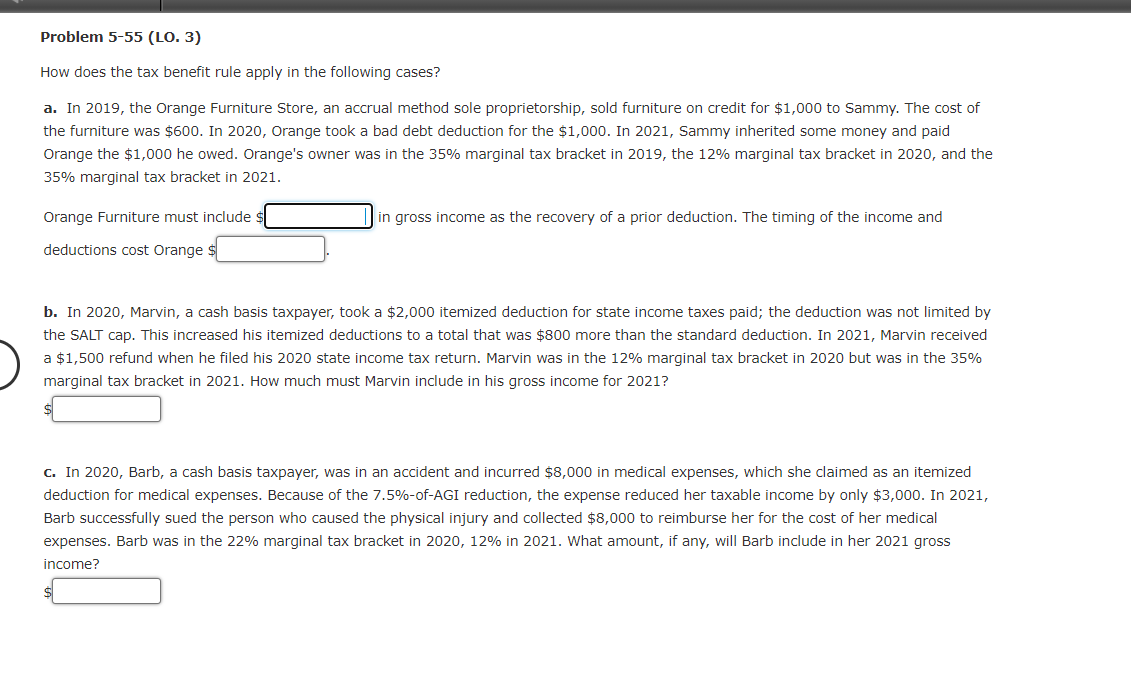

Problem 5-55 (LO. 3) How does the tax benefit rule apply in the following cases? a. In 2019, the Orange Furniture Store, an accrual method sole proprietorship, sold furniture on credit for $1,000 to Sammy. The cost of the furniture was $600. In 2020, Orange took a bad debt deduction for the $1,000. In 2021, Sammy inherited some money and paid Orange the $1,000 he owed. Orange's owner was in the 35% marginal tax bracket in 2019, the 12% marginal tax bracket in 2020, and the 35% marginal tax bracket in 2021. Orange Furniture must include s in gross income as the recovery of a prior deduction. The timing of the income and deductions cost Orange $ b. In 2020, Marvin, a cash basis taxpayer, took a $2,000 itemized deduction for state income taxes paid; the deduction was not limited by the SALT cap. This increased his itemized deductions to a total that was $800 more than the standard deduction. In 2021, Marvin received a $1,500 refund when he filed his 2020 state income tax return. Marvin was in the 12% marginal tax bracket in 2020 but was in the 35% marginal tax bracket in 2021. How much must Marvin include in his gross income for 2021? c. In 2020, Barb, a cash basis taxpayer, was in an accident and incurred $8,000 in medical expenses, which she claimed as an itemized deduction for medical expenses. Because of the 7.5%-of-AGI reduction, the expense reduced her taxable income by only $3,000. In 2021, Barb successfully sued the person who caused the physical injury and collected $8,000 to reimburse her for the cost of her medical expenses. Barb was in the 22% marginal tax bracket in 2020, 12% in 2021. What amount, if any, will Barb include in her 2021 gross income?

Problem 5-55 (LO. 3) How does the tax benefit rule apply in the following cases? a. In 2019, the Orange Furniture Store, an accrual method sole proprietorship, sold furniture on credit for $1,000 to Sammy. The cost of the furniture was $600. In 2020, Orange took a bad debt deduction for the $1,000. In 2021, Sammy inherited some money and paid Orange the $1,000 he owed. Orange's owner was in the 35% marginal tax bracket in 2019, the 12% marginal tax bracket in 2020, and the 35% marginal tax bracket in 2021. Orange Furniture must include s in gross income as the recovery of a prior deduction. The timing of the income and deductions cost Orange $ b. In 2020, Marvin, a cash basis taxpayer, took a $2,000 itemized deduction for state income taxes paid; the deduction was not limited by the SALT cap. This increased his itemized deductions to a total that was $800 more than the standard deduction. In 2021, Marvin received a $1,500 refund when he filed his 2020 state income tax return. Marvin was in the 12% marginal tax bracket in 2020 but was in the 35% marginal tax bracket in 2021. How much must Marvin include in his gross income for 2021? c. In 2020, Barb, a cash basis taxpayer, was in an accident and incurred $8,000 in medical expenses, which she claimed as an itemized deduction for medical expenses. Because of the 7.5%-of-AGI reduction, the expense reduced her taxable income by only $3,000. In 2021, Barb successfully sued the person who caused the physical injury and collected $8,000 to reimburse her for the cost of her medical expenses. Barb was in the 22% marginal tax bracket in 2020, 12% in 2021. What amount, if any, will Barb include in her 2021 gross income?

Chapter5: Gross Income: Exclusions

Section: Chapter Questions

Problem 55P

Related questions

Question

Transcribed Image Text:Problem 5-55 (LO. 3)

How does the tax benefit rule apply in the following cases?

a. In 2019, the Orange Furniture Store, an accrual method sole proprietorship, sold furniture on credit for $1,000 to Sammy. The cost of

the furniture was $600. In 2020, Orange took a bad debt deduction for the $1,000. In 2021, Sammy inherited some money and paid

Orange the $1,000 he owed. Orange's owner was in the 35% marginal tax bracket in 2019, the 12% marginal tax bracket in 2020, and the

35% marginal tax bracket in 2021.

Orange Furniture must include

in gross income as the recovery of a prior deduction. The timing of the income and

deductions cost Orange $

b. In 2020, Marvin, a cash basis taxpayer, took a $2,000 itemized deduction for state income taxes paid; the deduction was not limited by

the SALT cap. This increased his itemized deductions to a total that was $800 more than the standard deduction. In 2021, Marvin received

a $1,500 refund when he filed his 2020 state income tax return. Marvin was in the 12% marginal tax bracket in 2020 but was in the 35%

marginal tax bracket in 2021. How much must Marvin include in his gross income for 2021?

c. In 2020, Barb, a cash basis taxpayer, was in an accident and incurred $8,000 in medical expenses, which she claimed as an itemized

deduction for medical expenses. Because of the 7.5%-of-AGI reduction, the expense reduced her taxable income by only $3,000. In 2021,

Barb successfully sued the person who caused the physical injury and collected $8,000 to reimburse her for the cost of her medical

expenses. Barb was in the 22% marginal tax bracket in 2020, 12% in 2021. What amount, if any, will Barb include in her 2021 gross

income?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT