EXERCISE 12 METRO is going to merge with MEDEC, with METRO as the surviving firm. It is agreed that the exchange ratio is 1:2 Metro (RM Medec(RM '000) *000) Assets Current assets Fixed assets 50 70 650 700 180 250 Liabilities and Equities Current liabilities Long term debt Common stock (RMI par) Capital surplus Retained earnings 30 140 10 60 400 80 50 70 30 80 700 250 Earnings available to common stockholders Common Dividends 130 100 30 100 50 50 Addition to Retained Earnings SITI RAHAYU BELI/FPP/UITM SABAH Page 25 Prepare a post merger financial position for METRO using the pooling of interest method.

EXERCISE 12 METRO is going to merge with MEDEC, with METRO as the surviving firm. It is agreed that the exchange ratio is 1:2 Metro (RM Medec(RM '000) *000) Assets Current assets Fixed assets 50 70 650 700 180 250 Liabilities and Equities Current liabilities Long term debt Common stock (RMI par) Capital surplus Retained earnings 30 140 10 60 400 80 50 70 30 80 700 250 Earnings available to common stockholders Common Dividends 130 100 30 100 50 50 Addition to Retained Earnings SITI RAHAYU BELI/FPP/UITM SABAH Page 25 Prepare a post merger financial position for METRO using the pooling of interest method.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter12: Fainancial Statement Analysis

Section: Chapter Questions

Problem 99.2C

Related questions

Question

Transcribed Image Text:EXERCISE 12

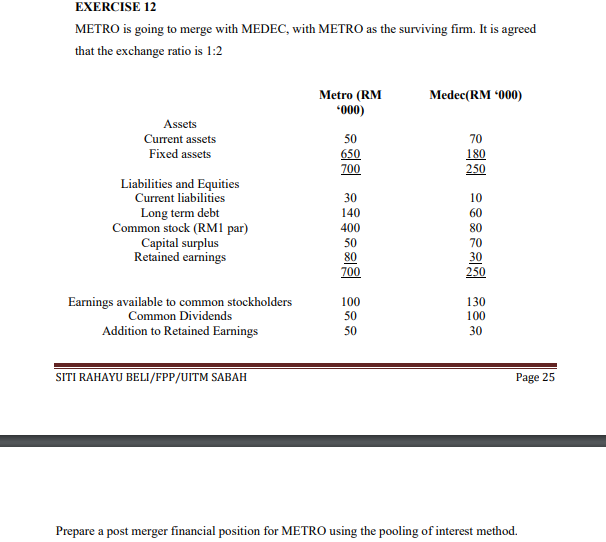

METRO is going to merge with MEDEC, with METRO as the surviving firm. It is agreed

that the exchange ratio is 1:2

Metro (RM

*000)

Medec(RM 000)

Assets

Current assets

50

70

Fixed assets

650

700

180

250

Liabilities and Equities

Current liabilities

Long term debt

Common stock (RM1 par)

Capital surplus

Retained earnings

30

10

140

60

400

80

50

80

30

250

700

Earnings available to common stockholders

Common Dividends

100

130

100

50

Addition to Retained Earnings

50

30

SITI RAHAYU BELI/FPP/UITM SABAH

Page 25

Prepare a post merger financial position for METRO using the pooling of interest method.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning