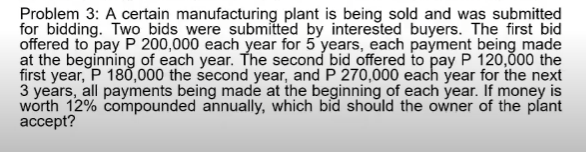

Problem 3: A certain manufacturing plant is being sold and was submitted for bidding. Two bids were submitted by interested buyers. The first bid offered to pay P 200,000 each year for 5 years, each payment being made at the beginning of each year. The second bid offered to pay P 120,00 the first year, P 18Ố,000 the second year, and P 270,000 each year for the next 3 years, all payments being made at the beginning of each year. If money is worth 12% compounded annually, which bid should the owner of the plant accept?

Problem 3: A certain manufacturing plant is being sold and was submitted for bidding. Two bids were submitted by interested buyers. The first bid offered to pay P 200,000 each year for 5 years, each payment being made at the beginning of each year. The second bid offered to pay P 120,00 the first year, P 18Ố,000 the second year, and P 270,000 each year for the next 3 years, all payments being made at the beginning of each year. If money is worth 12% compounded annually, which bid should the owner of the plant accept?

Essentials of Economics (MindTap Course List)

8th Edition

ISBN:9781337091992

Author:N. Gregory Mankiw

Publisher:N. Gregory Mankiw

Chapter19: The Basic Tools Of Finance

Section: Chapter Questions

Problem 1CQQ

Related questions

Question

Please show the solution of this and the answer must be the 2nd bid, P=859,727.18. Thank you!

Transcribed Image Text:Problem 3: A certain manufacturing plant is being sold and was submitted

for bidding. Two bids were submitted by interested buyers. The first bid

offered to pay P 200,000 each year for 5 years, each payment being made

at the beginning of each year. The second bid offered to pay P 120,000 the

first year, P 18Ố,000 the second year, and P 270,000 each year for the next

3 years, all payments being made at the beginning of each year. If money is

worth 12% compounded annually, which bid should the owner of the plant

аcсept?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning