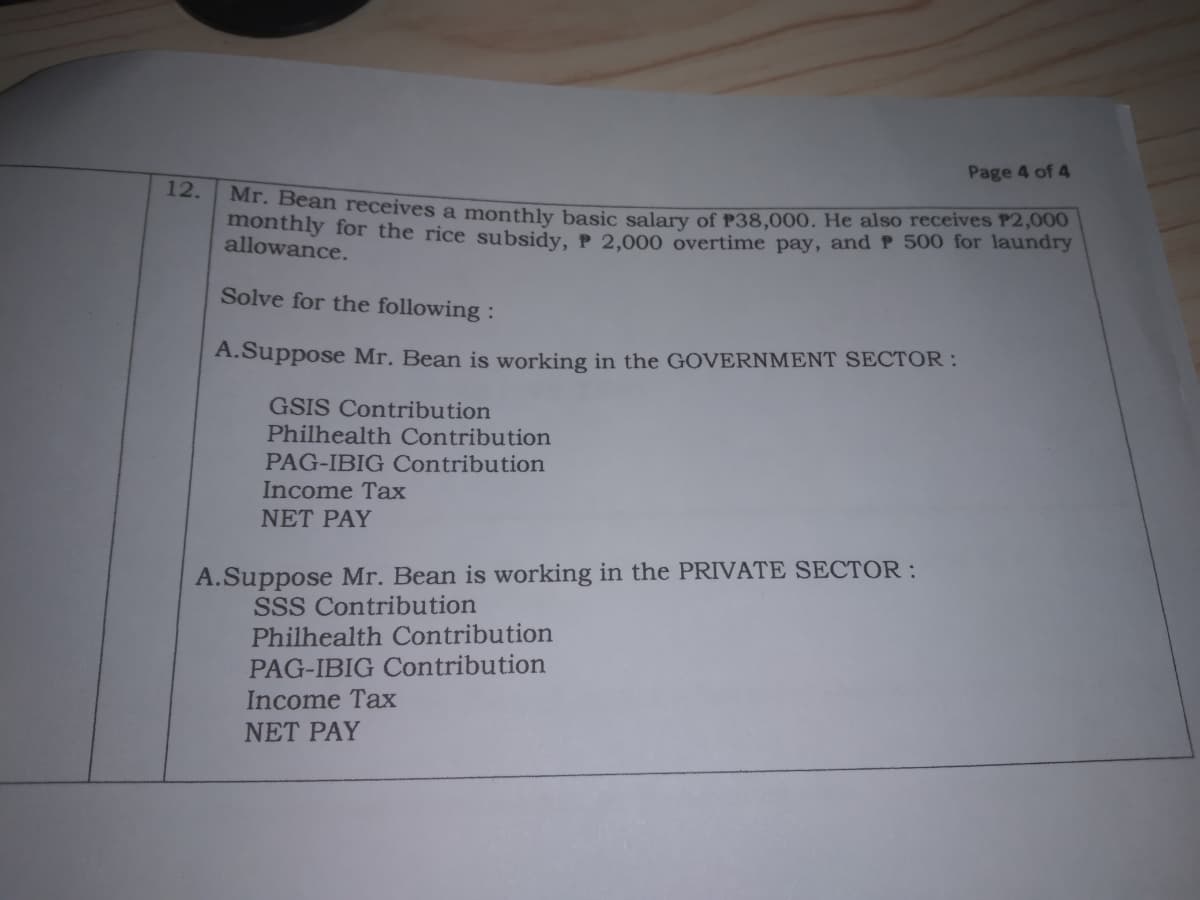

Page 4 of 4 12. Mr. Bean receives a monthly basic salary of P38,000. He also receives P2,0O00 monthly for the rice subsidy, P 2.000 overtime pay, and P 500 for laundry allowance. Solve for the following : A.Suppose Mr. Bean is working in the GOVERNMENT SECTOR: GSIS Contribution Philhealth Contribution PAG-IBIG Contribution Income Tax NET PAY A.Suppose Mr. Bean is working in the PRIVATE SECTOR : SSS Contribution Philhealth Contribution PAG-IBIG Contribution Income Tax NET PAY

Page 4 of 4 12. Mr. Bean receives a monthly basic salary of P38,000. He also receives P2,0O00 monthly for the rice subsidy, P 2.000 overtime pay, and P 500 for laundry allowance. Solve for the following : A.Suppose Mr. Bean is working in the GOVERNMENT SECTOR: GSIS Contribution Philhealth Contribution PAG-IBIG Contribution Income Tax NET PAY A.Suppose Mr. Bean is working in the PRIVATE SECTOR : SSS Contribution Philhealth Contribution PAG-IBIG Contribution Income Tax NET PAY

Chapter2: Gross Income And Exclusions

Section: Chapter Questions

Problem 30MCQ

Related questions

Question

Transcribed Image Text:Page 4 of 4

12.

Mr. Bean receives a monthly basic salary of P38,000. He also receives P2,000

monthly for the rice subsidy, P 2.000 overtime pay, and P 500 for laundry

allowance.

Solve for the following :

A.Suppose Mr. Bean is working in the GOVERNMENT SECTOR :

GSIS Contribution

Philhealth Contribution

PAG-IBIG Contribution

Income Tax

NET PAY

A.Suppose Mr. Bean is working in the PRIVATE SECTOR:

SSS Contribution

Philhealth Contribution

PAG-IBIG Contribution

Income Tax

NET PAY

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning