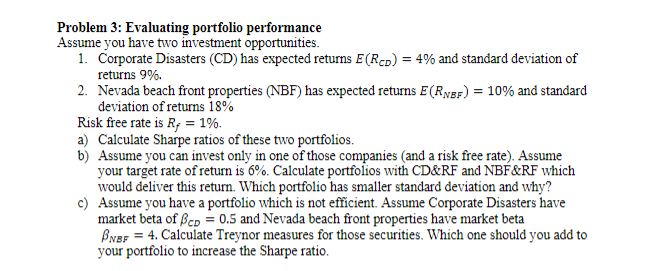

Problem 3: Evaluating portfolio performance Assume you have two investment opportunities. 1. Corporate Disasters (CD) has expected returns E(RcD) = 4% and standard deviation of returns 9%. 2. Nevada beach front properties (NBF) has expected returns E(RygF) = 10% and standard deviation of returns 18% Risk free rate is R; = 1%. a) Calculate Sharpe ratios of these two portfolios. b) Assume you can invest only in one of those companies (and a risk free rate). Assume your target rate of return is 6%. Calculate portfolios with CD&RF and NBF&RF which would deliver this return. Which portfolio has smaller standard deviation and why? c) Assume you have a portfolio which is not efficient. Assume Corporate Disasters have market beta of ßep = 0.5 and Nevada beach front properties have market beta BNef = 4. Calculate Treynor measures for those securities. Which one should you add to your portfolio to increase the Sharpe ratio.

Problem 3: Evaluating portfolio performance Assume you have two investment opportunities. 1. Corporate Disasters (CD) has expected returns E(RcD) = 4% and standard deviation of returns 9%. 2. Nevada beach front properties (NBF) has expected returns E(RygF) = 10% and standard deviation of returns 18% Risk free rate is R; = 1%. a) Calculate Sharpe ratios of these two portfolios. b) Assume you can invest only in one of those companies (and a risk free rate). Assume your target rate of return is 6%. Calculate portfolios with CD&RF and NBF&RF which would deliver this return. Which portfolio has smaller standard deviation and why? c) Assume you have a portfolio which is not efficient. Assume Corporate Disasters have market beta of ßep = 0.5 and Nevada beach front properties have market beta BNef = 4. Calculate Treynor measures for those securities. Which one should you add to your portfolio to increase the Sharpe ratio.

Chapter7: Types And Costs Of Financial Capital

Section: Chapter Questions

Problem 6EP

Related questions

Question

Transcribed Image Text:Problem 3: Evaluating portfolio performance

Assume you have two investment opportunities.

1. Corporate Disasters (CD) has expected returns E(RcD) = 4% and standard deviation of

returns 9%.

2. Nevada beach front properties (NBF) has expected returns E(RygF) = 10% and standard

deviation of returns 18%

Risk free rate is R; = 1%.

a) Calculate Sharpe ratios of these two portfolios.

b) Assume you can invest only in one of those companies (and a risk free rate). Assume

your target rate of return is 6%. Calculate portfolios with CD&RF and NBF&RF which

would deliver this return. Which portfolio has smaller standard deviation and why?

c) Assume you have a portfolio which is not efficient. Assume Corporate Disasters have

market beta of ßep = 0.5 and Nevada beach front properties have market beta

BNef = 4. Calculate Treynor measures for those securities. Which one should you add to

your portfolio to increase the Sharpe ratio.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning