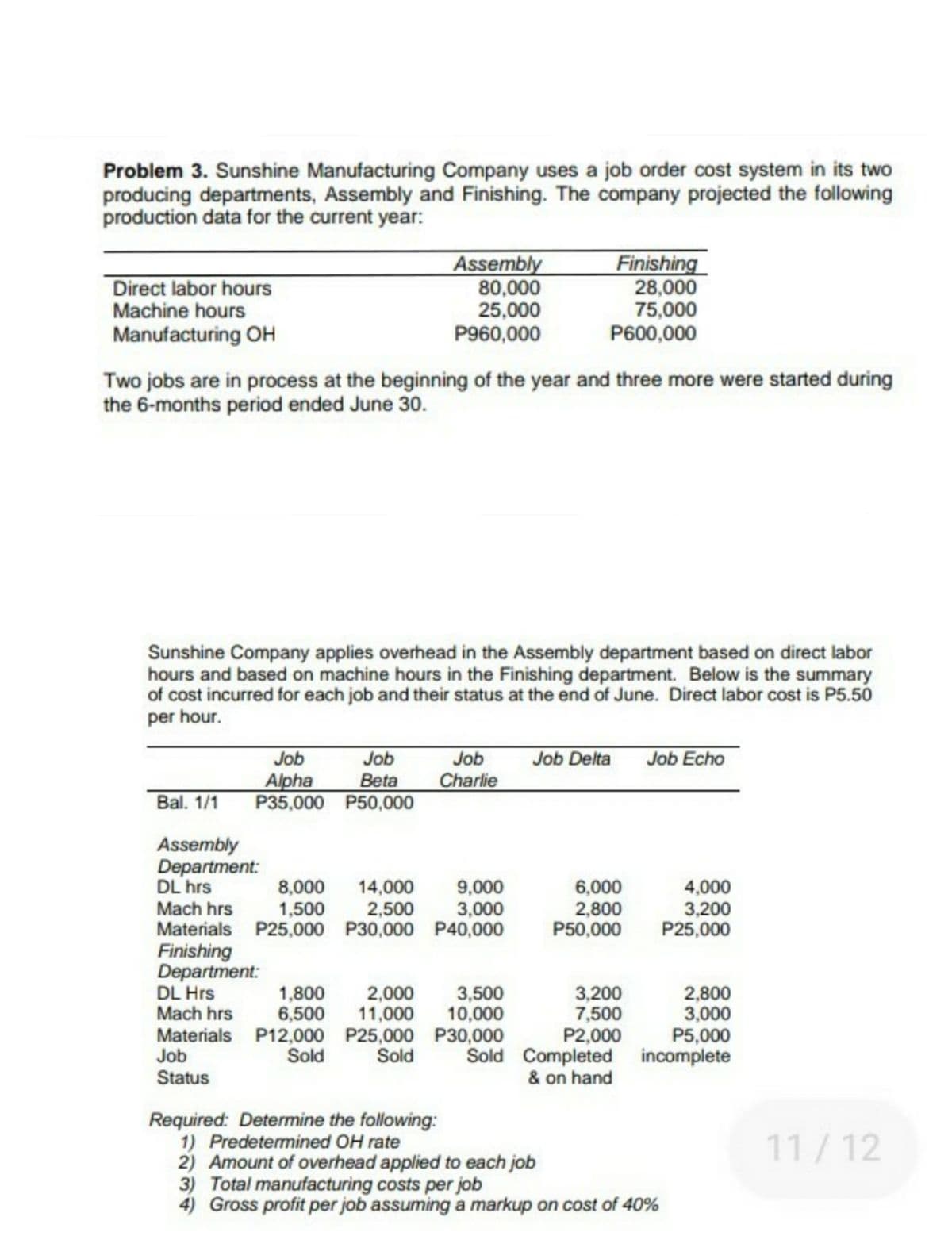

Problem 3. Sunshine Manufacturing Company uses a job order cost system in its two producing departments, Assembly and Finishing. The company projected the following production data for the current year: Assembly 80,000 25,000 P960,000 Finishing 28,000 75,000 P600,000 Direct labor hours Machine hours Manufacturing OH Two jobs are in process at the beginning of the year and three more were started during the 6-months period ended June 30. Sunshine Company applies overhead in the Assembly department based on direct labor hours and based on machine hours in the Finishing department. Below is the summary of cost incurred for each job and their status at the end of June. Direct labor cost is P5.50 per hour. Job Job Beta Alpha P35,000 P50,000 Job Charlie Job Delta Job Echo Bal. 1/1 Assembly Department: DL hrs 8,000 1,500 14,000 2,500 9,000 3,000 6,000 2,800 P50,000 4,000 3,200 P25,000 Mach hrs Materials P25,000 P30,000 P40,000 Finishing Department: DL Hrs Mach hrs 3,500 10,000 1,800 6,500 Materials P12,000 P25,000 P30,000 Sold 2,000 11,000 3,200 7,500 P2,000 Sold Completed incomplete & on hand 2,800 3,000 P5,000 Job Status Sold Required: Determine the following: 1) Predetermined OH rate 2) Amount of overhead applied to each job 3) Total manufacturing costs per job 11/12

Problem 3. Sunshine Manufacturing Company uses a job order cost system in its two producing departments, Assembly and Finishing. The company projected the following production data for the current year: Assembly 80,000 25,000 P960,000 Finishing 28,000 75,000 P600,000 Direct labor hours Machine hours Manufacturing OH Two jobs are in process at the beginning of the year and three more were started during the 6-months period ended June 30. Sunshine Company applies overhead in the Assembly department based on direct labor hours and based on machine hours in the Finishing department. Below is the summary of cost incurred for each job and their status at the end of June. Direct labor cost is P5.50 per hour. Job Job Beta Alpha P35,000 P50,000 Job Charlie Job Delta Job Echo Bal. 1/1 Assembly Department: DL hrs 8,000 1,500 14,000 2,500 9,000 3,000 6,000 2,800 P50,000 4,000 3,200 P25,000 Mach hrs Materials P25,000 P30,000 P40,000 Finishing Department: DL Hrs Mach hrs 3,500 10,000 1,800 6,500 Materials P12,000 P25,000 P30,000 Sold 2,000 11,000 3,200 7,500 P2,000 Sold Completed incomplete & on hand 2,800 3,000 P5,000 Job Status Sold Required: Determine the following: 1) Predetermined OH rate 2) Amount of overhead applied to each job 3) Total manufacturing costs per job 11/12

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter5: Product And Service Costing: Job-order System

Section: Chapter Questions

Problem 21E: Lorrimer Company has a job-order cost system. The following debits (credits) appeared in the...

Related questions

Question

Transcribed Image Text:Problem 3. Sunshine Manufacturing Company uses a job order cost system in its two

producing departments, Assembly and Finishing. The company projected the following

production data for the current year:

Assembly

80,000

25,000

P960,000

Finishing

28,000

75,000

P600,000

Direct labor hours

Machine hours

Manufacturing OH

Two jobs are in process at the beginning of the year and three more were started during

the 6-months period ended June 30.

Sunshine Company applies overhead in the Assembly department based on direct labor

hours and based on machine hours in the Finishing department. Below is the summary

of cost incurred for each job and their status at the end of June. Direct labor cost is P5.50

per hour.

Job

Job

Charlie

Job Delta

Job Echo

Job

Alpha

Beta

Bal. 1/1

P35,000 P50,000

Assembly

Department:

DL hrs

Mach hrs

Materials P25,000 P30,000 P40,000

Finishing

Department:

DL Hrs

Mach hrs

8,000

1,500

14,000

2,500

9,000

3,000

6,000

2,800

P50,000

4,000

3,200

P25,000

3,500

10,000

1,800

6,500

Materials P12,000 P25,000 P30,000

Sold

3,200

7,500

P2,000

Sold Completed incomplete

& on hand

2,000

11,000

2,800

3,000

P5,000

Job

Sold

Status

Required: Determine the following:

1) Predetermined OH rate

2) Amount of overhead applied to each job

3) Total manufacturing costs per job

4) Gross profit per job assuming a markup on cost of 40%

11/12

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,