Problem 4-3: Recording investment and valuing debt & equity investments At the beginning of the year of 2021, the management of Bitlife, Inc concludes that it has sufficient cash to permit some short-term investments in debt and share securities with 10% to 15%. During the year, the following transactions occurred are as followed. Jan 2 Purchased 300 ordinary shares of GothamCo. for $30,000. Feb 7 Purchased 550 ordinary shares of Scarlett, Inc for $38,500. June 4 Purchased at face value $2,500,000 of Goldman Corp 10 years, 8% bonds. Interest is payable semiannually on June 1 and December 1. Aug 16 Received a cash dividend of $2,5 per share on Gotham Co. ordinary shares. Sept 1 Sold 150 ordinary shares of Gotham Co. at $74 Nov 9 Received a cash dividend of $2 per share on Scarlett, Inc ordinary shares. Nov 30 Sold $750,000 the Goldman Corp bonds at 97. Dec 1 Received the semiannual interest on Goldman Corp. bonds. At December 31, the fair value of Gotham. Co ordinary shares was $90 per share. The fair value of Scarlett, Inc ordinary shares was $90 per share. Instructions a. Journalize the transactions (Assume all their investment are trading securities). b. Prepare the adjusting entry at Dec 31,2021, and the table to report the investment securities at fair value.

Problem 4-3: Recording investment and valuing debt & equity investments At the beginning of the year of 2021, the management of Bitlife, Inc concludes that it has sufficient cash to permit some short-term investments in debt and share securities with 10% to 15%. During the year, the following transactions occurred are as followed. Jan 2 Purchased 300 ordinary shares of GothamCo. for $30,000. Feb 7 Purchased 550 ordinary shares of Scarlett, Inc for $38,500. June 4 Purchased at face value $2,500,000 of Goldman Corp 10 years, 8% bonds. Interest is payable semiannually on June 1 and December 1. Aug 16 Received a cash dividend of $2,5 per share on Gotham Co. ordinary shares. Sept 1 Sold 150 ordinary shares of Gotham Co. at $74 Nov 9 Received a cash dividend of $2 per share on Scarlett, Inc ordinary shares. Nov 30 Sold $750,000 the Goldman Corp bonds at 97. Dec 1 Received the semiannual interest on Goldman Corp. bonds. At December 31, the fair value of Gotham. Co ordinary shares was $90 per share. The fair value of Scarlett, Inc ordinary shares was $90 per share. Instructions a. Journalize the transactions (Assume all their investment are trading securities). b. Prepare the adjusting entry at Dec 31,2021, and the table to report the investment securities at fair value.

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter15: Shareholders’ Equity: Capital Contributions And Distributions

Section: Chapter Questions

Problem 28P

Related questions

Question

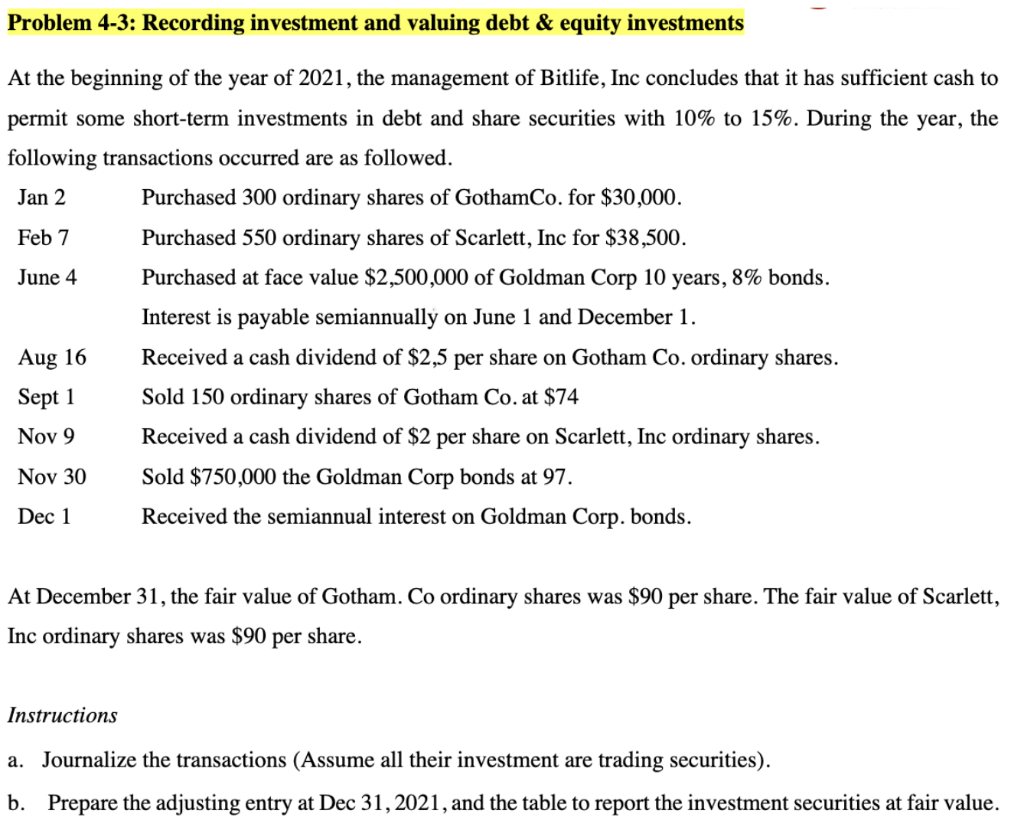

Transcribed Image Text:Problem 4-3: Recording investment and valuing debt & equity investments

At the beginning of the year of 2021, the management of Bitlife, Inc concludes that it has sufficient cash to

permit some short-term investments in debt and share securities with 10% to 15%. During the year, the

following transactions occurred are as followed.

Jan 2

Purchased 300 ordinary shares of GothamCo. for $30,000.

Feb 7

Purchased 550 ordinary shares of Scarlett, Inc for $38,500.

June 4

Purchased at face value $2,500,000 of Goldman Corp 10 years, 8% bonds.

Interest is payable semiannually on June 1 and December 1.

Aug 16

Received a cash dividend of $2,5 per share on Gotham Co. ordinary shares.

Sept 1

Sold 150 ordinary shares of Gotham Co. at $74

Nov 9

Received a cash dividend of $2 per share on Scarlett, Inc ordinary shares.

Nov 30

Sold $750,000 the Goldman Corp bonds at 97.

Dec 1

Received the semiannual interest on Goldman Corp. bonds.

At December 31, the fair value of Gotham. Co ordinary shares was $90 per share. The fair value of Scarlett,

Inc ordinary shares was $90 per share.

Instructions

a. Journalize the transactions (Assume all their investment are trading securities).

b. Prepare the adjusting entry at Dec 31, 2021, and the table to report the investment securities at fair value.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning