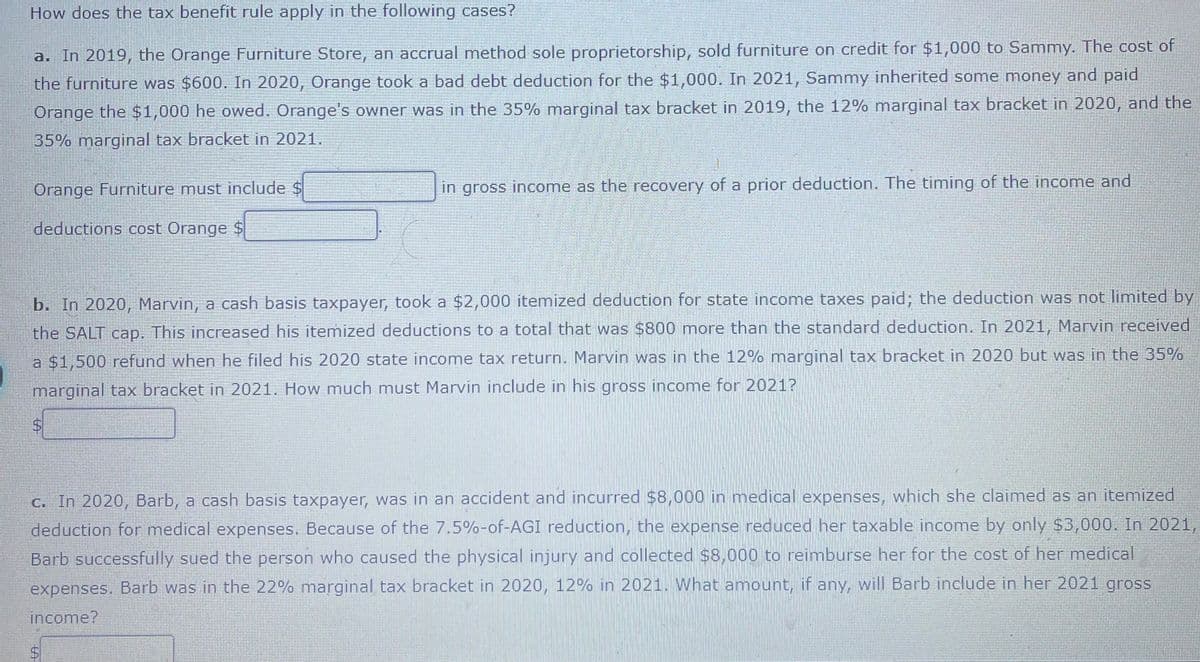

How does the tax benefit rule apply in the following cases? a. In 2019, the Orange Furniture Store, an accrual method sole proprietorship, sold furniture on credit for $1,000 to Sammy. The cost of the furniture was $600. In 2020, Orange took a bad debt deduction for the $1,000. In 2021, Sammy inherited some money and paid Orange the $1,000 he owed. Orange's owner was in the 35% marginal tax bracket in 2019, the 12% marginal tax bracket in 2020, and the 35% marginal tax bracket in 2021. Orange Furniture must include $ in gross income as the recovery of a prior deduction. The timing of the income and deductions cost Orange $ b. In 2020, Marvin, a cash basis taxpayer, took a $2,000 itemized deduction for state income taxes paid; the deduction was not limited by the SALT cap. This increased his itemized deductions to a total that was $800 more than the standard deduction. In 2021, Marvin received a $1,500 refund when he filed his 2020 state income tax return. Marvin was in the 12% marginal tax bracket in 2020 but was in the 35% marginal tax bracket in 2021. How much must Marvin include in his gross income for 2021? c. In 2020, Barb, a cash basis taxpayer, was in an accident and incurred $8,000 in medical expenses, which she claimed as an itemized deduction for medical expenses. Because of the 7.5%-of-AGI reduction, the expense reduced her taxable income by only $3,000. In 2021, Barb successfully sued the person who caused the physical injury and collected $8,000 to reimburse her for the cost of her medical expenses. Barb was in the 22% marginal tax bracket in 2020, 12% in 2021. What amount, if any, will Barb include in her 2021 gross income?

How does the tax benefit rule apply in the following cases? a. In 2019, the Orange Furniture Store, an accrual method sole proprietorship, sold furniture on credit for $1,000 to Sammy. The cost of the furniture was $600. In 2020, Orange took a bad debt deduction for the $1,000. In 2021, Sammy inherited some money and paid Orange the $1,000 he owed. Orange's owner was in the 35% marginal tax bracket in 2019, the 12% marginal tax bracket in 2020, and the 35% marginal tax bracket in 2021. Orange Furniture must include $ in gross income as the recovery of a prior deduction. The timing of the income and deductions cost Orange $ b. In 2020, Marvin, a cash basis taxpayer, took a $2,000 itemized deduction for state income taxes paid; the deduction was not limited by the SALT cap. This increased his itemized deductions to a total that was $800 more than the standard deduction. In 2021, Marvin received a $1,500 refund when he filed his 2020 state income tax return. Marvin was in the 12% marginal tax bracket in 2020 but was in the 35% marginal tax bracket in 2021. How much must Marvin include in his gross income for 2021? c. In 2020, Barb, a cash basis taxpayer, was in an accident and incurred $8,000 in medical expenses, which she claimed as an itemized deduction for medical expenses. Because of the 7.5%-of-AGI reduction, the expense reduced her taxable income by only $3,000. In 2021, Barb successfully sued the person who caused the physical injury and collected $8,000 to reimburse her for the cost of her medical expenses. Barb was in the 22% marginal tax bracket in 2020, 12% in 2021. What amount, if any, will Barb include in her 2021 gross income?

Chapter5: Gross Income: Exclusions

Section: Chapter Questions

Problem 55P

Related questions

Question

Transcribed Image Text:How does the tax benefit rule apply in the following cases?

a. In 2019, the Orange Furniture Store, an accrual method sole proprietorship, sold furniture on credit for $1,000 to Sammy. The cost of

the furniture was $600. In 2020, Orange took a bad debt deduction for the $1,000. In 2021, Sammy inherited some money and paid

Orange the $1,000 he owed. Orange's owner was in the 35% marginal tax bracket in 2019, the 12% marginal tax bracket in 2020, and the

35% marginal tax bracket in 2021.

Orange Furniture must include $

in gross income as the recovery of a prior deduction. The timing of the income and

deductions cost Orange $

b. In 2020, Marvin, a cash basis taxpayer, took a $2,000 itemized deduction for state income taxes paid; the deduction was not limited by

the SALT cap. This increased his itemized deductions to a total that was $800 more than the standard deduction. In 2021, Marvin received

a $1,500 refund when he filed his 2020 state income tax return. Marvin was in the 12% marginal tax bracket in 2020 but was in the 35%

marginal tax bracket in 2021. How much must Marvin include in his gross income for 2021?

%$4

C. In 2020, Barb, a cash basis taxpayer, was in an accident and incurred $8,000 in medical expenses, which she claimed as an itemized

deduction for medical expenses. Because of the 7.5%-of-AGI reduction, the expense reduced her taxable income by only $3,000. In 2021,

Barb successfully sued the person who caused the physical injury and collected $8,000 to reimburse her for the cost of her medical

expenses. Barb was in the 22% marginal tax bracket in 2020, 12% in 2021. What amount, if any, will Barb include in her 2021 gross

income?

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT