrow $200 from a local bank and buy the equipment. Reynolds's balance sheet prior to the acquisition of the equipment is as follows:

Current assets: $300 Debt: $400

Net Fixed Assets: 500 Equity: 400

Total assets: 800 Total claims: 800

a. (1) What is RC's current debt ratio?

(2) What would be the company's debt ratio if it purchased the equipment?

(3) What would be the debt ratio if the equipment were leased and the lease was not capitalized?

(4) What would be the debt ratio if the equipment were leased and the lease were capitlaized? Assume that the present value of the lease payments is equal to the cost of the equipment.

b. Would the company's financial risk be different under the leasing and purchasing alternatives?

Cordell Construction needs a piece of equipment that can be leased orpurchased. The equipment costs $100. One option is to borrow $100 from the local bankand use the money to buy the equipment. The other option is to lease the equipment. Thecompany’s balance sheet prior to the equipment purchase or lease is shown below:What would be the company’s debt ratio if it chose to purchase the equipment? Whatwould be the company’s debt ratio if it leased the equipment and it could keep the leaseoff its balance sheet? Is the company’s financial risk any different whether the equipmentis leased or purchased? Explain.

Boswell Manufacturing Company has been in business for five years. Thecompany has now decided to expand its operations. To finance this process, the company is considering two approaches:

(1) Lease the assets that are needed on a long term basis or

(2) Issue bonds and use the proceeds to purchase the assets. The CEO is seeking your advice on the matter. Without knowledge of the comparative cost involved, how would you advise him in the following questions:

(i) What might be the advantages and disadvantages of leasing the assetsinstead of owning them. (List at least three advantages and threedisadvantages) (ii) How will leasing the assets instead of owning them affect the financialstatements?

Chapter 19 Solutions

Intermediate Financial Management (MindTap Course List)

Ch. 19 - Define each of the following terms: a. Lessee;...Ch. 19 - Distinguish between operating leases and financial...Ch. 19 - Prob. 3QCh. 19 - Prob. 4QCh. 19 - Prob. 5QCh. 19 - Prob. 6QCh. 19 - Prob. 7QCh. 19 - Prob. 8QCh. 19 - Reynolds Construction (RC) needs a piece of...Ch. 19 - Lease versus Buy Consider the data in Problem...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Northwest Lumber Company needs to expand its facilities. To do so, the firm must acquire a machine costing $80,000. The machine can be leased or purchased. The firm is in the 21% tax bracket, and its after-tax cost of debt is 9%. The terms of the lease and purchase plans are as follows: Lease: The leasing arrangement requires beginning-of-year payments of $19,800 over 5 years. All maintenance costs will be paid by the lessor. The lessee will exercise its option to purchase the asset for $24,000 at termination of the lease. Ignore any future tax benefit associated with the purchase of the equipment at the end of year 5 under the lease option. Purchase: If the firm purchases the machine, its cost of $80,000 will be financed with a 14% loan amortised over 5-year period. The machine will be depreciated under MACRS using a 5-year recovery period. The firm will pay $2,000 per year at the beginning of the year for a service contract that covers all maintenance costs. The…arrow_forwardNorthwest Lumber Company needs to expand its facilities. To do so, the firm must acquire a machine costing $80,000. The machine can be leased or purchased. The firm is in the 21% tax bracket, and its after-tax cost of debt is 9%. The terms of the lease and purchase plans are as follows: Lease: The leasing arrangement requires beginning-of-year payments of $19,800 over 5 years. All maintenance costs will be paid by the lessor. The lessee will exercise its option to purchase the asset for $24,000 at termination of the lease. Ignore any future tax benefit associated with the purchase of the equipment at the end of year 5 under the lease option. Purchase: If the firm purchases the machine, its cost of $80,000 will be financed with a 14% loan amortised over 5-year period. The machine will be depreciated under MACRS using a 5-year recovery period. The firm will pay $2,000 per year at the beginning of the year for a service contract that covers all maintenance costs. The…arrow_forwardHeidi Inc. is considering whether to lease or purchase a piece of equipment. The total cost to lease the equipment will be $128,000 over its estimated life, while the total cost to buy the equipment will be $83,000 over its estimated life. At Heidi’s required rate of return, the net present value of the cost of leasing the equipment is $81,300 and the net present value of the cost of buying the equipment is $75,000. Based on financial factors, Heidi should:arrow_forward

- In a cost center, the manager has responsibility and authority for making decisions that affect a. costs b. investments in assets c. both costs and revenues d. revenues Keating Co. is considering disposing of equipment with a cost of $68,000 and accumulated depreciation of $47,600. Keating Co. can sell the equipment through a broker for $27,000 less 8% commission. Alternatively, Gunner Co. has offered to lease the equipment for five years for a total of $46,000. Keating will incur repair, insurance, and property tax expenses estimated at $10,000 over the five-year period. At lease-end, the equipment is expected to have no residual value. The net differential income from the lease alternative is a. $11,160 b. $7,812 c. $16,740 d. $13,392 If sales are $828,000, variable costs are 68% of sales, and operating income is $278,000, what is the contribution margin ratio? a. 64% b. 36% c. 68% d. 32%arrow_forwardJLB Corporation is attempting to determine whether to lease or purchase research equipment. The firm is in the 40% tax bracket, and its after-tax cost of debt is currently 8%. The returns of the least and of the purchase are as follows:Lease Annual end-of-year lease payments of $25,200 are required over the 3-year life of the lease. All maintenance costs will be paid by the lessor; insurance and other costs will be borne by the lessee. The lessee will exercise its option to purchase the asset for $5,000 at termination of the lease. Purchase The research equipment, costing $60,000, can be financed entirely with a 14% loan requiring annual end-of-year payments of $25,844 for 3 years. The firm in this case will depreciate the equipment under MACRS using a 3-yar recovery period (33.33%, 44.45%, 14.81%, and 7.41%, respectively). The firm will pay $1,800 per year for a service contract that covers all maintenance costs; insurance and other costs will be borne by the firm. The firm plans to…arrow_forwardJLB Corporation is attempting to determine whether to lease or purchase research equipment. The firm is in the 40% tax bracket, and its after-tax cost of debt is currently 8%. The returns of the least and of the purchase are as follows:Lease Annual end-of-year lease payments of $25,200 are required over the 3-year life of the lease. All maintenance costs will be paid by the lessor; insurance and other costs will be borne by the lessee. The lessee will exercise its option to purchase the asset for $5,000 at termination of the lease. Purchase The research equipment, costing $60,000, can be financed entirely with a 14% loan requiring annual end-of-year payments of $25,844 for 3 years. The firm in this case will depreciate the equipment under MACRS using a 3-yar recovery period (33.33%, 44.45%, 14.81%, and 7.41%, respectively). The firm will pay $1,800 per year for a service contract that covers all maintenance costs; insurance and other costs will be borne by the firm. The firm plans to…arrow_forward

- Sugar has entered into a long-term contract to build an asset for a customer, Hewer. Sugar will satisfy the performance obligation over time and has measured the progress towards satisfying the performance obligation at 45% at the year end. The price of the contract is $8 million. Sugar has spent $4.5 million to date, but the estimated costs to complete are $5.5 million. To date, Hewer has paid Sugar $3 million. What is the net liability that should be recorded in Sugar’s statement of financial position?arrow_forwardKeating Co. is considering disposing of equipment that cost $62,000 and has $43,400 of accumulated depreciation to date. Keating Co. can sell the equipment through a broker for $33,000 less a 6% commission. Alternatively, Gunner Co. has offered to lease the equipment for five years for a total of $45,000. Keating will incur repair, insurance, and property tax expenses estimated at $12,000 over the five-year period. At lease-end, the equipment is expected to have no residual value. The net differential profit or loss from the sell alternative is a a. $2,376 profit b. $1,980 loss c. $1,386 loss d. $2,970 profitarrow_forwardKeating Co. is considering disposing of equipment that cost $65,000 and has $45,500 of accumulated depreciation to date. Keating Co. can sell the equipment through a broker for $33,000 less a 7% commission. Alternatively, Gunner Co. has offered to lease the equipment for five years for a total of $45,000. Keating will incur repair, insurance, and property tax expenses estimated at $9,000 over the five-year period. At lease-end, the equipment is expected to have no residual value. The net differential profit or loss from the sell alternative is aarrow_forward

- Radley Co. is growing its business and is currently deciding how to finance this programme. Following some research, the business decides that it can either (1) issue bonds and use the money to buy the necessary assets, or (2) lease the assets for an extended period of time. Please respond to the following questions without understanding the relative costs involved: a. What benefits might leasing the assets have over purchasing them? b. What drawbacks can leasing the assets have in comparison to buying them? c. How would leasing the assets vary from issuing bonds and buying the assets in terms of how it will impact the Statement of Financial Position?arrow_forwardYou have an opportunity to acquire a property from First Capital Bank. The bank recently obtained the property from a borrower who defaulted on his loan. First Capital is offering the property for $200,000. If you buy the property, you believe that you will have to spend (1) $10,500 on various acquisition-related expenses and (2) an average of $2,000 per monthduring the next 12 months for repair costs, etc., in order to prepare it for sale. Because First Capital Bank would like to sell the property as soon as possible, it is willing to provide $180,000 in financing at 8 percent interest for 12 months payable monthly (interest only). Your market research indicates that after you repair the property, it may sell for about $225,000 at the end of one year. Furthermore, you will probably have to pay about $3,000 in fees and selling expenses in order to sell the property at that time. If you wanted to earn a 20 percent return compounded monthly, do you believe that this would be a good…arrow_forwardABC can either purchase the machine for $225,000 or lease it from KLease for 12 annual lease payments (paid at the beginning of the year) of $26,000. The machine has CCA rate of 30%. The salvage value is expected to be $12,500. ABC does not have any other asset in the asset class and KLease always has a positive UCC in the asset class. ABC and KLease have cost of debt of 9% and 5%% respectively. KLease pays the statutory corporate tax rate of 25% and ABC only pays 15%. a) Calculate the NPV of leasing for ABC and KLease. b) What are the minimum and maximum annual lease payments that make leasing acceptable to botharrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Accounting for Finance and Operating Leases | U.S. GAAP CPA Exams; Author: Maxwell CPA Review;https://www.youtube.com/watch?v=iMSaxzIqH9s;License: Standard Youtube License