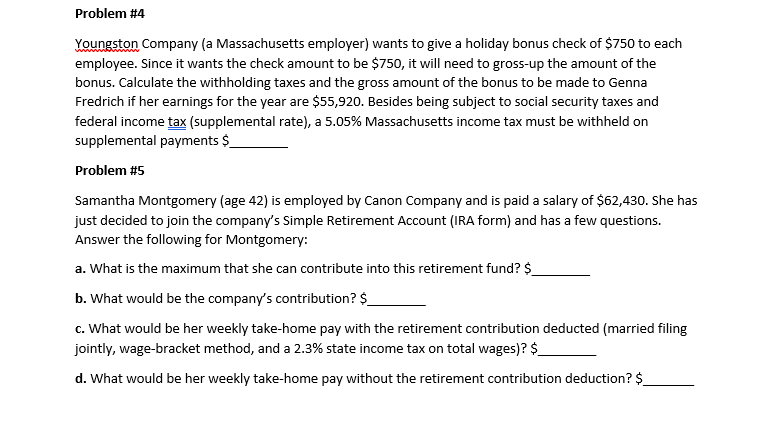

Problem #4 Youngston Company (a Massachusetts employer) wants to give a holiday bonus check of $750 to each employee. Since it wants the check amount to be $750, it will need to gross-up the amount of the bonus. Calculate the withholding taxes and the gross amount of the bonus to be made to Genna Fredrich if her earnings for the year are $55,920. Besides being subject to social security taxes and federal income tax (supplemental rate), a 5.05% Massachusetts income tax must be withheld on supplemental payments $_

Problem #4 Youngston Company (a Massachusetts employer) wants to give a holiday bonus check of $750 to each employee. Since it wants the check amount to be $750, it will need to gross-up the amount of the bonus. Calculate the withholding taxes and the gross amount of the bonus to be made to Genna Fredrich if her earnings for the year are $55,920. Besides being subject to social security taxes and federal income tax (supplemental rate), a 5.05% Massachusetts income tax must be withheld on supplemental payments $_

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter7: Employee Earnings And Deductions

Section: Chapter Questions

Problem 2E

Related questions

Question

Transcribed Image Text:Problem #4

Youngston Company (a Massachusetts employer) wants to give a holiday bonus check of $750 to each

employee. Since it wants the check amount to be $750, it will need to gross-up the amount of the

bonus. Calculate the withholding taxes and the gross amount of the bonus to be made to Genna

Fredrich if her earnings for the year are $55,920. Besides being subject to social security taxes and

federal income tax (supplemental rate), a 5.05% Massachusetts income tax must be withheld on

supplemental payments $

Problem #5

Samantha Montgomery (age 42) is employed by Canon Company and is paid a salary of $62,430. She has

just decided to join the company's Simple Retirement Account (IRA form) and has a few questions.

Answer the following for Montgomery:

a. What is the maximum that she can contribute into this retirement fund? $

b. What would be the company's contribution? $

c. What would be her weekly take-home pay with the retirement contribution deducted (married filing

jointly, wage-bracket method, and a 2.3% state income tax on total wages)? $

d. What would be her weekly take-home pay without the retirement contribution deduction? $_

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT