Problem 31-10 Merger gains and costs As financial manager of Corton Inc., you are investigating a possible acquisition of Denham. You have the basic data given in the following table. Corton Denham Forecast earnings per share Forecast dividend per share Number of shares Stock price 2$ 2$ 7.00 1.70 4.20 2$ .91 2,000,000 2$ 1,600,000 2$ 90 20 You estimate that investors expect a steady growth of about 6% in Denham's earnings and dividends. Under new management, this growth rate would be increased to 8.53% per year without the need for additional capital. Required: a. What is the gain from the acquisition? b. What is the cost of the acquisition if Corton pays $25 in cash for each share of Denham? c. What is the cost of the acquisition if Corton offers one share of Corton for every two shares of Denham? d. How would the cost of the cash offer change if the expected growth rate of Corton was not changed by the merger? e. How would the cost of the share offer change if the expected growth rate was not changed by the merger? (For all requirements, do not round intermediate calculations. Enter your answers in millions rounded to 2 decimal places.) Corton Denham Forecast earnings per share Forecast dividend per share 2$ 2$ 7.00 1.70 2$ 2,000,000 2$ 4.20 .91 Number of shares 1,600,000 2$ Stock price 90 20 You estimate that investors expect a steady growth of about 6% in Denham's earnings and dividends. Under new management, this growth rate would be increased to 8.53% per year without the need for additional capital. Required: a. What is the gain from the acquisition? b. What is the cost of the acquisition if Corton pays $25 in cash for each share of Denham? c. What is the cost of the acquisition if Corton offers one share of Corton for every two shares of Denham? d. How would the cost of the cash offer change if the expected growth rate of Corton was not changed by the merger? e. How would the cost of the share offer change if the expected growth rate was not changed by the merger? (For all requirements, do not round intermediate calculations. Enter your answers in millions rounded to 2 decimal places.) a. Gain million b. Cost million C. Cost million d. Cash offer million le. Share offer million

Problem 31-10 Merger gains and costs As financial manager of Corton Inc., you are investigating a possible acquisition of Denham. You have the basic data given in the following table. Corton Denham Forecast earnings per share Forecast dividend per share Number of shares Stock price 2$ 2$ 7.00 1.70 4.20 2$ .91 2,000,000 2$ 1,600,000 2$ 90 20 You estimate that investors expect a steady growth of about 6% in Denham's earnings and dividends. Under new management, this growth rate would be increased to 8.53% per year without the need for additional capital. Required: a. What is the gain from the acquisition? b. What is the cost of the acquisition if Corton pays $25 in cash for each share of Denham? c. What is the cost of the acquisition if Corton offers one share of Corton for every two shares of Denham? d. How would the cost of the cash offer change if the expected growth rate of Corton was not changed by the merger? e. How would the cost of the share offer change if the expected growth rate was not changed by the merger? (For all requirements, do not round intermediate calculations. Enter your answers in millions rounded to 2 decimal places.) Corton Denham Forecast earnings per share Forecast dividend per share 2$ 2$ 7.00 1.70 2$ 2,000,000 2$ 4.20 .91 Number of shares 1,600,000 2$ Stock price 90 20 You estimate that investors expect a steady growth of about 6% in Denham's earnings and dividends. Under new management, this growth rate would be increased to 8.53% per year without the need for additional capital. Required: a. What is the gain from the acquisition? b. What is the cost of the acquisition if Corton pays $25 in cash for each share of Denham? c. What is the cost of the acquisition if Corton offers one share of Corton for every two shares of Denham? d. How would the cost of the cash offer change if the expected growth rate of Corton was not changed by the merger? e. How would the cost of the share offer change if the expected growth rate was not changed by the merger? (For all requirements, do not round intermediate calculations. Enter your answers in millions rounded to 2 decimal places.) a. Gain million b. Cost million C. Cost million d. Cash offer million le. Share offer million

Fundamentals of Financial Management (MindTap Course List)

14th Edition

ISBN:9781285867977

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter21: Mergers And Acquisitions

Section: Chapter Questions

Problem 7SP

Related questions

Question

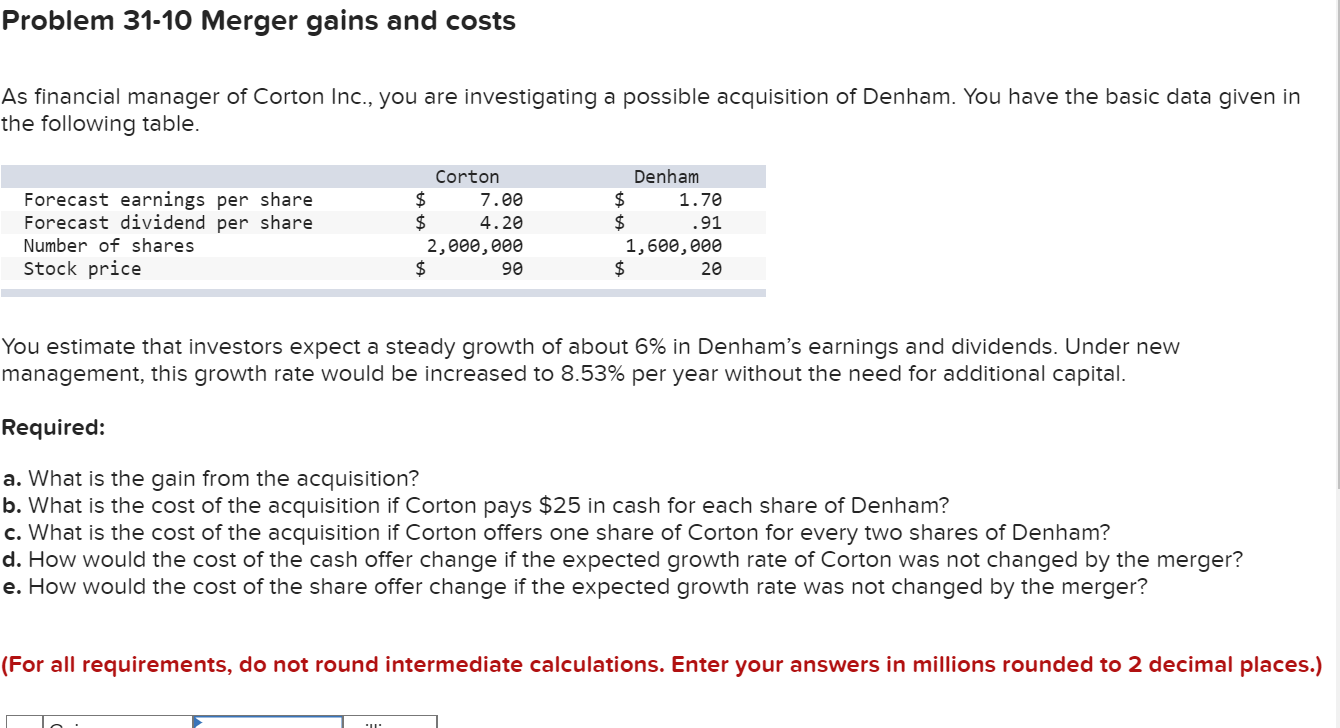

Transcribed Image Text:Problem 31-10 Merger gains and costs

As financial manager of Corton Inc., you are investigating a possible acquisition of Denham. You have the basic data given in

the following table.

Corton

Denham

Forecast earnings per share

Forecast dividend per share

Number of shares

Stock price

2$

2$

7.00

1.70

4.20

2$

.91

2,000,000

2$

1,600,000

2$

90

20

You estimate that investors expect a steady growth of about 6% in Denham's earnings and dividends. Under new

management, this growth rate would be increased to 8.53% per year without the need for additional capital.

Required:

a. What is the gain from the acquisition?

b. What is the cost of the acquisition if Corton pays $25 in cash for each share of Denham?

c. What is the cost of the acquisition if Corton offers one share of Corton for every two shares of Denham?

d. How would the cost of the cash offer change if the expected growth rate of Corton was not changed by the merger?

e. How would the cost of the share offer change if the expected growth rate was not changed by the merger?

(For all requirements, do not round intermediate calculations. Enter your answers in millions rounded to 2 decimal places.)

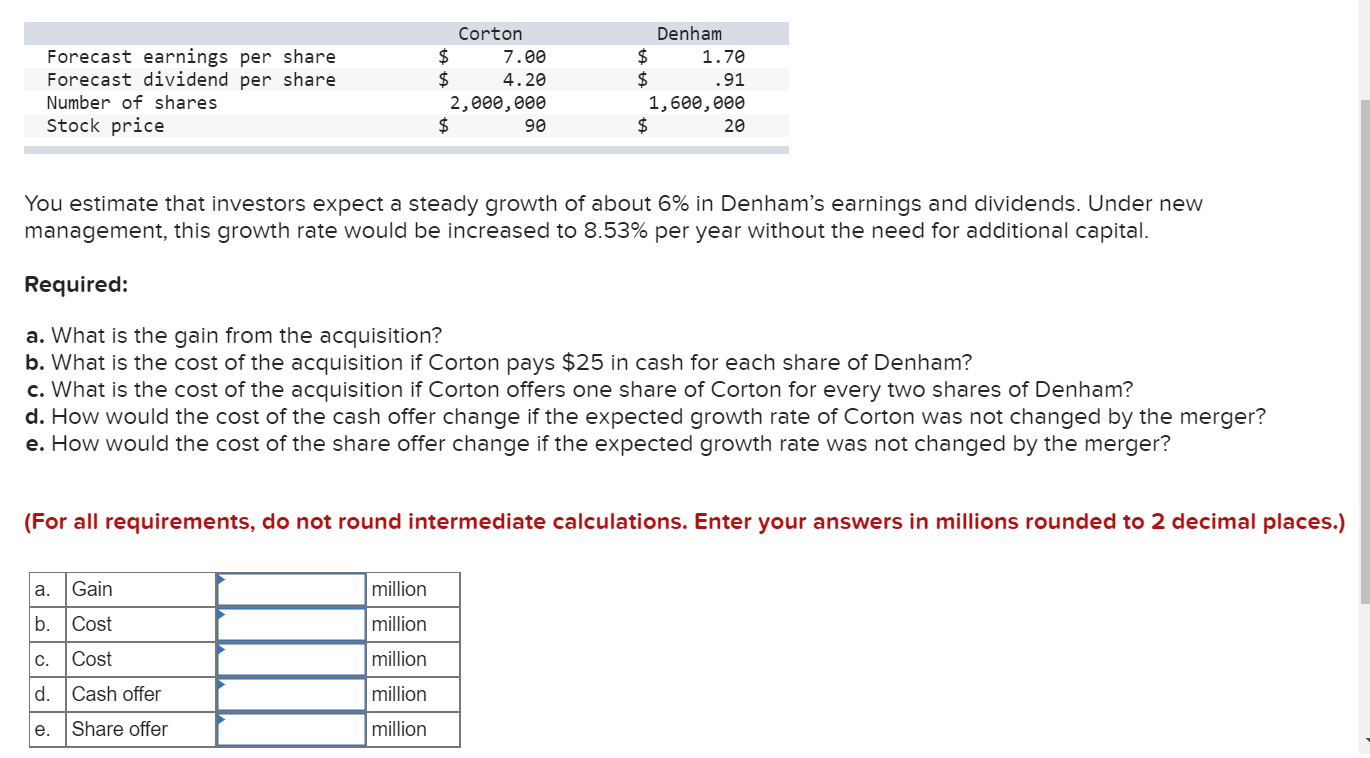

Transcribed Image Text:Corton

Denham

Forecast earnings per share

Forecast dividend per share

2$

2$

7.00

1.70

2$

2,000,000

2$

4.20

.91

Number of shares

1,600,000

2$

Stock price

90

20

You estimate that investors expect a steady growth of about 6% in Denham's earnings and dividends. Under new

management, this growth rate would be increased to 8.53% per year without the need for additional capital.

Required:

a. What is the gain from the acquisition?

b. What is the cost of the acquisition if Corton pays $25 in cash for each share of Denham?

c. What is the cost of the acquisition if Corton offers one share of Corton for every two shares of Denham?

d. How would the cost of the cash offer change if the expected growth rate of Corton was not changed by the merger?

e. How would the cost of the share offer change if the expected growth rate was not changed by the merger?

(For all requirements, do not round intermediate calculations. Enter your answers in millions rounded to 2 decimal places.)

a.

Gain

million

b.

Cost

million

C.

Cost

million

d.

Cash offer

million

le.

Share offer

million

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 5 images

Recommended textbooks for you

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning